Corporate governance

Capital adequacy regulations, the Good Governance Code of Listed Companies and international good governance guidelines and recommendations, all require Bankinter, as a bank and listed company, to have a corporate governance policy. On 25 October 2017, Bankinter's board of directors approved Bankinter Group's Corporate Governance Policy.

In accordance with the corporate by-laws, the board of directors of Bankinter S.A. is the competent body to approve the corporate policies of the Bank and its Group, excluding Linea Directa Aseguradora, which has its own regulations.

In accordance with the corporate by-laws, the board of directors of Bankinter S.A. is the competent body to approve the corporate policies of the Bank and its Group, excluding Linea Directa Aseguradora, which has its own regulations.

The approved Corporate Governance Policy contains the general principles that inform the specific corporate policies and internal rules and procedures in corporate governance matters, that form, together with it, the Group’s internal corporate governance framework and are mandatory for all group entities and their respective governing bodies.

Furthermore, the Corporate Governance Policy contains the principles that define the corporate structure of Bankinter Group as well as the core rules of its internal operations, based on and for the implementation of applicable legislation and the best corporate governance practices.

The corporate governance policy is available on Bankinter’s corporate website.

Size and composition of the board

The board of directors of Bankinter, S.A. is formed by ten members, who are characterised by their professional capability, integrity and independent judgement. These conditions are reported on annually in the corporate governance report, which is approved by the board of directors.

Two of its ten members are executive directors and eight are external directors. Five of the latter are independent, two are proprietary and the last, in the opinion of the Board, is neither proprietary nor independent.

Changes in the composition of the board during 2017

On 4 April 2017, Ms Rosa María García García resigned from her position as a director of Bankinter as a result of assuming new responsibilities in the company where she was an executive director. To cover this vacancy, the appointments and corporate governance committee began the selection process, in accordance with the board member selection and succession policy (described in the following sections) with the help of an external expert. On 7 November 2017, the board co-opted Ms Teresa Martín-Retortillo Rubio as an independent external director after the European Central Bank had received the positive suitability assessment of her proposed nomination. The ratification of this appointment will be proposed at the 2018 annual general meeting of shareholders (Ms Martín-Retortillo’s profile can be found on Bankinter’s corporate website).

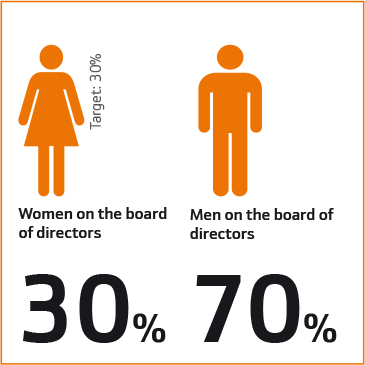

The appointment of Ms Martín-Retortillo to board of directors increases the following ratios:

