We use first and third-party cookies for analytical and statistical purposes and to show you personalised advertisements based on a profile compiled from your browsing habits (e.g. pages visited). For more information, click on our Cookie Policy. You can accept all cookies by pressing 'Accept', you can reject all cookies by pressing 'Reject', or you can customize your choice by pressing 'Manage'.

Investment funds

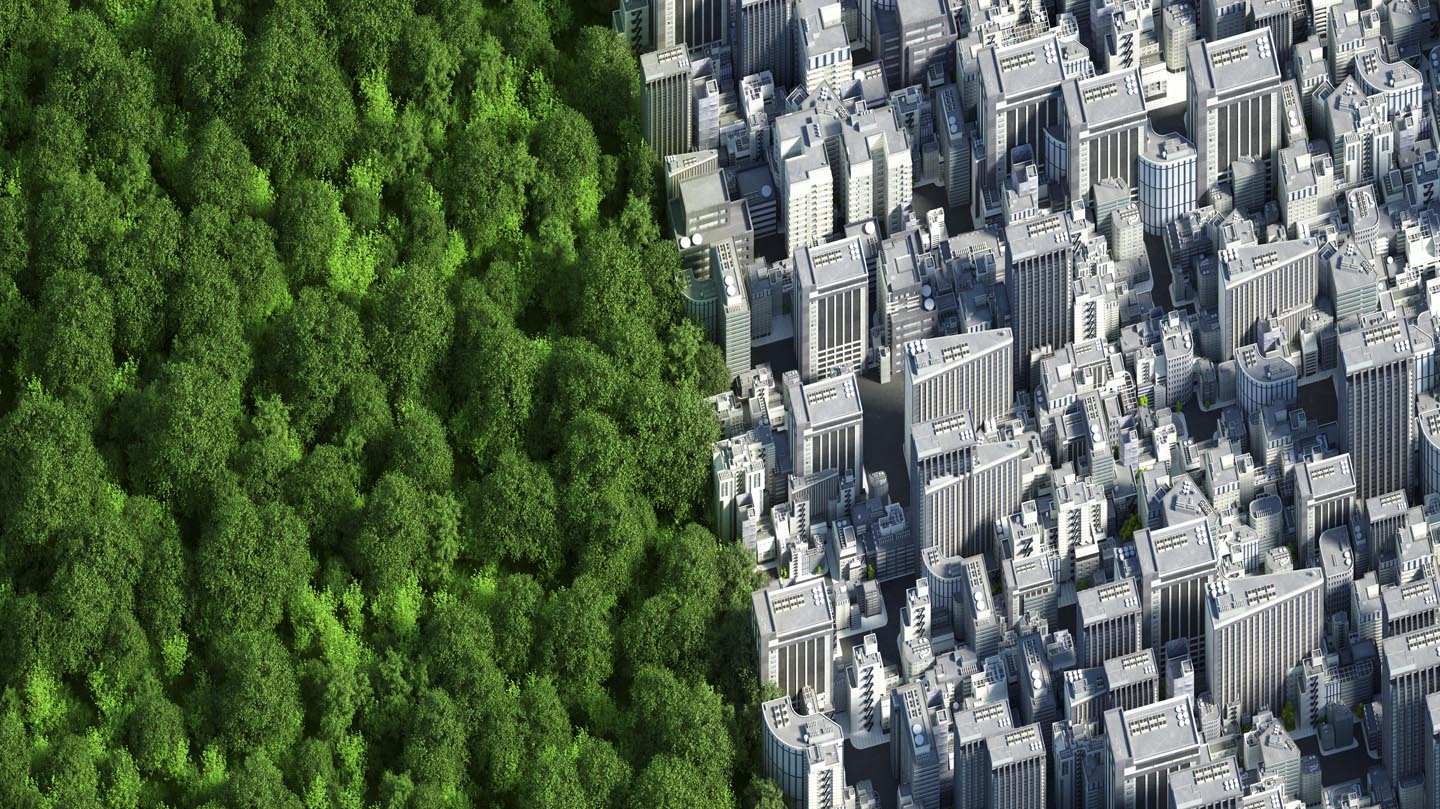

Istanbul, the year 2000: 8.8 million residents.

Istanbul, the year 2022: 15.4 million residents.

Smart cities

Data that corroborates the growth that cities are experiencing. A transformation that foresees that, in the coming years, 70% of the population will live in urban areas. But for that to happen, solutions will be needed that can satisfy the needs of their residents, improving their quality of life, smart solutions capable of combining benefits for the planet with financial benefits.

