We use first and third-party cookies for analytical and statistical purposes and to show you personalised advertisements based on a profile compiled from your browsing habits (e.g. pages visited). For more information, click on our Cookie Policy. You can accept all cookies by pressing 'Accept', you can reject all cookies by pressing 'Reject', or you can customize your choice by pressing 'Manage'.

Investment funds

We are what we eat: eat better to live better.

Nutrition

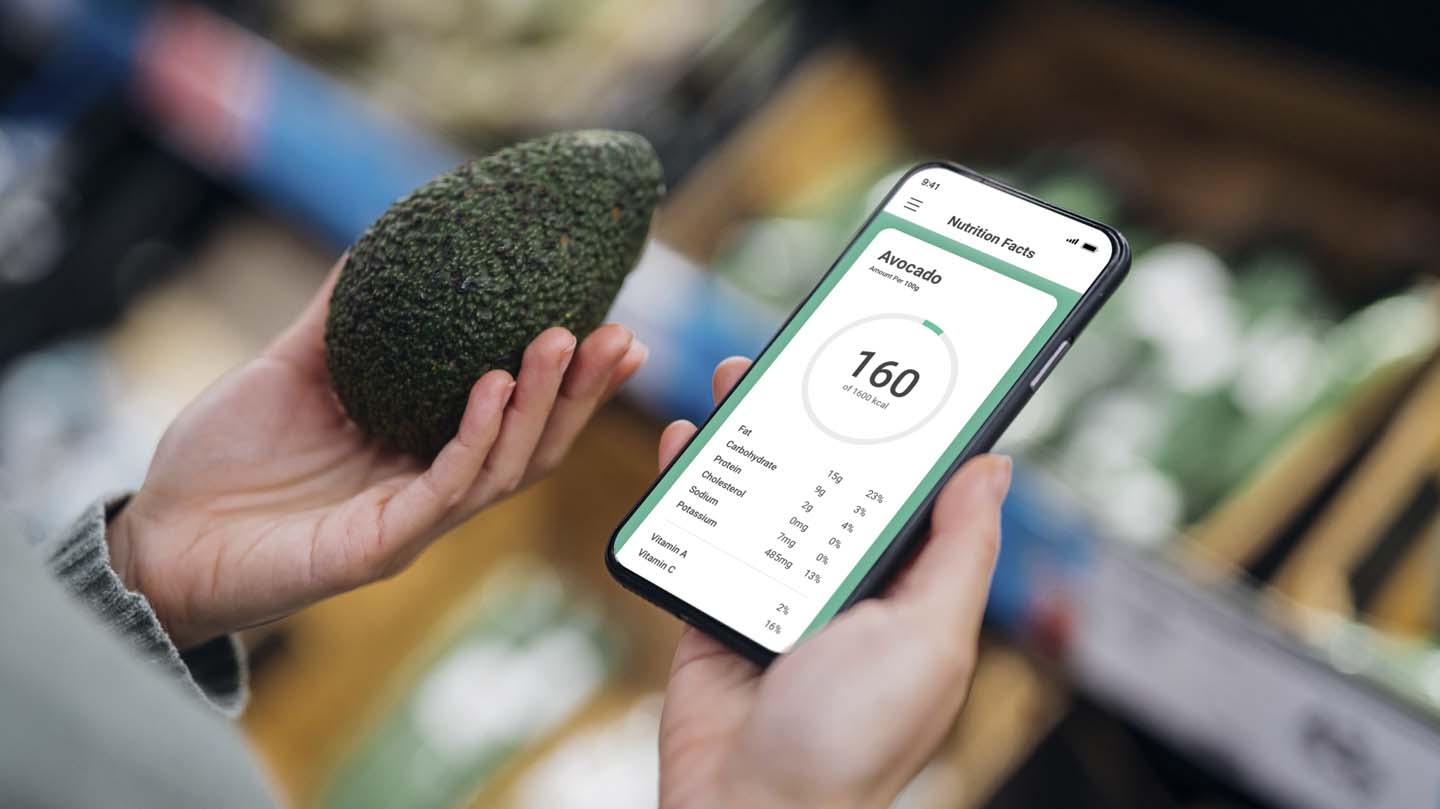

No preservatives, no saturated fat, no added sugar... We read it on the labelling of the products we buy, we hear it in the adverts that emphasise the healthy properties of their foods. It is the industry's response to a trend: nutrition.

-

Consumers are changing their habits: they are more conscious of their diet.It increasingly demands healthier and more ecologically sustainable products.

-

There is an industry that has shown that it is prepared to respond to a new demand.Companies with advantageous positions in their sector that have demonstrated a natural ability to anticipate the changes in consumer preferences.

-

This is a mature sector, regardless of cycles: foodstuffs.Nutrition is part of the food industry and as such is one of the assets to drive social and environmental changes.

-

It is an opportunity to invest in a trend with structural changes worldwide.But it is also a way to be part of a transition to a more sustainable world.

