We use first and third-party cookies for analytical and statistical purposes and to show you personalised advertisements based on a profile compiled from your browsing habits (e.g. pages visited). For more information, click on our Cookie Policy. You can accept all cookies by pressing 'Accept', you can reject all cookies by pressing 'Reject', or you can customize your choice by pressing 'Manage'.

Bankinter Personal Banking

Person to person.

That is our concept of Personal Banking. A service based on an in-depth knowledge of our customers that enables us to anticipate their needs. A personal touch for a specialised service.

Personalised service supported by people, channels and products.

A person you can trust. Your personal bank manager

The expert always by your side to advise you, to help you make decisions, to anticipate your needs. Always there to analyse your financial situation and then come up with an exclusive investment plan to optimise your assets.Decide how you want to communicate and bank with us

Since not all needs are the same and not all days are the same, you choose the time and the channel.We bring all of our experience to all of our services.

We're proud of our experience and our team.

- You will be able to decide, at any given moment, how far you want to delegate decision-making.

- You will be able to communicate with your Personal Banking manager through your branch, mobile or internet.

- Website and app: Through our website or App, you choose when: 24 hours, 7 days a week. You can check your positions, carry out transactions, manage your cards, etc. Anywhere, anytime.

- Telephone banking: Speak to our professionals if you have a query or want to carry out a transaction, whether you're in Spain or abroad.

- 17,000 ATMs:1 The largest ATM network in Spain for withdrawing cash from your account, free of charge.

- Digital tools: All with an intuitive environment to make every process a simple one: comparators, calculators, payment platforms like Apple Pay, card switch on and off facility on mobile devices, and more.

Over 50 years. Over 5,600 people.

A team who is able to design innovative products, guarantee agile incident resolution, anticipate your needs and, in short, give you personal solutions.

That is our concept of Personal Banking.

So you won't just find products with us, you'll find solutions.

Personal solutions

for personal banking.

What you need, when you need it.

Research tools

All the information you need, put together by our experts

Video analysis.

Every week you'll be able to watch a video with key information about the markets and interest-rate trends.

Product analysis

Everything about funds, markets, interest rates and currencies. And now you can also stay up to date through WhatsApp, Telegram and even with our podcasts ...

Regular reports

Every week you'll receive an email with key information about market activity and trends.

Bankinter Broker

The broker that adapts to your investor knowledge.

All of your trading with the same broker: from the simplest to the most sophisticated transactions.

- Tools, interactive charts, stop orders, alerts to mobiles...

- Trading in over 25 markets: shares, ETFs, warrants, options, etc.

- Over-the-phone advice and assistance from stock market experts.

- Find out about our Broker2 Account, which pays 2% annual AER for trading on the stock market. Maximum interest-bearing balance of €5,000€ a quarter. Limited to 40,000 accounts.

Investment funds

Our 4,000 funds include the perfect one for you.

The value of investment funds can fall as well as rise, and you may get back less than you invested.

Regular contributions

If you invest in funds, pension plans or stocks ...

Profiled Funds

A selection of funds segmented according to the investor profile. In other words, according to the expected return and the risk you're comfortable with. There's no such thing as the perfect fund, but there are funds adapted to every investor.

Investment funds for beginners

If you've never bought an investment fund or you're not sure how they work... We'll explain everything in detail to make it easy for you.

Find out more about Funds for beginners

Delegated Investment

There are no difficult decisions when professionals are on your side, only expert decisions.

From €8,000 for pension plan portfolios3 and from €1,000 for investment funds4 and securities, you can delegate the management of your investments to a team of experts. There are two types of management to choose from, depending on your investor profile:

- Risk management

- Fundamental management

The value of investment funds can fall as well as rise, and you may get back less than you invested.

You can find out more about risk indicators and liquidity alerts for pension plans at https://www.bankinter.com/banca/en/investment-savings/retirement.

Roboadvisor

Bankinter's robo-advisor

With the Roboadvisor digital investment platform you will have a team of experts to manage your assets, so you won't have to worry about a thing.

- From €1,000. Choose the product that best suits your needs.

- We offer three types of fund portfolios: managed, indexed and sustainable.

- You can also choose from a wide range of pension plans.

Accounts

You have an account suited to your needs and your personality.

Salary account

For employed workers.

Non-Salary Account

If you don't have a regular income but need to set up direct debits for your bills.

Business Account

Self-employed? Bankinter has a special place for you.

Pension Account

If you are a pensioner, you deserve the best.

Tú y Yo Account

If you share expenses you can share an account.