Why invest in this trend?

-

The global growth rate of cities is increasing.Young and developing cities, especially those located in emerging markets, require investment in basic infrastructure and construction: raw materials, concrete, construction machinery, etc.

-

Greater growth, greater diversity in infrastructure.As cities grow, so do their infrastructure needs: telecommunication networks such as 5G, transportation, housing and social infrastructure such as hospitals and schools.

-

Government policies support the sustainable growth of cities.These policies promote the development of cities, including the reduction of the level of contamination, an efficient consumption of resources, improvement of health care and better public infrastructures.

A smart city looks to benefit its population, focusing on increasing residents' quality of life and always under an environmental sustainability approach.

Cities with better infrastructure, greater comfort, and attractive job opportunities tend to attract global talent and, as a consequence, industry.

There are plenty of well-known examples such as San Francisco, London, Paris and New York. These cities have served as the launching pad for a wide variety of entrepreneurial projects, given their large and dense populations.

-

Cities with higher population density and younger consumers.Young people with higher disposable income, the perfect ingredients for innovation and an entrepreneurial spirit.

-

Increasingly large cities, which need larger essential infrastructures.Such as the development of large-scale transportation, airports and bridges.

-

Hyperconnected cities.These are characterised by a broad use of technologies, from the cloud to wireless networks to guarantee a more economically efficient management.

-

Cities where cars have their days numbered.For short journeys, cars will be replaced by travelling on foot, bicycle or public transport; for long journeys, electric and self-driving vehicles will be the preferred mode of transport.

One objective: energy self-sufficiency:

-

Reduction of environmental impact through sensors.Sensors that monitor the use of available resources and pollution.

-

Investment in low emission infrastructures.Public transport, renewable energy, efficiency in commercial buildings and good waste management could reduce the energy costs of cities by more than 17 billion dollars by 2050.

-

Innovation and technological development.New ideas and technology for new cities: deliveries made by drones, use of seawater to reduce the temperature of houses, connected trains, smart traffic lights to reduce traffic jams or the use of remote controls to manage our homes.

Cities and megacities in figures: 80% of world GDP is generated by cities.

-

Data from the Mckinsey consultancy:As of October 2018, the top 50 cities accounted for 8% of the global population, 21% of global GDP, 37% of high-income urban households, and 45% of businesses with more than 1 billion dollars in annual income.

-

UN data:The UN predicts that by 2030 the world will be home to 43 megacities with more than 10 million inhabitants. If this happens, there will only be fertile ground for growth by driving innovation.

-

World Bank data:55% of the population currently lives in cities, and it is expected that by 2050 this figure will reach 70%, with the consequent increase in GDP.

Our investment proposal focuses on companies that contribute to global urbanisation or that we know benefit from it. Companies that operate in sectors such as mobility, infrastructures or sustainable resource management, mainly highlighting:

- Companies that contribute to a better quality of life in cities through the application of new technologies.

- Companies dedicated to managing the city, building the city and living in the city.

What do the experts think?

- According to the UN, by 2050 close to 70% of the world population will live in cities, forcing them to be redeveloped, with a change in the construction model that involves the industrialisation of the sector and greater needs for waste management, water, traffic and communications.

- An OECD report estimates that by 2030, investment needs in energy, transport, water and telecommunications infrastructure, without taking climate considerations into account, will reach as much as 6.3 trillion dollars a year.

- A recent report from the Global Commission on the Economy and Climate found that investing in low-emission public transport, using more renewable energy, and increasing efficiency in commercial buildings and waste management in cities could lower costs worldwide by about USD 17 trillion by 2050, as well as reducing the time spent commuting to and from work and improving overall quality of life.

Our investment proposal

Invest in funds through shares in infrastructure corporates around the globe.

The value of investment funds1 can fall as well as rise, and you may get back less than you invested.

LU2092758726

ROBECOSAM CIRCULAR ECONOMY

High

EUR

1000 €

Access your private area to continue arranging the fund.

Go to y account

Call us on 900 816 833 and we'll explain how to arrange this fund.

-

Show/Hide legal text1 Investment funds: The key investor information document, prospectus and all other legal documents related to Bankinter's collective investment institutions are available in Spanish at any of our branches, on the Bankinter website (www.bankinter.com) and on the website of the Spanish National Securities Market Commission (CNMV).

-

Show/Hide legal text2 The fees shown are the sum of the management and depositary fees. These fees are charged annually.