Lower growth risk factors

Source: Blackrock

A consumption habit supported by the different world governments, which implies a structural change that ranges from cultivation to new distribution models.

But the support is not only evident in the regulatory forces. There are other driving forces, with the same importance and influence, that favour the growth of this trend:

-

Social forces.The radical change in the nutritional habits of a society that seeks a healthy and balanced diet.

-

Economic forces.A new range of consumer experiences, such as home delivery, prepared food services, the appearance of spaces for shopping from your car and the reinterpretation of traditional markets, which will mean a change in our shopping habits.

-

New production models.The technological revolution has also affected food production through the development of new processes that improve the final quality of the product.

-

And the aforementioned regulatory forces.New regulations that favour food production under sustainability criteria.

Figures, by way of example, that corroborate the trend phenomenon of nutrition:

-

Mobile applications for food delivery.In 2017, they were worth $4 billion. By 2023, this figure is expected to reach $16.6 billion.

-

Meat substitutes.In the last four years, the sale of these products in the European market has been multiplied by four.

-

The transformative power of legislation.In the United Kingdom, the imposition of a new tax on sugar has led to a 50% reduction in the consumption of sugary drinks.

Our investment proposal covers all activities that are part of the food sector, from the agricultural value chain to packaging, processing, distribution, technology, food grade chemicals, producers and, of course, without forgetting the source: seeds:

- Companies with an active commitment to the search for sustainability that, from their activity, participate and are committed to environmentally responsible development.

- Companies that use new technologies for marketing and distribution: home delivery companies or, for example, companies that provide discounts for customers, but always from a nutritional point of view.

What do the experts think?

- The UN estimates that a shift to healthy diets around the world would help control the rise in hunger, while also leading to huge savings. A change that would make it possible to almost completely offset the health costs associated with unhealthy eating, which is estimated to reach USD 1.3 trillion per year in 2030.

- According to Pictet, malnutrition, poor diet and obesity are costing millions of dollars in healthcare costs and lost productivity worldwide.

Our investment proposal

Invest in funds through shares in infrastructure corporates around the globe.

The value of investment funds1 can fall as well as rise, and you may get back less than you invested.

LU0366534344

PICTET - NUTRITION - P EUR

Medium/High

EUR

1000 €

LU2146189407

ROBECOSAM SUSTAINABLE HEALTHY LIVING EQUITIES

Advanced

EUR

1000 €

Access your private area to continue arranging the fund.

Go to y account

Call us on 900 816 833 and we'll explain how to arrange this fund.

- SEE SUMMARY IN ENGLISH OF THE INVESTOR RIGHTS OF THE Pictet - Nutrition - P EUR FUND

- SEE SUMMARY IN ENGLISH OF THE INVESTOR RIGHTS OF THE ROBECOSAM SUSTAINABLE HEALTHY LIVING EQUITIES FUND

-

Show/Hide legal text1 Investment funds: The key investor information document, prospectus and all other legal documents related to Bankinter's collective investment institutions are available in Spanish at any of our branches, on the Bankinter website (www.bankinter.com) and on the website of the Spanish National Securities Market Commission (CNMV).

-

Show/Hide legal texthttps://am.pictet/es/spain The Key Investor Information Document and the prospectus are available on the website of the investment managers: [Robeco España | Pure wealth management (https://www.robeco.com/es-es/), Pictet AM Spain - Pictet Asset Management.

For more information about this product, please refer to the websites of the investment managers: [Robeco España | Pure wealth management (https://www.robeco.com/es-es/), Pictet AM Spain - Pictet Asset Management. -

Show/Hide legal textThis is an advertising communication. Please refer to the UCITS prospectus and key investor information document before making a final investment decision. The fund managers may decide to stop marketing the funds in the situations provided for in applicable legislation, in accordance with Article 93a of Directive 2009/65/EC and Article 32a of Directive 2011/61/EU.

-

Show/Hide legal textThe Pictet - Nutrition - P EUR Fund is a sub-fund of Pictet AM, authorised in Luxembourg, regulated by the Commissión de Surveillance du Secteur Financier (CSSF) and registered with the CNMV under number 194.

-

Show/Hide legal textThe ROBECOSAM SUSTAINABLE HEALTHY LIVING EQUITIES Fund is a sub-fund of Robeco Capital Growth Funds, a SICAV authorised in Luxembourg, regulated by the Autoriteit Financiële Markten and registered with the CNMV under number 254.

-

Show/Hide legal textThe CIS promotes environmental, social and governance (ESG) criteria under Article 8 of Regulation (EU) 2019/2088 on the disclosure of information related to sustainability in the financial services sector, also known by the English acronym SFDR, and is subject to sustainability risk, as defined in the risk profile. The decision to invest in the fund must be made taking into account all the characteristics or objectives of the promoted fund.

-

Show/Hide legal textSee information on aspects related to sustainability: [Responsible investing | Pictet|https://www.pictet.com/es/es/una-vision-responsable/inversion-responsable,] [Sustainable investing | Robeco España|https://www.robeco.com/es-es/sostenibilidad]