Bk Mini

The account for our younger customers. Today's account for tomorrow's savings.

BK Youth

If you're between 18 and 24, count on BK Youth

BK Salary

If you have a salary and are less than 31 years old, you already have your account

Broker account

The account that pays for your trading on the stock market

Cards

If your purchases aren't the same, why always use the same card?

Combo Débito+ card5

Decide how you want to pay: now or later

- Use the 'now' side as a debit card.

- Use the 'later' side to split your purchase into four instalments.

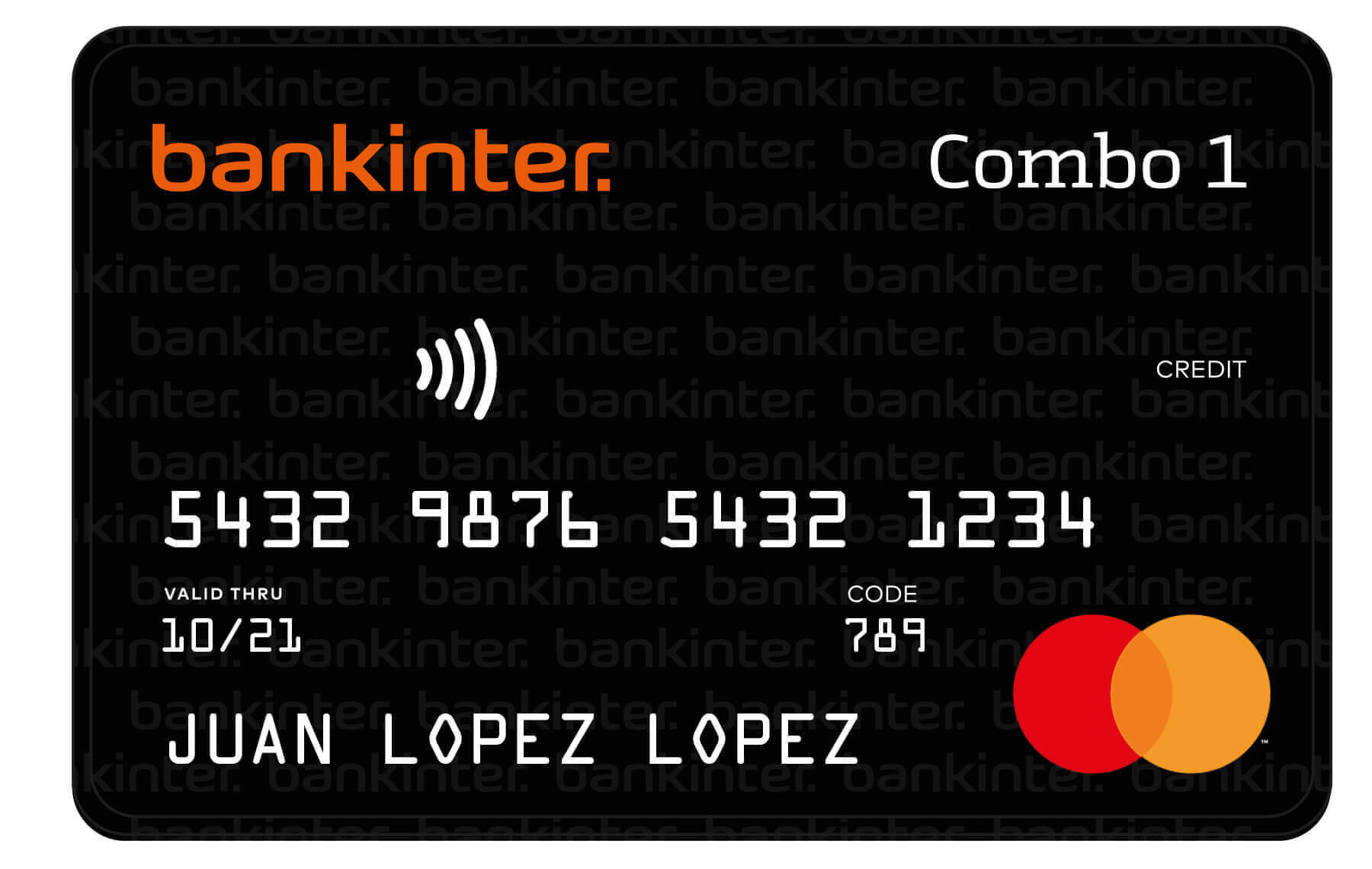

Combo Card5

Two cards in one

- Use the Combo 1 side if you want to pay at the end of the month.