Current composition of the board

Separation of functions

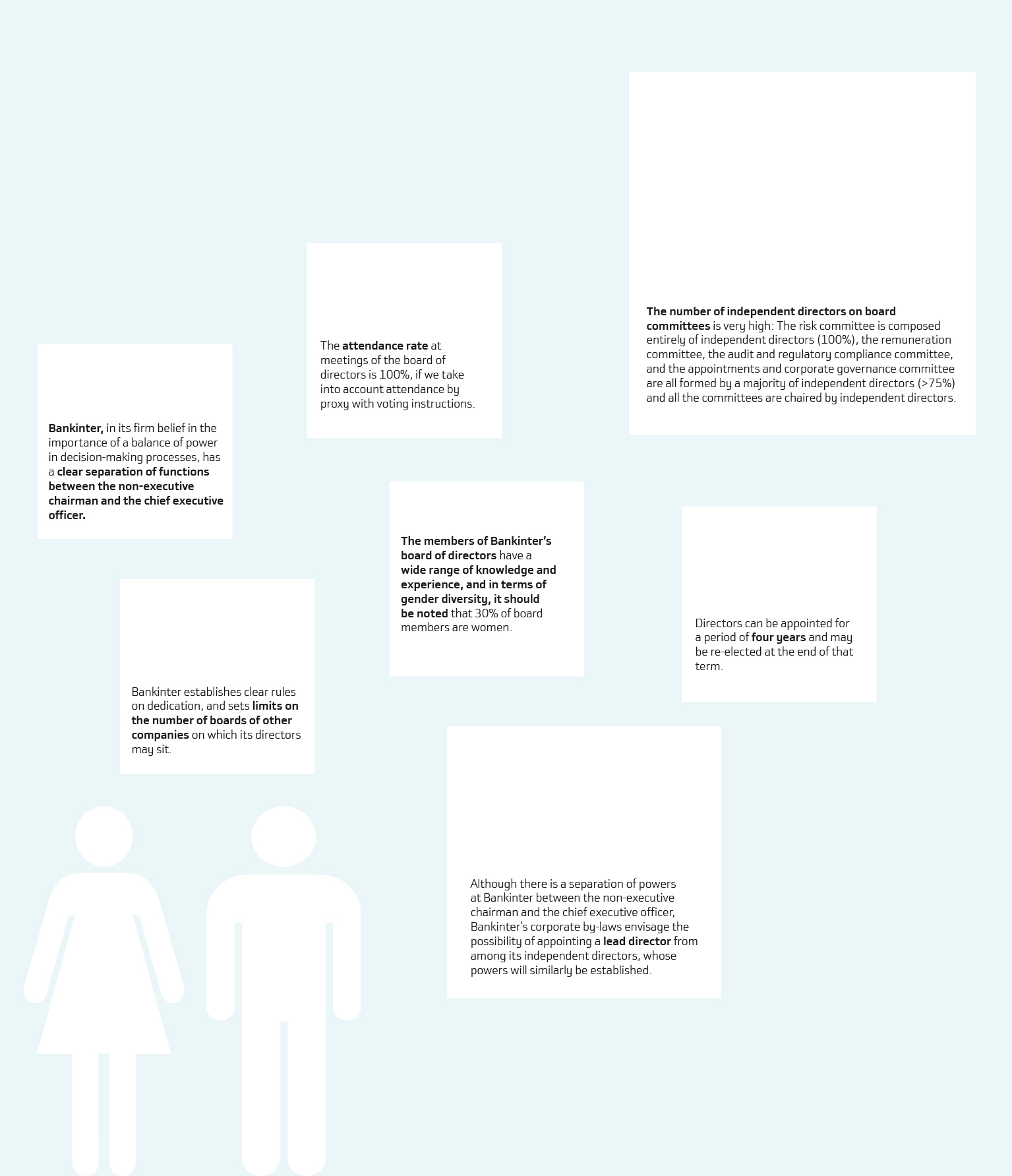

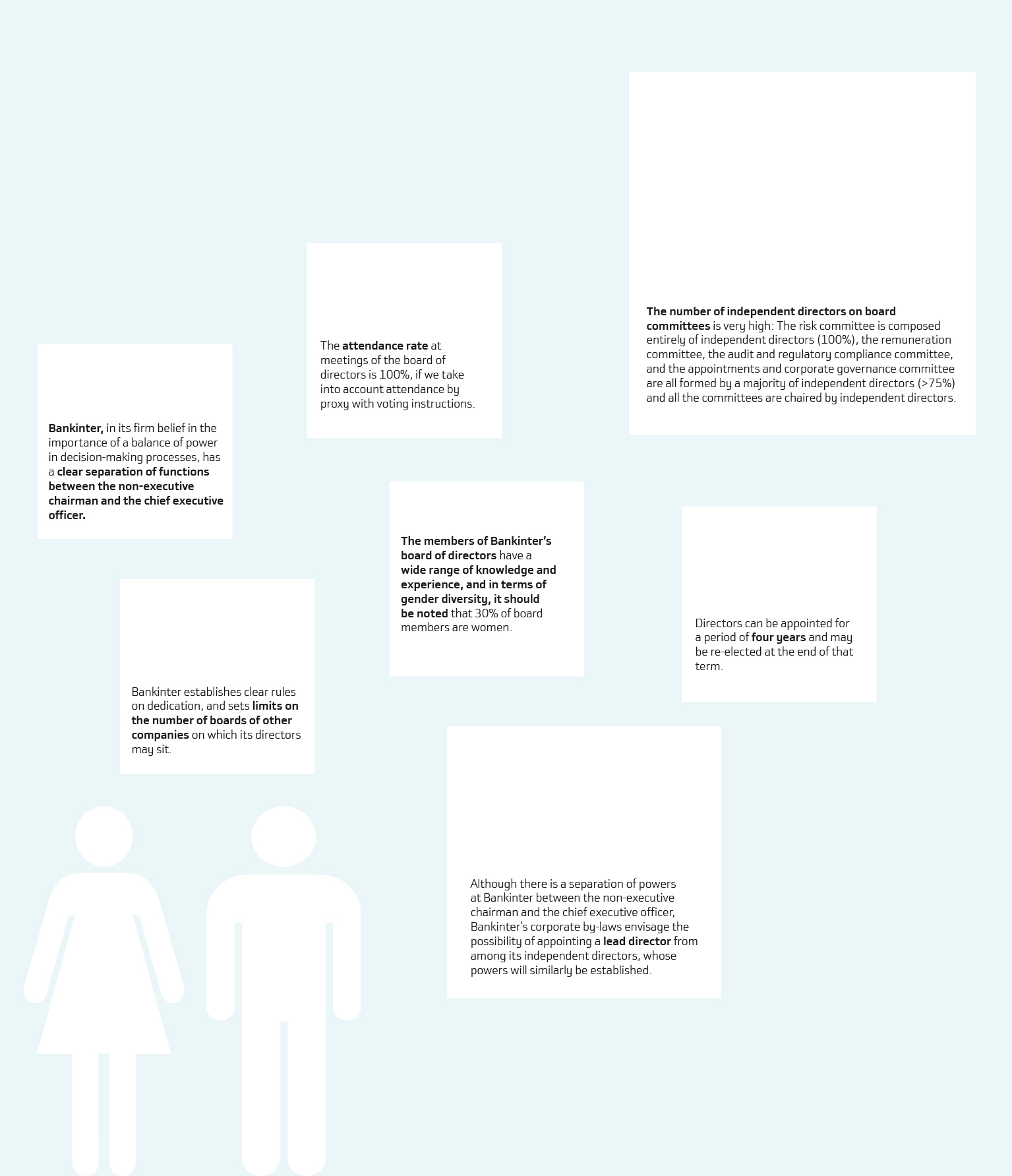

Bankinter, in its firm belief in the importance of a balance of power in decision-making processes, has established a clear separation of functions between the non-executive chairman and the chief executive officer.

Even though, Bankinter has separated the two functions, its corporate by-laws envisage the possibility of appointing a lead director from among its independent directors, whose powers will be similarly established.

