We use first and third-party cookies for analytical and statistical purposes and to show you personalised advertisements based on a profile compiled from your browsing habits (e.g. pages visited). For more information, click on our Cookie Policy. You can accept all cookies by pressing 'Accept', you can reject all cookies by pressing 'Reject', or you can customize your choice by pressing 'Manage'.

Investment funds

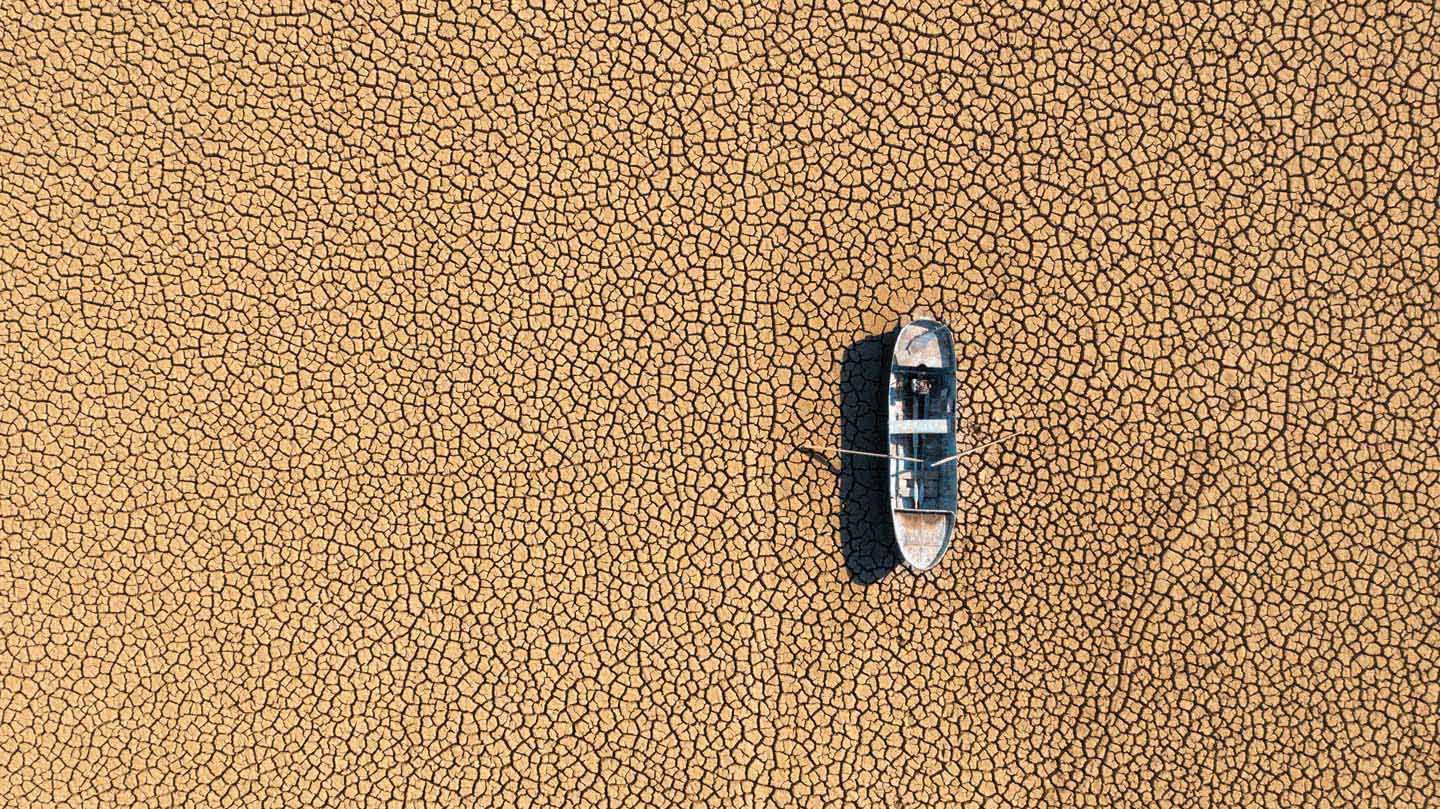

The value of water is not appreciated until the well runs dry.

Water

We can survive without gold, without oil. We can survive without most of the things that surround us, but not without the most precious and indispensable element that exists on Earth: water

Why invest in this trend?

-

The gap between water consumption and its supply is widening.This is a problem that requires a large investment in new technologies and services. Regulatory backing for well-positioned companies will help them grow well in the long run.

-

The need to promote efficient water use.Investors play a fundamental role in promoting innovative and advanced companies in this field.

-

Responsibility to future generations.Protecting the environment is protecting future generations, and this implies reducing carbon dioxide emissions, but also reducing efficiency in the use of water.

We all know that 70% of the Earth is covered by water, but do we know that 185 litres of our most precious asset is needed to make one bag of crisps?