- Use the Combo 2 side if you prefer to pay little by little.

- There are no issuance or maintenance fees with the Salary, Non-Salary and Pension accounts.

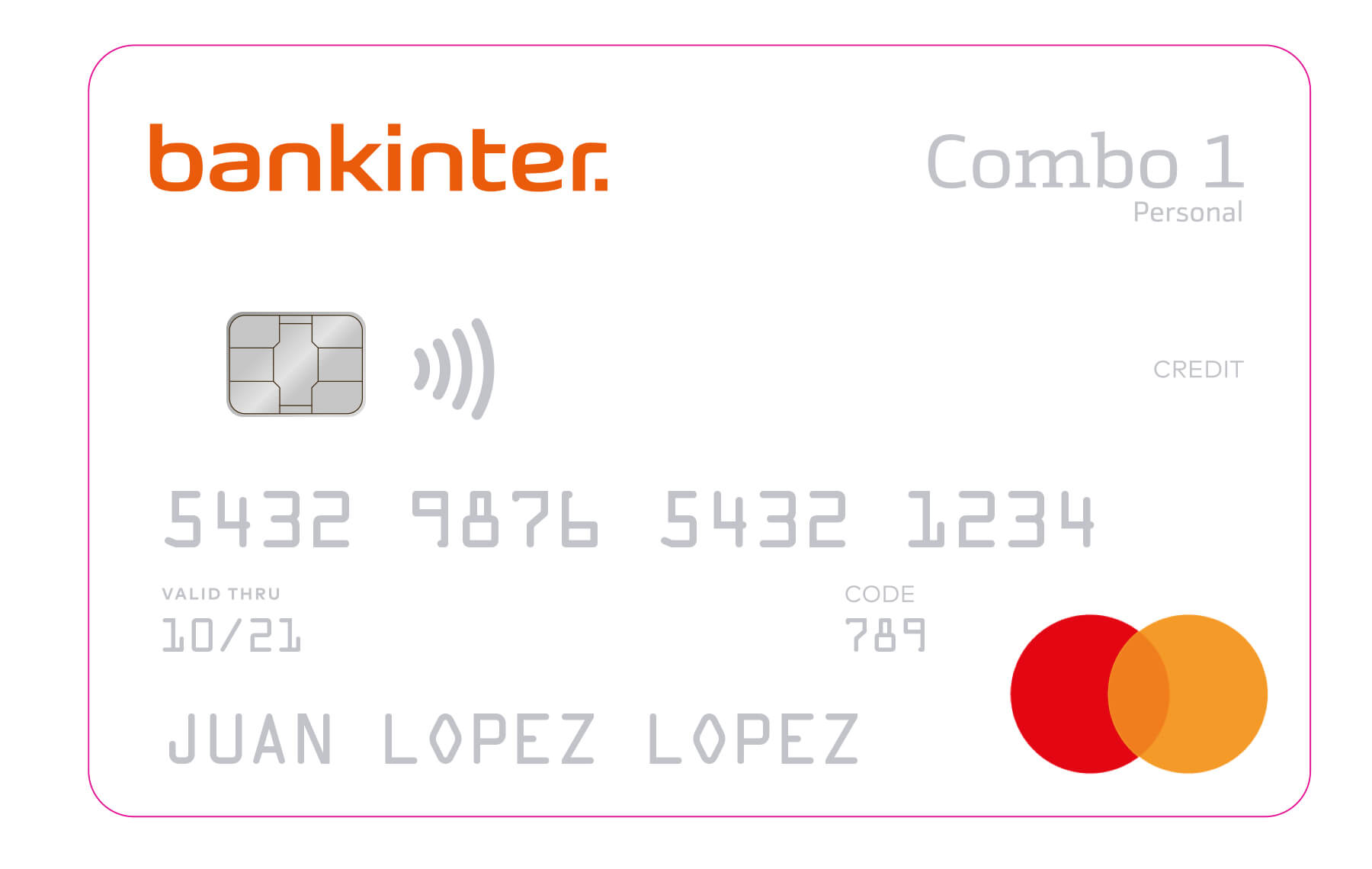

Combo Profesional card5

A card with a personal side and a business side

- Two separate statements.

- Month-end or deferred payment.

- No issuance or maintenance fees with the business account.

Única card5

A card with everything for everything

- Split your purchases in a few easy steps.

- Withdraw cash from your account at more than 17,000 free ATMs.1

- Transfer funds to your account.

Bankinter Solidarios card5

Help us with our solidarity projects.