Board committees

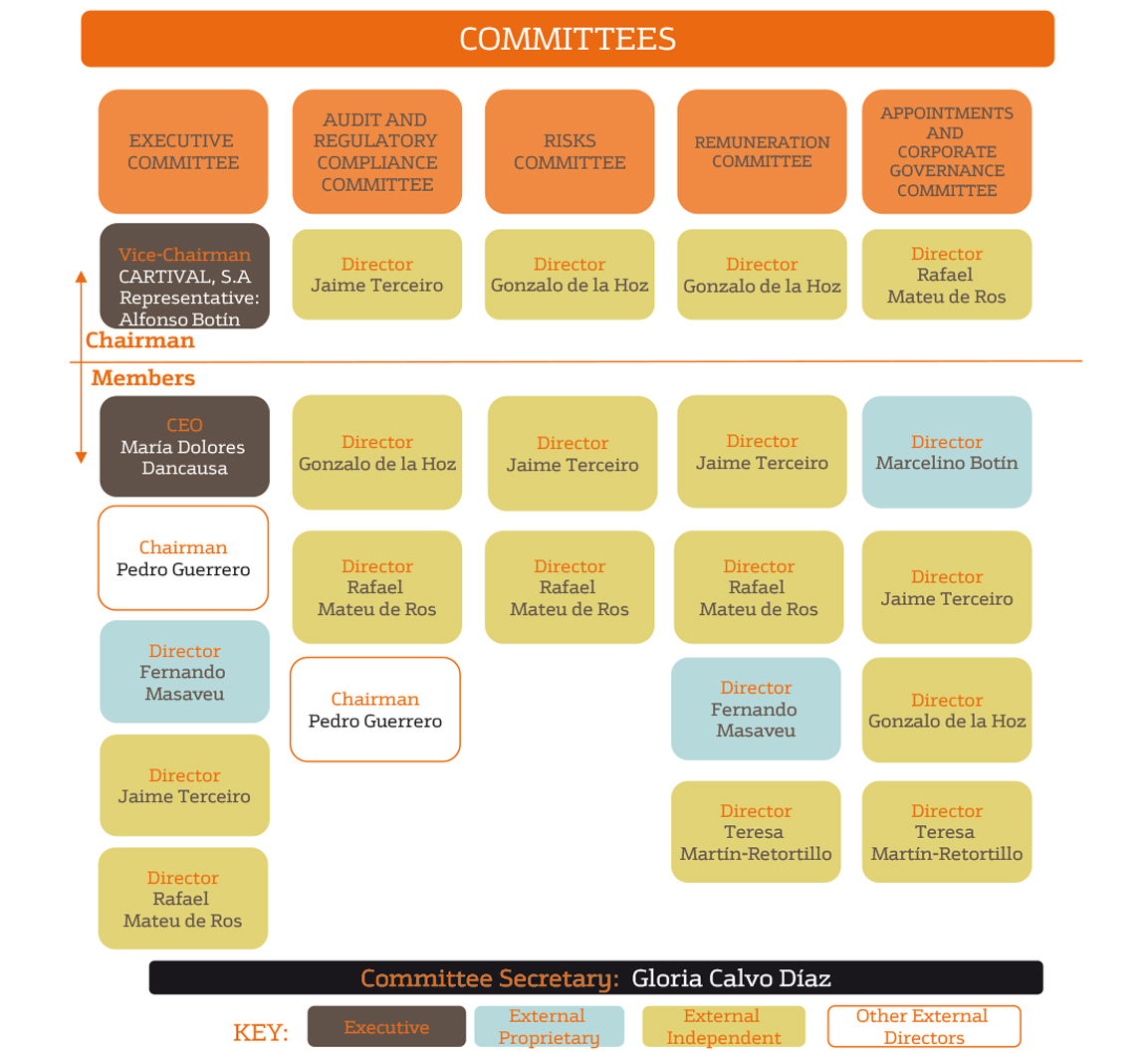

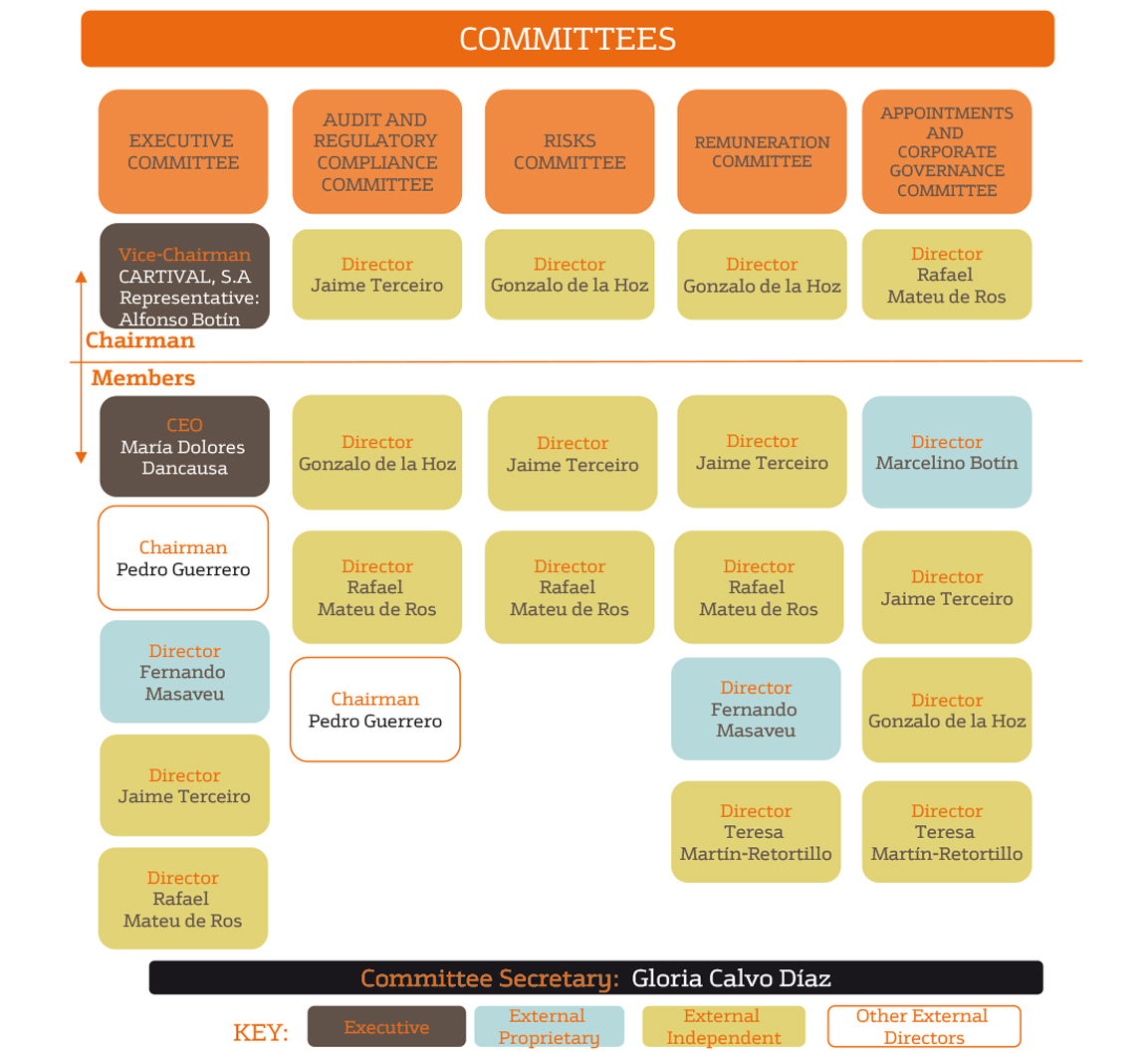

The board has created an executive committee, with delegated powers. Furthermore, the board of directors has the following committees with supervisory, reporting, advisory and proposal powers: audit and regulatory compliance committee, risk committee, remuneration committee and the appointments and corporate governance committee. The Rules and Regulations of the Board of Directors, available on the company's corporate website, detail the functions and powers assigned to each of these committees.

The current composition of the aforementioned committees is as follows:

Selection of directors. Diversity in the composition of the Board

On 18 November 2015, Bankinter's board of directors approved the director selection and succession policy, according to which the processes of selection and succession of directors will adhere to the following general principles:

i. They will guarantee compliance with applicable legislation and be carried out respecting the characteristics of the composition of the board of directors set out in the corporate by-laws and in the Rules and Regulations of the Board of Directors.

ii. They will encourage there to be a clear majority of independent directors on the board of directors and the number of executive directors to be the minimum necessary taking into account the Group's complexity.

iii. They will guarantee that there is an adequate balance between proprietary and independent directors, reflecting, as much as possible, the proportion between share capital with voting rights represented by proprietary directors and the rest of the share capital.

iv. They will ensure diversity of nationalities, gender and experiences, such that decision-making is enriched and a variety of points of view are heard when debating matters within its competence.

v. They will guarantee the stability of the board of directors in line with the measures taken by the Company to ensure, whenever possible, that the appointment or re-election of directors does not affect more than one fourth of the board members in any given year.

