We use first and third-party cookies for analytical and statistical purposes and to show you personalised advertisements based on a profile compiled from your browsing habits (e.g. pages visited). For more information, click on our Cookie Policy. You can accept all cookies by pressing 'Accept', you can reject all cookies by pressing 'Reject', or you can customize your choice by pressing 'Manage'.

Bankinter rebaja al 2,99% el tipo de interés de la hipoteca fija en todos sus plazos y en el tramo fijo de la Hipoteca Dual

- Una reducción de 31 puntos básicos sobre el precio anterior que el banco aplicará en todas las modalidades de hipoteca fija, incluido el tramo fijo de su Hipoteca Dual, un préstamo innovador que conjuga al mismo tiempo y en un solo producto las ventajas de la hipoteca fija y de la variable.

- El banco abre la contratación de la Hipoteca Dual a sus clientes empresas, que podrán financiarse a partir de ahora con la flexibilidad que permite este préstamo, si bien en este caso con precios personalizados.

2024-04-23 10:00:00.0

Bankinter launches a new advertising campaign to highlight the advantages and profitability of its accounts

- Titled “Your money works for you”, the new campaign will launch on prime-time TV on Sunday 14 April.

- The spot presents the advantages of Bankinter's digital account, the only from a listed bank that yields up to 1.5% AER with no time or balance limit; and the salary account, that yields up to €680 the first two years.

2024-04-12 11:45:00.0

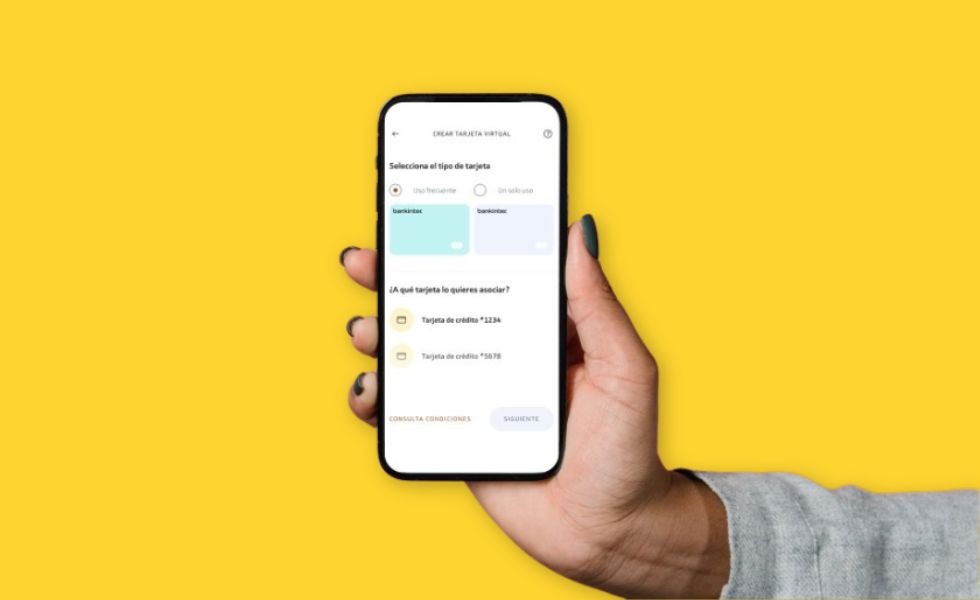

Bankinter impulsa la emisión de tarjetas virtuales como fórmula para mejorar la seguridad en las operaciones online

- El banco ha lanzado de forma pionera este innovador medio de pago en dos modalidades: tarjetas de un solo uso, para realizar una única operación o compra online; y de uso frecuente, para utilizar en comercios online con pagos periódicos.

- Su principal ventaja es que proporciona al cliente un mayor control de sus gastos y, sobre todo, más seguridad en todo tipo de compras online, al tener acotadas las operaciones y los límites de gasto.

2024-04-11 10:20:00.0

Bankinter reaches 1.5 billion euros in less than five months with the Bankinter Premium Renta Fija investment fund

- It's become the Bank's third biggest fund in terms of the volume of assets.

- At the end of last October, the Bank launched a fund designed by Bankinter Asset Management to offer customers with an option with potential.

2024-03-13 11:20:00.0

Bankinter launches an interest-bearing account with up to 3% AER for its SME customers

- The account, available to customers of the Plan 0 of the “Bankinter Corporate Plan”, offers a remuneration of 3% AER the first year and 1.5% AER the second year, with a maximum interest-bearing balance of 50,000 euros and no fees.

- A new advantage of the “Bankinter Corporate Plan”, a model which the Bank launched almost two years ago to simplify the range of accounts for SMEs and make fees as simple and transparent as possible.

2024-03-07 11:00:00.0

Bankinter Investment and Sonae Sierra launch ORES Germany, a new alternative investment vehicle that invests in retail real estate in the German market

- ORES Germany focuses on investment in retail real estate in this market.

- The vehicle has a total investment of EUR 200 million, with a portfolio of eight large retail properties with long-term leases and first-class operators in the food and DIY-home sectors.

- Bankinter Investment has already launched 23 alternative investment vehicles with almost EUR 4.8 billion of capital committed by investors

- Sierra continues to expand its investment management business and currently manages properties worth over EUR 6.6 billion.

2024-02-19 11:00:00.0

Bankinter launches a new campaign to highlight the advantages of its partner banking to advertising agencies and media

- The new "Half Agencies and Media" campaign will be launched in the media in the first quarter and continue with direct marketing actions throughout the year.