- they get up to 5% of what you spend.

- Choose when and how much you want to pay.6

- We donate 100% of the fee.

Quiero card5

Instant access to extra expenses.

- No issuance or maintenance fee.

- Choose when and how much you want to pay.6

- Withdraw cash from your account at more than 17,000 free ATMs.1

Pension plans

Don't give up your lifestyle.

Do you know how much your pension will be when you retire?

PIAS (individual systematic savings plans)

Use our PIAS Gestión Dinámica unit-linked insurance8 to invest in investment funds while you save on taxes.

- As you are investing in investment funds, provided you maintain your PIAS you will not be taxed on your returns.

- If you opt for a life annuity when you receive your savings, you will not be taxed on the returns.

PIAS are products that can fall as well as rise in value, and you may get back less than you invested.

Fixed-rate Mortgage

If you prefer the same instalment every month.

Variable-Rate Mortgage

A traditional mortgage but with excellent terms and conditions.

Mixed-rate Mortgage

If you prefer to combine fixed interest with variable-rate interest.

Hipoteca Sin Más

A mortgage in which the only guarantee is your home.

Personal Loans

Need it? Want it?

Whatever you need, you'll get it instantly and with the best terms and conditions.

- Between €3,000 and €90,000

- Repayment between 12 and 96 months

- Just with your personal guarantee9

A bank for today, a society for tomorrow.

Fundación de la innovación Bankinter

From the inside, for everyone.

CSR

Our best legacy.

Because we believe in and trust in society, we've created a sustainability plan focused on three broad areas:

- Economic: to encourage a change in the production models

- Social: to achieve a demographic change

- Environmental: to fight climate change

-

Show/Hide legal text1 ATMs: Bankinter will not charge you any fees when you withdraw cash with your debit card, no matter the amount, provided you use a Bankinter ATM or an ATM belonging to any of the following banks: Grupo Cajas Rurales, Deutsche Bank, Grupo Cajamar, Laboral Kutxa, Banca March, Targo Bank, Euro Automatic Cash, Euronet and the entire Euro 6000 ATM network: CajaSur Banco, EVO Bank, CECABANK, Cashzone, Caixa Ontinyent, Colonya Caixa Pollença, ABANCA, Ibercaja, Kutxabank and Unicaja.

-

Show/Hide legal text2 Broker Account: Promotion valid until - or up to a maximum of 40,000 new accounts. Nominal annual interest rate of 1,99% (2% AER). Leap year quarterly settlement. For a sample daily balance of €5,000 in a Broker Account, the gross remuneration calculated for a quarterly settlement period would be: 1st quarter: €24.74, 2nd quarter: €24.74, 3rd quarter: €25.01, 4th quarter: €25.01.

To be eligible for this remuneration, you must perform at least 10 buy/sell trades on the market each calendar quarter via any of the channels available for arranging the products offered by Bankinter Broker at any given time. Trades performed using accounts (securities, derivatives and/or fixed income) linked to the Broker Account and any other Bankinter account you hold or jointly hold will be taken into account when calculating the number of trades. The promotion does not include currency trades or trades using delegated portfolio management services. You must also pay a standard custody fee on the securities account linked to the Broker Account and on all securities accounts you hold or hold jointly with others.

Only one Broker Account is permitted per customer, who must be a private individual resident in Spain. This account is not available to Bankinter Group employees and agents. The currency of the Broker account is the euro.

-

Show/Hide legal text3 Investment funds: The key investor information document, prospectus and all other legal documents related to Bankinter's collective investment institutions are available in Spanish at any of our branches, on the Bankinter website (www.bankinter.com) and on the website of the Spanish National Securities Market Commission (CNMV).

-

Show/Hide legal text4 5% - 2% regular contributions promotion: To qualify for the promotion you must hold a Salary, Pension, Business, Non-Salary, Youth Salary Account, Tú y Yo, Broker or Current account with Bankinter and make a regular contribution from that account of at least €50 per month to an investment fund, pension plan, EPSV or individual systematic savings plan (PIAS), or alternatively allocate €250 per month to the purchase of shares. The promotion applies exclusively to product lines where you do not currently have regular contributions and have not had them in the last 12 months. If you fail to make any of these regular minimum contributions you will not receive the bonus. First year: 5%. Second year: 2%. Monthly settlement on the total accumulated net balance: sum of regular contributions made to investment funds, pension plans, EPSVs, PIAS and shares, minus redemptions from investment funds with declared regular contributions and external transfers of investment funds, pension plans, EPSVs, PIAS and shares with declared regular contributions. The maximum bonus-bearing balance is €1,000. The following is an example for a regular monthly contribution of €100 to an investment fund over the course of 24 months. Total first year bonus: €31.26 gross. Total second year bonus: €20.04 gross.