The director selection processes are based on an analysis of the needs of the Company and of the entities that make up its Group. The board of directors carries out such analysis with the advice of the appointments and corporate governance committee.

Additionally, and as a general rule, the candidates to become directors of the Company must be persons of integrity and suitability and have recognised solvency, skill, experience, qualification, training, availability and commitment to their duties.

The appointments and corporate governance committee assesses the balance of powers, expertise, diversity and experience necessary for the board of directors. For this purpose, it defines the functions and aptitudes required of candidates for each vacancy; and assesses the time and dedication necessary for them to properly discharge their duties. During 2017, the committee initiated the selection process to fill the vacancy produced in the board of directors as a result of the resignation of Ms Rosa Mª García, determining that the needs to be covered at that time, taking into account the profiles of the current directors and that which Ms García had, were: i) gender diversity, ii) business management experience, iii) international training and experience, iv) strategy skills, v) technological and digital expertise, and vi) medium/long-term commitment.

The appointments and corporate governance committee assesses the balance of powers, expertise, diversity and experience necessary for the board of directors. For this purpose, it defines the functions and aptitudes required of candidates for each vacancy; and assesses the time and dedication necessary for them to properly discharge their duties. During 2017, the committee initiated the selection process to fill the vacancy produced in the board of directors as a result of the resignation of Ms Rosa Mª García, determining that the needs to be covered at that time, taking into account the profiles of the current directors and that which Ms García had, were: i) gender diversity, ii) business management experience, iii) international training and experience, iv) strategy skills, v) technological and digital expertise, and vi) medium/long-term commitment.

