We use first and third-party cookies for analytical and statistical purposes and to show you personalised advertisements based on a profile compiled from your browsing habits (e.g. pages visited). For more information, click on our Cookie Policy. You can accept all cookies by pressing 'Accept', you can reject all cookies by pressing 'Reject', or you can customize your choice by pressing 'Manage'.

Estate administration service

At difficult times, we want to make things easier for you.

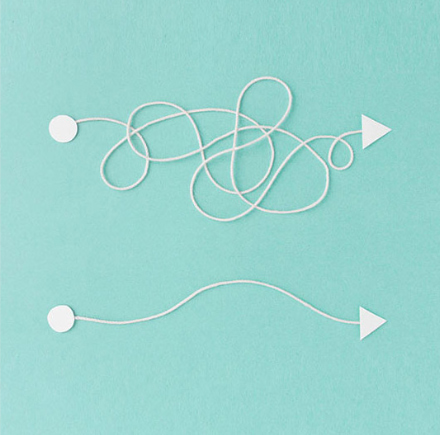

That's the philosophy behind our estate administration service. A comprehensive service provided by a team of lawyers who will guide you and take care of all the arrangements related to the deceased's positions at Bankinter.

Bereavement Service Area

Our estate administration service is delivered through the Bereavement Service Area. Its mission is to make this complex, bureaucratic process as easy as possible for you by reducing the amount of paperwork involved and visits to your branch. You will have:

A professional team

Step-by-step guidance

Start-to-finish solution

Want some help with the administration of an estate?

If you need help or advice with the administration of an estate, all you need to do is:

- Call our Bereavement Service Area on 919 906 135

- Write to us at [email protected]

Guide to estate administration: steps to follow, required documents, etc.

See FAQs FAQs

What's the cost of the estate administration service?

There is a flat fee of €85 for the service. This includes handling the paperwork, submitting documents, providing the legal report, opening accounts where necessary and distributing the inheritance between the heirs.