We use first and third-party cookies for analytical and statistical purposes and to show you personalised advertisements based on a profile compiled from your browsing habits (e.g. pages visited). For more information, click on our Cookie Policy. You can accept all cookies by pressing 'Accept', you can reject all cookies by pressing 'Reject', or you can customize your choice by pressing 'Manage'.

Rental Savings Plan – Virtual piggy bank

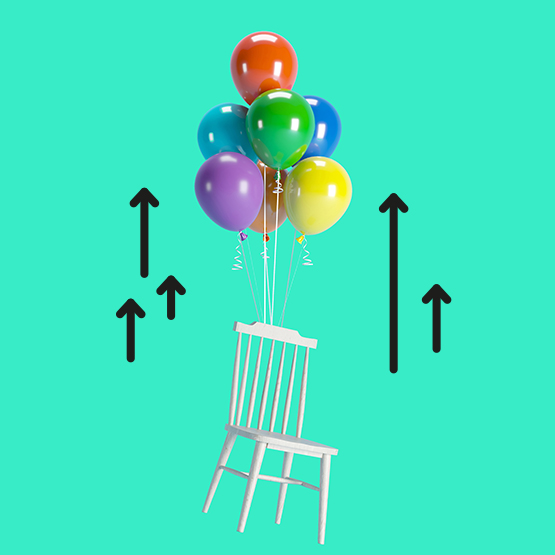

Thinking of buying a house? We'll contribute the sofa!

The lamps, the fridge... It's up to you. If you're currently paying rent but think that you're going to have to buy your own home sooner or later, then you're in luck. Pay your rent through your Bankinter account and when you take out your mortgage with us, we'll pay a bonus into your account.

- Rental Savings Plan: a virtual piggy bank to spend on whatever you want.

- It doesn't matter what your rent is.

This is how Rental Savings Plan works

What's the virtual piggy bank?

It's where we'll deposit your bonuses. You'll be able to access the funds in your piggy bank when you take out your mortgage with us. So you'll have cash in hand to spend on whatever you want.Up to 10% off your rent

Every year you'll receive 10% of your average monthly rent as a bonus. This average will be calculated on a maximum rent of €1,000 and will be paid twice a year.Every six months... chink, chink.

Every six months we'll calculate your bonus and put it in your virtual piggy bank, up to a maximum of €500. How long it takes you to reach that amount will depend on how much rent you pay.

It's easier to explain with an example:

Supposing you paid a monthly rent of €800 for six months – the monthly average would be €800. So the bonus paid into your virtual piggy bank would be €800x(10%/2)=€40 gross.

And all because you paid it through your Bankinter account.

What are you waiting for? This is all you have to do:

See Terms and conditions Terms and conditions

Requirements

To register with Rental Savings Plan you must meet the following requirements:

- Be a resident in Spain.

- Be under 36 years old.

- Hold a euro account at Bankinter.

- Pay your rent by making a regular transfer from a Bankinter account, or have a direct debit set up in the account for this purpose.

Apply

You don't need to provide any documents to register with Rental Savings Plan. If you meet the requirements, just go to your "Private Area" on our website or in the app and sign up.

Payment of the bonus

When you apply for your Bankinter mortgage, we'll ask you to provide your rental agreements. On the day after the mortgage is signed, we'll transfer the amount in the money box to your current account.

See FAQs FAQs

Can I sign up for more than one Rental Savings Plan?

No, only one Rental Savings Plan per customer is allowed.

Once I've signed up for the Rental Savings Plan, can I change the plan details?

Yes, of course. If your rent changes, you can change your home address, the rent amount and even the Bankinter account from which you pay it.

What happens if I turn 36 and I still haven't taken out a mortgage?

The Rental Savings Plan does not generate any commitment. The only thing that would happen is that you would lose the bonus funds that you've built up in your virtual piggy bank.

What happens to my virtual piggy bank if my rent changes?

The only thing that will change will be the bonus that we pay into your virtual piggy bank because we calculate it on your average monthly rent.

I'm signed up for the Rental Savings Plan but I'm going away for three months and won't be paying rent out of my account during that time. Will I lose the funds I've accumulated in my virtual piggy bank?

No, you don't lose it. The funds will stay in your piggy bank until you turn 36. If you set up a new direct debit for your rent in your Bankinter account when you come back, your virtual piggy bank will keep building up until you take out your mortgage.

If two people are signed up for the Rental Savings Plan and then take out a mortgage together, what happens to the bonuses?

You'll both get the bonus that's built up in your respective piggy banks.