In general, Bankinter uses external advisers to select candidates capable of forming part of the board of directors in the capacity of independent directors.

With regard to gender equality, Bankinter is committed to equal opportunities for men and women, which is in line with carrying out objective selection processes that are free from any determining conditions or biases which may limit the access of women to appointments as directors. Therefore, the candidate's independence, professional qualifications, capacity and experience in the industry are assessed in each case. The candidate selection process seeks to ensure that the candidates reviewed always include women.

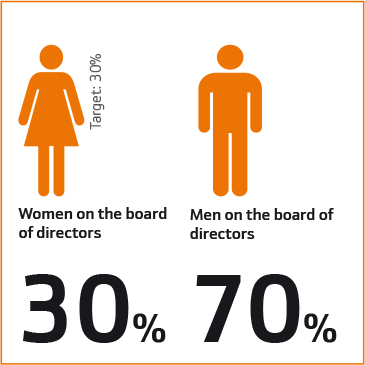

As a result of this commitment, a female member of the board of directors was appointed in 2010 as executive director and chief executive officer of the company, and since that date, all the independent directors appointed to the board have been women. As a result, the board of directors has a 30% female ratio, having achieved ahead of schedule the target internally agreed in its document entitled ‘Representation target for the less represented gender on the board and guidance on how to achieve such target’ adopted by the board of directors in 2014 and established for 2020 in the Good Governance Code of listed companies.

Succession plans for the chairman and executive directors

In accordance with the policy approved by the board in 2015, the succession process for board members must guarantee that it is carried out in a planned and coordinated way, thus protecting the continuity of the business without any delays.

The appointments and corporate governance committee looks to ensure the existence of succession plans and update them for the chairman and the executive directors of the Company and, where applicable, to submit proposals to the board of directors so that this succession is carried out in a planned and orderly manner. This analysis is submitted to the board of directors on an annual basis.

Training of board members

On 25 October 2017, the board of directors approved the policy on the training of board members. This policy aims to define the required principles and planning for guaranteeing that board members’ qualifications are up to date through training, in order to ensure that they have, at all times, the abilities required to perform their supervisory duties objectively and with independent judgement. It sets out two training scenarios:

i) When board members are selected, in order to ensure that they have sufficient specialised skills in order to fulfil their duties efficiently; and to familiarise them with the organisational structure of Bankinter and its Group, focusing especially on the regulations that apply to their business activity and on any topics considered important for new board members to know in order to perform their duties while serving on the board; and

ii) As part of a continued training plan, at the request of the board members themselves or following an analysis conducted by Bankinter itself, so that board members may access group and/or personalised training programmes based on their individual skill set and role on the board, bearing in mind the diverse profiles, training, experience and expertise that Bankinter may require.

The policy on the training of board members is available on Bankinter’s corporate website.

In 2017, the initial training programme for newly appointed board members and the continued training programme for the full board were put into practice.

The initial training programme commenced after Ms Martín-Retortillo had joined the board of directors, thus guaranteeing her deep understanding of Bankinter, its Group and organisational structure, its business activities and regulations that apply to it, with special focus on risk control in the primary stage of the programme. This training, which is still being provided, is carried out internally and will complement the new director's skills and experience.

In regard to the continued training programme, board members have received specific training on crime prevention (liabilities of legal entities and money laundering prevention).

Secretary of the board

The Rules and Regulations of the Board of Directors contain an article describing the functions of the secretary of the board, attributing them all the functions that correspond to them under the Spanish Corporate Enterprises Act and in line with best corporate governance practices. These functions include safeguarding the formal and material legality of the board's actions, overseeing compliance with good governance recommendations assumed by the Bank and ensuring that the procedures and rules of governance are respected and reviewed on a regular basis.

The Rules and Regulations of the Board of Directors contain an article describing the functions of the secretary of the board, attributing them all the functions that correspond to them under the Spanish Corporate Enterprises Act and in line with best corporate governance practices. These functions include safeguarding the formal and material legality of the board's actions, overseeing compliance with good governance recommendations assumed by the Bank and ensuring that the procedures and rules of governance are respected and reviewed on a regular basis.

On 16 December 2015, the board of directors approved a procedure for preparation of meetings of the board and its committees, attributing to the secretary of the board, among others, those functions related to assisting the chairman to ensure that all directors receive the relevant information in order to discharge their duties in good time and in the appropriate format.

