We use first and third-party cookies for analytical and statistical purposes and to show you personalised advertisements based on a profile compiled from your browsing habits (e.g. pages visited). For more information, click on our Cookie Policy. You can accept all cookies by pressing 'Accept', you can reject all cookies by pressing 'Reject', or you can customize your choice by pressing 'Manage'.

What's a salary account?

Your first salary? Your first salary account

Season one, the terms and conditions!

Fees?

Whether or not you have to pay a maintenance or administration fee or when you send a bank transfer.

Cards?

The option of including credit or debit cards without an issuance and maintenance fee.

Direct debits?

The number of bills you have to pay through the account to qualify for the perks.

Discounts?

The discounts offered: from a refund of part of your direct debits to discounts on brands.

More products?

The type of conditions for taking out other financial products with the bank, such as loans and mortgages.

Interest paid?

The interest earned for having the account and the interest rate.

Something else you should know...

Youth salary account

Business account

Pension account

And now you have all the information, we proudly present our own salary account

What does it offer? Well, just for opening the account you'll get two free additional accounts1 for whatever you want and for anyone you want, and an Combo Card as well.

- No fees

- Free cash withdrawals from your account.

- Interest of up to 5% AER2 the first year and up to 2% AER the second year.

- Maximum interest-bearing balance: €10,000.

- Offer valid until 31.12.2023 or until 40,000 new salary accounts have been opened.

Want to know exactly how much interest our Salary Account yields?

Oh, But it doesn't end there:

You've convinced me! How do I open it?

Get your documents ready:

ID, proof of address, last payslip, tax return or employment contract and home address.Start the process through whichever channel you want:

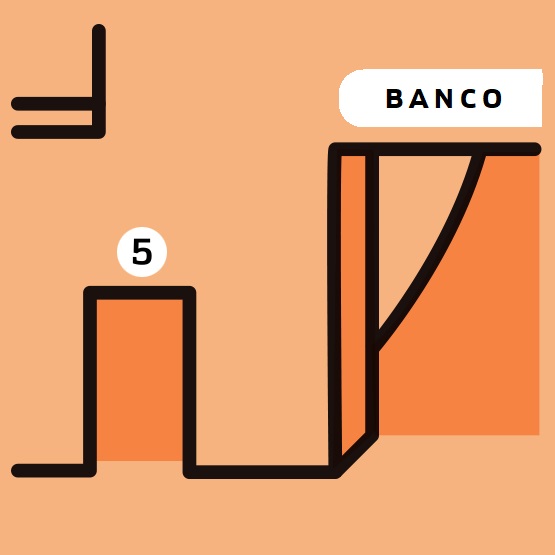

Either visit a branch or set it up online in 5 easy stepsYouth salary account

Are you aged between 18 and 30?

Have your salary paid into the Bankinter Youth Salary Account to get customised exclusive perks.

If you need more information to make up your mind,

-

Show/Hide legal text1

If you open a Salary/Pension/Business/Non-Salary/Youth Salary account, you can have up to two current accounts with no maintenance fee (NIR 0%, APR 0% calculated for a hypothetical daily balance of €10,000 maintained for one year). This offer is available until 31/12/2023 for both new and existing customers, and is compatible with all the other benefits of the Salary/Pension/Business/Non-Salary/Young Salary accounts. To keep the benefit you must meet the requirements of the Salary/Pension/Business/Non-Salary/Youth Salary account.

-

Show/Hide legal text2 5% interest-bearing accounts: Offer valid until -. For new and existing individual customers who live in Spain, who have not held a Salary/Pension/Business/Non-Salary/Youth Salary account at Bankinter in the 12 months before opening this new account and who must have never received remuneration for any of these accounts. For Salary/Pension/Business Accounts, customers must also have at least €800 of the salary/pension/professional income paid into the account per month. To take advantage of this promotion, the customer may not be the holder of more than two of the following accounts: Salary/Youth Salary Account, Pension Account, Business Account and Non-Salary Account.

The maximum interest-bearing balance is €10,000. Year 1: nominal annual interest rate of 4.94% (5% AER). Year 2: nominal annual interest rate of 1.99% (2% AER). Interest paid every six months. Example for a daily balance of €10,000 in a salary account, calculated for an interest payment period of 180 days (gross remuneration): 1st six months €243.62, 2nd six months €243.62, 3rd six months €98.14, 4th six months €98.14.

In order to earn and retain all the benefits of our Salary/Business/Pension Account, you must maintain your declared level of income and pay at least three (3) bills by direct debit per quarter. The card linked to the account must also remain active, meaning that it must be used to make at least three payments each quarter. For the Pension Account, you do not have to activate the linked credit card. For the Non-Salary account, you must pay at least 10 direct debits per quarter and spend at least €3,000 per year with the card(s) linked to the account.