-

Show/Hide legal text5 For Combo, Única, Quiero and Solidarios cards: Card issued and financing offered by Bankinter Consumer Finance, E.F.C., S.A., a hybrid payment entity with a safeguard system consisting of the deposit of the funds in a separate current account opened at Bankinter, S.A., registered with Banco de España under number 8832, with registered office at 12 Avda. de Bruselas, 28108, Alcobendas, Madrid, recorded in Volume 22,729, Folio 181, Sheet No. M-259543 of the Madrid Companies Register, and with Tax ID Number A82650672. For all other cards the issuer is Bankinter, S.A., which also offers the financing.

-

Show/Hide legal text6 The Solidarios and the Quiero cards are issued with the deferred payment (revolving) method. The monthly instalment can either be a fixed amount or a percentage of the credit drawn.

-

Show/Hide legal text7 Pension Plans: The pension plan promoter is Bankinter Seguros de Vida, S.A. de Seguros y Reaseguros. The pension fund manager is Bankinter Seguros de Vida, S.A. de Seguros y Reaseguros. The pension fund depository is Bankinter, S.A. The prospectus and key investor information document are available at all Bankinter branches and on our website www.bankinter.com.

-

Show/Hide legal text8 PIAS: This financial product entails a high risk and its value may fall as well as rise. The customer acknowledges that in certain circumstances they may lose a significant part of the initial capital invested, depending on the performance of the fund selected. This document is provided for reference purposes only. The customer states that before purchasing this product they have assessed the legal, regulatory, accounting, financial and fiscal implications and that they have sufficient knowledge and experience to do so, either independently or through their advisers.

PIAS: This financial product entails a high risk and its value may fall as well as rise. The customer acknowledges that in certain circumstances they may lose a significant part of the initial capital invested, depending on the performance of the fund selected. This document is provided for reference purposes only. The customer states that before purchasing this product they have assessed the legal, regulatory, accounting, financial and fiscal implications and that they have sufficient knowledge and experience to do so, either independently or through their advisers. The Bank may not be considered an adviser to the customer under any circumstances. In reaching a decision regarding the expediency of undertaking any operation, the customer must take into account their own business financial situation and their ability to assess the risk entailed. Insurance issued by Bankinter Seguros de Vida S.A. of Insurance and Reinsurance, tax ID code A‐78510138, and mediated by Bankinter, S.A., bancassurance operator with Tax ID code A‐28157360, registered with the Directorate-General for Insurance and Pension Funds under number OV‐0028. Bankinter, S.A., as the bancassurance operator, signed insurance agency agreements with the following entities: ~Groupama Seguros y Reaseguros, S.A., Liberty Seguros, Compañía Seguros y Reaseguros, S.A., AXA Seguros Generales, S.A. de Seguros y Reaseguros, Mapfre Familia Compañía de Seguros y Reaseguros, SA, Mapfre Empresas, Compañía de Seguros y Reaseguros, SA, Bankinter Seguros de Vida, SA, Helvetia Swiss Company, Insurance and Reinsurance Corporation, Hannover International Insurance and Reinsurance, SA (Sociedad Unipersonal), CPP Protección y Servicios de Asistencia, SAU, CPP Protección Familiar, SL, Stonebridge International Insurance LTD, Genworth Financial Insurance, Insurance and Reinsurance Company, SA, SOS Seguros y Reaseguros, SA, ACE European Group Limited, Línea Directa Aseguradora, SA, Asefa, SA Insurance and Reinsurance, Euler Hermes Credito, Insurance and Reinsurance Company, S.A., Sanitas and Cigna. The prospectus and key investor information document are available at all Bankinter branches and at www.bankinter.com/Savings and investment/. -

Show/Hide legal text9 All financing operations are analysed and then either approved or turned down by the Bank. Financing offered by Bankinter Consumer Finance EFC, S.A., a financial credit institution registered with the Bank of Spain under number 8832, with registered office at 12 Avda. de Bruselas, 28108 Alcobendas, Madrid, recorded in Volume 22,729, Folio 181, Sheet No. M-259543 of the Madrid Companies Register, and with tax identification number A82650672.

STANDARD EUROPEAN CONSUMER CREDIT INFORMATION (SECCI) ON LOANS