Functioning of the board

In accordance with the Rules and Regulations of the Board of Directors, before the start of each financial year, the board will approve the meeting schedule for the following year and the expected agenda for them. The directors are entitled to propose additional items to be included on the agenda. The calendar and the agenda may be amended by resolution of the board itself or by decision of the chairman, who will report the change to the directors sufficiently in advance, except in cases of emergency. The minimum number of meetings will be 10 per year (well above the legal requirement to hold meetings once a quarter).

The board of directors of Bankinter met 12 times in 2017.

Preparation of the meetings

As indicated in the previous section, in 2015 the board of directors approved a procedure for preparing the meetings of the board and its committees following a proposal from the appointments and corporate governance committee. Notice must be given, except in cases of emergency or necessity, sufficiently in advance of the date of the meeting. This procedure includes, among others, the following aspects:

- Meetings calendar of the board and its committees.

- Method and place where meetings will be held.

- Call notice and agenda for each meeting.

- Time and means for making available the documentation to be analysed and discussed at each meeting.

- Means of communicating with the directors responsible for compliance with this procedure.

Directors are guaranteed to receive the necessary information in order to adequately assess the corresponding transactions or decisions prior to when the board or committee meetings are held, so that they may reasonably prepare for the meetings and actively participate in the discussions.

Conduct of the meetings

The board of directors, either directly or through its committees, fully exercised its supervisory role in 2017. It was kept well informed of the progress and activity of Bankinter Group's various business areas and of general matters within the scope of its supervisory functions, and, most prominently, the board has continued to monitor the Bank's strategic objectives defined in 2015, which have been periodically discussed in specific items in the respective agendas. Similarly, board members have been informed about the conclusions of the various internal and external audit reports, among many other matters addressed, such as the management and control of risks associated with Bankinter Group.

Dedication to the board's tasks

Directors are required to devote the time and effort necessary in order to effectively discharge their duties and, in any case, to comply with the limits on the maximum number of boards to which they may belong, as established by law.

Directors must ensure that absences from meetings of the board of directors and the committees of which they are members are limited to unavoidable cases.

These requirements have been adequately met by all members of Bankinter's board of directors, with an attendance rate of 96.15%, (100%, if attendance via proxy with specific instructions is included), and full commitment to the analysis and discussion of the issues that have been placed before them through the study of the supporting documentation and any other information required for such purpose.

The 2017 assessment was conducted internally and was presented at the board meeting held in January 2018.

Assessment of the board and its delegated committees

One of the board's powers is to produce an annual assessment of its own workings and those of its committees and, based on its conclusions, to propose an action plan to correct any shortcomings detected.

In accordance with corporate governance recommendations, the board of directors decided that this assessment will be carried out by external advisors at least every three years. In 2016, the assessment was carried out by an independent external expert, Russell Reynolds, whose findings were submitted in January 2017.

The 2017 assessment was conducted internally and presented to the board in January 2018.

Both the 2016 assessment by Russell Reynolds and the internal assessment for 2017 covered such aspects as the operations of the board of directors and its committees, as well as the performance of its chairman and executive directors.

Neither assessment found any weaknesses that necessitated the implementation of a corrective action plan in any of the areas that were analysed: i) quality and efficiency in the board’s functions; ii) the functions and the composition of board committees; iii) diversity in the composition and the authority of the board of directors; iv) the performance of the chairman of the board and the chief executive officer of Bankinter; and v) the performance and contribution of each director, with a special focus on committee chairs.

Nonetheless, the analysis of the findings of both assessments led to some suggestions for improvement, which will be examined by the appointments and corporate governance committee.

Remuneration and incentives

The principles and components of director remuneration are detailed in the directors' remuneration policy which will be voted on at the annual general meeting of shareholders to be held in March 2018, and in the annual report on directors' remuneration which is subject to an advisory vote at the annual general meeting.

Description of the remuneration system

The principles and components of director remuneration are detailed in the directors' remuneration policy which is voted on at the annual general meeting of shareholders, and in the annual report on directors' remuneration which is subject to an advisory vote at the annual general meeting.

As part of its good governance policy, Bankinter decided, as of its entry into force in 2008, to implement and enforce recommendation 40 of the then Unified Good Governance Code of Listed Companies in relation to submitting its report on the directors' remuneration policy to the annual general meeting of shareholders as a separate item on the agenda, subject to an advisory vote, which is also a requirement included in the Spanish Corporate Enterprises Act.

