We use first and third-party cookies for analytical and statistical purposes and to show you personalised advertisements based on a profile compiled from your browsing habits (e.g. pages visited). For more information, click on our Cookie Policy. You can accept all cookies by pressing 'Accept', you can reject all cookies by pressing 'Reject', or you can customize your choice by pressing 'Manage'.

Switch your salary to Bankinter

Lights, camera, action! It's time to switch your salary

Switch your salary to Bankinter and enjoy all the benefits we offer

The process for switching your salary to Bankinter is:

- Simple.

- Fast.

- 100% online.

- Without leaving home.

You can start enjoying the benefits of our salary account when you do:

- No fees

- With 2 free accounts1 for whatever you want.

- And up to €6802 the first two years.

- Sign up online and you can choose between a debit or credit card with no issue or maintenance fee3.

- The maximum interest-bearing balance is €10,000. Up to 40,000 accounts.

Chill out on the sofa. We'll take care of it all

100% online

You decide what you want to switch

Bankinter does it for you

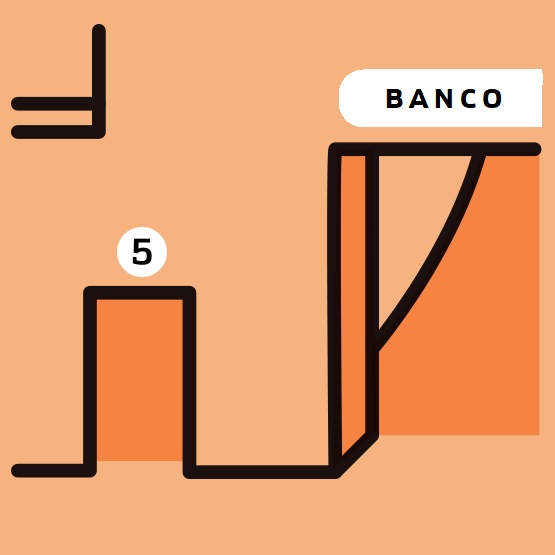

Shall we begin? You can switch your salary to Bankinter in just 2 steps

Step 1: become a customer

What are you waiting for? It's as easy as clicking, entering your details and identifying yourself using your mobile phone. Job done! Your account is ready.

Step 2: switch bank

-

Select the holder.

-

Select the account you want to switch and the actions you want to perform: transfer your balance, switch your transfers and direct debits, report the new account to the issuers of your bills...

-

Choose the start date: this will ensure that your payment obligations and ongoing regular income will continue as normal.

-

Confirm the process and you're done!

What about all the other admin? We'll take care of it!

- We will switch your income and direct debit payments to your new account.

- We will set up the transfers you make to other banks.

- We will cancel your old account and transfer the outstanding balance to your new Bankinter account.

Have you switched your salary account? You can switch everything you want to Bankinter!

If you want to switch your bills...

Just follow these steps to switch the bills you want to your new Bankinter account.

- Select the type of bill you want to switch and choose an alias: electricity, gas, school...

- Attach the bills you want to bring over.

- Sign and we contact the issuers of the bills to make the change.

And if you want to switch other products...

Pension plans4 / EPSVs5

Switch the plan on which you will build your future.

Investment funds6

Switch your funds from other banks.

Securities

Switch your shares, ETFs and other listed products.

Mortgages

Switch your mortgage to Bankinter. It's much easier than you imagine. With our mortgages, you can choose between a fixed, variable or mixed interest rate.

You can see all your banks from Bankinter

With our financial aggregation service you can see all your positions with other banks without leaving the Bankinter website or app.

- You decide which banks you want to include.

- It is easy to set up and even easier to use.

- You can view all your accounts, cards, movements and other banking products at a glance.

- You will have an overview of all your money, making it easier to manage.

- You can make transfers using the bank account you choose from the Bankinter website or app.

Already a customer?

If you're a Bankinter customer and want to see your transactions and products, log in to your private area.

And if you want to find out more... we have all the information you need

See What do I need to switch my salary? What do I need to switch my salary?