- Established 30 years ago, Bankinter Partner is a unique business model based on the partnership between the bank and a business customer which enables employees of that business to access financial products and services tailored for them, sharing the profits.

2024-02-01 11:40:00.0

Bankinter supports Metro de Madrid with 94 million euros for new trains

- The Madrid Corporate Banking area and the Investment Banking subsidiary Bankinter Investment jointly agree an innovative loan featuring a guarantee from an insurance company.

- This financial support complements that from the EIB and the ICO for the purchase of 80 new vehicles to enhance Madrid's suburban train network.

2024-01-17 11:00:00.0

The Bankinter Energy Efficiency fund is among the most profitable in its category in 2023 with a gain of 24.3%

- Bankinter Asset Management has succeeded in situating this investment option that complies with sustainability criteria at the top of the VDOS ranking, which includes domestic and international funds.

2024-01-03 12:20:00.0

Bankinter raises more than 700 million euros in one month with its Bankinter Premium Fixed Income investment fund

- The bank has launched a fund, designed by Bankinter Asset Management, that enables customers with savings and a preference for monetary assets, treasury bills and similar options, to take positions in fixed income.

2023-12-27 11:00:00.0

Bankinter Investment agrees project financing of 35 million euros for the renewables company X-ELIO

- The financial backing will be used to develop, operate and maintain three photovoltaic energy projects.

2023-12-14 11:45:00.0

Bankinter Roboadvisor launches a new feature to allow regular contributions when investing in funds

- The bank's 100% online investment manager is therefore responding to customer demand.

2023-11-29 10:00:00.0

Bankinter Broker becomes the first broker offering 'zero' fees in the national market with remuneration from securities lending

- Broker customers who assign their shares to Bankinter will receive some of the returns from the lending of those securities.

- They can trade at any time with no limitations, and retrieve their shares at any time.

- This new benefit has been made possible by an agreement with Citi, which offers a securities lending agent service (Citi's Securities Lending Access™ platform), enabling Bankinter to offer this solution to its retail customers.

2023-11-21 13:50:00.0

Bankinter offers discounts on security trading and splitting payments on card purchases during Black Friday and Cyber Monday

- The Bank reduces the purchase fee for securities on the New York Stock Exchange (NYSE) index from 20 to 5 euros on Friday and on Monday for the Nasdaq.

- The 'Compra Smart' service, which lets customers split credit card purchases into several payments, will be free of charge on Black Friday.

- As a third promotion, Bankinter offers customers who purchase Amazon gift vouchers through the bank's app a 2% saving on said purchase.

2023-11-20 10:00:00.0

Bankinter launches the Bankinter Premium Fixed Income investment fund to round off its range of profiled products

- Bankinter Asset Management has designed a fund that enables customers with savings and a preference for monetary assets, treasury bills and similar options to begin taking positions in fixed income.

- The current interest rate environment offers the ideal opportunity to invest in a short-term fixed income fund, which is mid-way between monetary and direct fixed income funds.

2023-11-15 09:30:00.0

Bankinter offers a cash bonus of up to 6% to savers who bring their pension plan to the Bank

- The Bank has a launched a campaign until 31 January offering cash bonuses of up to 6% on the amount transferred, with a guaranteed minimum bonus of 4%.

- On top of that, customers will benefit from an extra bonus of 0.25% if they make an additional contribution of 1,500 euros and have an equity of at least 30,000 euros in their pension plan at the end of the year.

2023-10-05 11:00:00.0

Bankinter launches an advertising campaign highlighting the groundbreaking nature of the new Dual Mortgage and its advantages as a unique financial product

- The bank resumes its commitment to "society's progress" from its previous campaign, highlighting the advantages of an innovative product, tailored to the current situation and each customer's needs.

- With the Dual Mortgage, Bankinter is launching a new loan category that combines the benefits of fixed- and variable-rate mortgages.

2023-10-03 12:34:00.0

Bankinter creates the Dual Mortgage and launches a new loan category that combines the benefits of fixed- and variable-rate mortgages

- The bank has designed a groundbreaking mortgage credit facility that is tailored to the needs of each customer and all types of market environment.

- The customer decides at the time of agreement what percentage of the loan will be taken out as a variable-rate mortgage and what part will be at a fixed rate, with each of them maintaining the respective specific features of that mortgage type.

- The Dual Mortgage helps the customer's decision-making process when opting for one type of mortgage or another, without forcing them to give up the benefits of each type.

2023-09-28 11:53:00.0

Bankinter Investment promotes Palatino Residencial, a new alternative investment vehicle focused on rental homes

- Bankinter's Investment Banking subsidiary partners with the VÍA ÁGORA real estate group to create its first vehicle focused on the residential real estate sector.

- This alternative investment vehicle is now beginning to be marketed among Bankinter customers.

2023-09-18 15:30:00.0

Bankinter exceeds 55 billion in volume of Wealth Management assets managed, with a year-on-year growth of 11%

- The area managing high-net-worth assets set a record by increasing the amount under management by 5.3 billion euros by the end of June compared to the first half of 2022.

2023-08-08 11:00:00.0

Bankinter Roboadvisor ends the first half of the year with returns of up to 8.8% on its investment fund portfolios and pension plans

- The bank's 100% online manager is establishing itself as a leader in the fully digital investment business.

- Bankinter was the first bank to launch its own roboadvisor, back in 2018.

2023-08-03 13:00:00.0