- External directors do not receive variable remuneration.

- The variable remuneration at Bankinter is limited, and defined in absolute amounts.

- There is a deferral period for variable remuneration of more than three years.

- Bankinter has established recovery and reduction mechanisms (malus and clawback clauses) for variable remuneration.

- There are no severance packages.

- Bankinter has approved a long-term incentive plan with quantifiable targets which provide a long-term vision of the bank to the beneficiaries of the plan, in order to promote a culture of sustainability.

The annual general meeting of shareholders is the competent body to approve the maximum annual amount of remuneration corresponding to all directors acting as such. This amount will remain in force until the annual general meeting of shareholders agrees to change it, although the board may reduce its amount.

The specific amount that corresponds to each of the directors for the concepts established in the corporate by-laws and the form of payment will be determined by the board of directors. To this end, the positions held by each director on the body itself and their membership on and attendance at the various committees will be taken into account.

This remuneration currently has two components: i) an annual fixed amount, and ii) attendance fees.

The directors are entitled to remuneration (salaries, incentives, variable remuneration, pensions, insurance and severance payments) that, as proposed by the remuneration committee and approved by the board of directors, is deemed appropriate for the performance of other functions in the Company, regardless of whether they are executive directors or not, other than those that entail collective supervisory and decision-making functions discharged as mere board members. Currently, only two executive directors receive variable remuneration.

The variable components of remuneration will be set so that an appropriate ratio results between the fixed and variable components of the total remuneration and so that they do not exceed 100% of the fixed components of each director’s total remuneration, unless the annual general meeting of shareholders approves a higher ratio, which may not, under any circumstances, exceed 200% of the fixed components of their total remuneration, in the terms established by law.

Transparency

The annual report individually presents the remuneration received by each director, expressing the amounts relating to each remuneration item. Additionally these items appear individually in the report as well as the remuneration that corresponds to the executive functions entrusted to the Bank's executive directors.

In accordance with the corporate by-laws, the board of directors of Bankinter S.A. is the competent body to approve the corporate policies of the Bank and its Group, excluding Linea Directa Aseguradora, which has its own regulations.

In accordance with the corporate by-laws, the board of directors of Bankinter S.A. is the competent body to approve the corporate policies of the Bank and its Group, excluding Linea Directa Aseguradora, which has its own regulations.

The appointments and corporate governance committee assesses the balance of powers, expertise, diversity and experience necessary for the board of directors. For this purpose, it defines the functions and aptitudes required of candidates for each vacancy; and assesses the time and dedication necessary for them to properly discharge their duties. During 2017, the committee initiated the selection process to fill the vacancy produced in the board of directors as a result of the resignation of Ms Rosa Mª García, determining that the needs to be covered at that time, taking into account the profiles of the current directors and that which Ms García had, were: i) gender diversity, ii) business management experience, iii) international training and experience, iv) strategy skills, v) technological and digital expertise, and vi) medium/long-term commitment.

The appointments and corporate governance committee assesses the balance of powers, expertise, diversity and experience necessary for the board of directors. For this purpose, it defines the functions and aptitudes required of candidates for each vacancy; and assesses the time and dedication necessary for them to properly discharge their duties. During 2017, the committee initiated the selection process to fill the vacancy produced in the board of directors as a result of the resignation of Ms Rosa Mª García, determining that the needs to be covered at that time, taking into account the profiles of the current directors and that which Ms García had, were: i) gender diversity, ii) business management experience, iii) international training and experience, iv) strategy skills, v) technological and digital expertise, and vi) medium/long-term commitment. The Rules and Regulations of the Board of Directors contain an article describing the functions of the secretary of the board, attributing them all the functions that correspond to them under the Spanish Corporate Enterprises Act and in line with best corporate governance practices. These functions include safeguarding the formal and material legality of the board's actions, overseeing compliance with good governance recommendations assumed by the Bank and ensuring that the procedures and rules of governance are respected and reviewed on a regular basis.

The Rules and Regulations of the Board of Directors contain an article describing the functions of the secretary of the board, attributing them all the functions that correspond to them under the Spanish Corporate Enterprises Act and in line with best corporate governance practices. These functions include safeguarding the formal and material legality of the board's actions, overseeing compliance with good governance recommendations assumed by the Bank and ensuring that the procedures and rules of governance are respected and reviewed on a regular basis.