You just need the following to switch your salary to Bankinter:

- Your valid ID.

- A Spanish mobile phone number.

- An email address.

- A mobile device with a camera to verify your identity.

See What does the two free accounts promotion consist of? What does the two free accounts promotion consist of?

When you sign up for one of our salary, non-salary, professional or pension accounts, we will give you 2 free accounts to use for whatever you want. You can use them to invest, save, share or pay, so you can organise your finances the way you want.

You can open these two accounts with whoever you want: for you, your partner, your children, your grandchildren or for anyone you can think of.

See What requirements do I have to meet to benefit from this promotion? What requirements do I have to meet to benefit from this promotion?

You must meet the following requirements to benefit from this promotion of 2 free Bankinter accounts:

- Sign up for a salary account, pension account, professional account or non-salary account.

- This offer is available until the promotion ends on 31/12/2023 or until 40,000 accounts have been set up.

- This promotion is open to Bankinter customers and new customers.

Important information

-

Show/Hide legal text1

If you open a Salary/Pension/Business/Non-Salary/Youth Salary account, you can have up to two current accounts with no maintenance fee (NIR 0%, APR 0% calculated for a hypothetical daily balance of €10,000 maintained for one year). This offer is available until 31/12/2023 for both new and existing customers, and is compatible with all the other benefits of the Salary/Pension/Business/Non-Salary/Young Salary accounts. To keep the benefit you must meet the requirements of the Salary/Pension/Business/Non-Salary/Youth Salary account.

-

Show/Hide legal text2 5% interest-bearing accounts: Offer valid until -. For new and existing individual customers who live in Spain, who have not held a Salary/Pension/Business/Non-Salary/Youth Salary account at Bankinter in the 12 months before opening this new account and who must have never received remuneration for any of these accounts. For Salary/Pension/Business Accounts, customers must also have at least €800 of the salary/pension/professional income paid into the account per month. To take advantage of this promotion, the customer may not be the holder of more than two of the following accounts: Salary/Youth Salary Account, Pension Account, Business Account and Non-Salary Account.

The maximum interest-bearing balance is €10,000. Year 1: nominal annual interest rate of 4.94% (5% AER). Year 2: nominal annual interest rate of 1.99% (2% AER). Interest paid every six months. Example for a daily balance of €10,000 in a salary account, calculated for an interest payment period of 180 days (gross remuneration): 1st six months €243.62, 2nd six months €243.62, 3rd six months €98.14, 4th six months €98.14.

In order to earn and retain all the benefits of our Salary/Business/Pension Account, you must maintain your declared level of income and pay at least three (3) bills by direct debit per quarter. The card linked to the account must also remain active, meaning that it must be used to make at least three payments each quarter. For the Pension Account, you do not have to activate the linked credit card. For the Non-Salary account, you must pay at least 10 direct debits per quarter and spend at least €3,000 per year with the card(s) linked to the account.

-

Show/Hide legal text3 If you open a Salary/Pension/Business/Youth Salary account online you can choose between a credit card or debit card, with no issue or maintenance fee. This offer is available until - for new customers only and is compatible with all the other benefits linked to the Salary/Pension/Business/Youth Salary accounts.

-

Show/Hide legal text4 Pensions plans: The key information document for unit holders is available at bankinter.com. The pension plan promoter is Bankinter Seguros de Vida, S.A. de Seguros y Reaseguros. The Pension Fund Manager is Bankinter Seguros de Vida, S.A. de Seguros y Reaseguros. The depositary of the pension funds is Bankinter, S.A.

-

Show/Hide legal text5 Retirement Plans: Bankinter EPSV Individual Retirement Plan: Promoter Partner: Bankinter, S.A.: Manager: Bankinter Seguros de Vida, S.A. de Seguros y Reaseguros.

-

Show/Hide legal text6 Investment funds: The key investor information document, prospectus and all other legal documents related to Bankinter's collective investment institutions are available at any of our branches, on the Bankinter website (www.bankinter.com) and on the Spanish National Securities Market Commission (CNMV) website (www.cnmv.es).