Agent network

Notable improvement in results

The agent network has confirmed itself as a benchmark business model in the sector. It comprises professionals with their own office that work with Bankinter to provide private banking services. The agents provide their knowledge and their customers, while the Bank contributes its product portfolio, structure and brand. Generated profits are shared in accordance with the provisions of the corresponding commercial agreements.

At the end of 2017, the network was formed by 400 agents, who were highly qualified and focused on the wealth management of high net worth customers. All of them are fully qualified to provide the functions of the advisory services they carry out and have received the training required by the MiFID 2 directive, that tightens up the protection of customers in financial transactions.

At the end of 2017, the network was formed by 400 agents, who were highly qualified and focused on the wealth management of high net worth customers. All of them are fully qualified to provide the functions of the advisory services they carry out and have received the training required by the MiFID 2 directive, that tightens up the protection of customers in financial transactions.

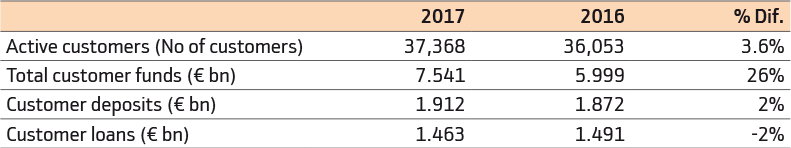

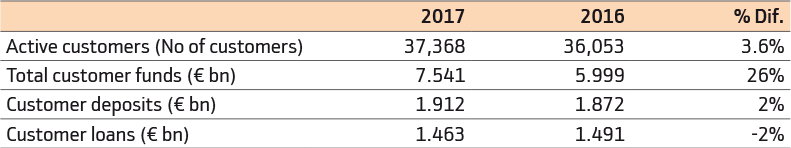

The balance sheet of the agent network totalled 11.801 billion euros at 31 December, which is practically triple the amount of six years ago. The average balance managed per agent is 29 million euros, compared to 21 million euros at the same date in 2016, with a rise of almost 40% in just 12 months.

New customers

The commercial activity and the attraction of new professionals (34 in 2017) saw 1,241 new private banking customers join Bankinter in 2017 through the agent network, 26% of the total, with the resulting impact on sales volume and fee income.

The agent network contributed 41.4 million euros to the Bank's gross operating income and 21 million euros in pre-tax profit, up 14% and 38% on 2016, respectively. Just three years ago, in 2015, this business had EBT of 10.7 million euros; in other words, a little over half that of 2017.

Alongside this improvement in earnings, in 2017 two major challenges were undertaken: the construction of a training database and the adaptation of all the agent's agreements to the new regulations, the Internal Code of Conduct and a Code of Ethics specific to the agent network.

In 2018, it is planned to carry on with the adaptation of MiFID 2, improve the control environment, make further progress with digitalisation, maintain the rate of attracting new agents and increase the contribution of profit to the Bank.

At the end of 2017, the network was formed by 400 agents, who were highly qualified and focused on the wealth management of high net worth customers. All of them are fully qualified to provide the functions of the advisory services they carry out and have received the training required by the MiFID 2 directive, that tightens up the protection of customers in financial transactions.

At the end of 2017, the network was formed by 400 agents, who were highly qualified and focused on the wealth management of high net worth customers. All of them are fully qualified to provide the functions of the advisory services they carry out and have received the training required by the MiFID 2 directive, that tightens up the protection of customers in financial transactions.