The population growth, urbanisation, the abandonment of traditional diets and the increasing demand for water by industry highlight the need to find solutions for survival and economical development.

-

Improve supply, improve the economy.One tenth of the global burden of disease could be contained through improved water supplies and the hygiene improvements that would come with it. It is estimated that for every dollar invested in improving food supply and hygiene, an average of between 4 and 12 dollars is recovered.

-

Consume less, reuse more.The main industries in the world are adopting a circular economy system by treating wastewater as a resource to be used and not as waste.

In the last 50 years, water consumption has doubled.

Graphic source: waterfootprint.org

An irreplaceable, vital asset with a growing demand motivated by different factors:

-

Population growth.Water consumption multiplies year after year and is expected to continue to increase, even more in developing countries or in the so-called third world countries, where the difficulties to access potable water are greater.

-

Food production.All food products need, to a greater or lesser extent, water for their production, and these values can some cases become very high.

-

Climate change.The global increase in temperatures will bring with it increasingly severe and frequent droughts, a reality that of course requires improving efficiency in the use of water.

Our investment universe focuses on companies that contribute to improving infrastructure, access to clean water and its sanitation, and efficient use.

- Companies located in the water value chain, covering activities such as water infrastructure, wastewater treatment and public supplies.

- Companies that develop activities to promote efficient use of water resources.

What do the experts think?

According to the International Energy Agency, in 2030 the world will need almost 60% more energy than in 2020. An energy production in which water is a critical element.

Our investment proposal

Invest in funds through shares in infrastructure corporates around the globe.

The value of investment funds1 can fall as well as rise, and you may get back less than you invested.

LU2146190835

ROBECOSAM SUSTAINABLE WATER EQUITIES

Advanced

EUR

1000 €

LU1892830248

FIDELITY FUNDS - SUSTAINABLE WATER & WASTE FUND

Medium/High

EUR

1000 €

Today is a good day to start investing through thematic ETFs1 focused on the main corporates in the water sector.

Access your private area to continue arranging the fund.

Go to y account

Call us on 900 816 833 and we'll explain how to arrange this fund.

- SEE SUMMARY IN SPANISH OF THE RIGHTS OF INVESTORS IN THE ROBECOSAM SUSTAINABLE WATER EQUITIES FUND

- SEE SUMMARY IN SPANISH OF THE RIGHTS OF INVESTORS IN THE PICTET - WATER FUND

- SEE SUMMARY IN SPANISH OF THE RIGHTS OF INVESTORS IN THE FIDELITY FUNDS - SUSTAINABLE WATER & WASTE FUND

-

Show/Hide legal text1 Investment funds/ETFs: The key investor information document, prospectus and all other legal documents related to Bankinter's collective investment institutions are available in Spanish at any of our branches, on the Bankinter website (www.bankinter.com) and on the website of the Spanish National Securities Market Commission (CNMV).

-

Show/Hide legal textThe Key Investor Information Document and the prospectus are available on the website of the investment managers: [Robeco España | Pure wealth management (https://www.robeco.com/es-es/), Pictet Asset Management (assetmanagement.pictet); Homepage (fidelity.lu)

For more information on this product, check the investment managers' website: [Robeco España | Pure wealth management (https://www.robeco.com/es-es/), Pictet Asset Management (assetmanagement.pictet); Homepage (fidelity.lu) -

Show/Hide legal textThis is an advertising communication. Please refer to the UCITS prospectus and key investor information document before making a final investment decision. The fund managers may decide to stop marketing the funds in the situations provided for in applicable legislation, in accordance with Article 93a of Directive 2009/65/EC and Article 32a of Directive 2011/61/EU.

-

Show/Hide legal textThe Pictet - Water Fund is a sub-fund of Pictet AM, authorised in Luxembourg, regulated by the Commissión de Surveillance du Secteur Financier (CSSF) and registered with the CNMV under number 194.

-

Show/Hide legal textThe Fidelity Funds - Sustainable Water & Waste Fund is a sub-fund of Fidelity Funds, authorised in Luxembourg, regulated by the Commission de Surveillance du Secteur Financier (CSSF) and registered with the CNMV under number 124.

-

Show/Hide legal textThe RobecoSAM Sustainable Water Equities Fund is a sub-fund of Robeco Capital Growth Funds, SICAV, authorised in the Netherlands, regulated by Autoriteit Financiële Markten and registered with the CNMV under number 254.

-

Show/Hide legal textThe CIS promotes environmental, social and governance (ESG) criteria under Article 8 of Regulation (EU) 2019/2088 on the disclosure of information related to sustainability in the financial services sector, also known by the English acronym SFDR, and is subject to sustainability risk, as defined in the risk profile. The decision to invest in the fund must be made taking into account all the characteristics or objectives of the promoted fund.

-

Show/Hide legal textSee information in Spanish on aspects related to sustainability: [Letter to BlackRock customers | sustainability|https://www.blackrock.com/co/blackrock-client-letter]; Sustainable investment (robeco.com)