We use first and third-party cookies for analytical and statistical purposes and to show you personalised advertisements based on a profile compiled from your browsing habits (e.g. pages visited). For more information, click on our Cookie Policy. You can accept all cookies by pressing 'Accept', you can reject all cookies by pressing 'Reject', or you can customize your choice by pressing 'Manage'.

News

Bankinter expands its business strategy in Ireland and establishes a branch

- The creation of the branch in Ireland will allow the Bank to operate in the deposit market and then roll out all its other financial products and services.

- The Bank is carrying out the necessary administrative requirements to establish Bankinter Ireland, which involves the acquisition, from its consumer subsidiary BKCF, of the shares of Avant Money.

2024-04-26 11:10:00.0

Bankinter lanza un programa de formación para digitalizar empresas de la mano de reconocidas escuelas de negocios

- Esta iniciativa, denominada “Generación digital”, se incluye dentro de los fondos ‘Next Generation EU’, cuya subvención recae en las escuelas formativas.

- El banco ofrecerá esta formación a empresas clientes, sin coste, con el fin de contribuir a que materialicen un avance digital real.

2024-04-24 11:45:00.0

Bankinter rebaja al 2,99% el tipo de interés de la hipoteca fija en todos sus plazos y en el tramo fijo de la Hipoteca Dual

- Una reducción de 31 puntos básicos sobre el precio anterior que el banco aplicará en todas las modalidades de hipoteca fija, incluido el tramo fijo de su Hipoteca Dual, un préstamo innovador que conjuga al mismo tiempo y en un solo producto las ventajas de la hipoteca fija y de la variable.

- El banco abre la contratación de la Hipoteca Dual a sus clientes empresas, que podrán financiarse a partir de ahora con la flexibilidad que permite este préstamo, si bien en este caso con precios personalizados.

2024-04-23 10:00:00.0

Bankinter achieved a net profit of 200.8 million euros in the first quarter, an increase of 8.7%, with solid growth in all its lines of business and all countries

Return on equity (RoE) consolidated at 17.4%, while RoTE was 18.4%. The efficiency ratio improved to 35.3% and the CET1 fully-loaded capital ratio increased to 12.5%, 466 basis points above the minimum required of Bankinter by the ECB..

The bank's balance sheet shows growth that outpaces the sector: lending (+5%), retail funds (+6%) and off-balance-sheet managed funds (investment and pension funds and wealth management/SICAVs) which grew by 18.2%..

Bankinter shows strength in all account margins: net interest income grew by 10.6%; gross income, which groups all revenues, by 6.9%; and operating income before provisions by 7.6%.

2024-04-18 08:01:00.0

Bankinter launches a new advertising campaign to highlight the advantages and profitability of its accounts

- Titled “Your money works for you”, the new campaign will launch on prime-time TV on Sunday 14 April.

- The spot presents the advantages of Bankinter's digital account, the only from a listed bank that yields up to 1.5% AER with no time or balance limit; and the salary account, that yields up to €680 the first two years.

2024-04-12 11:45:00.0

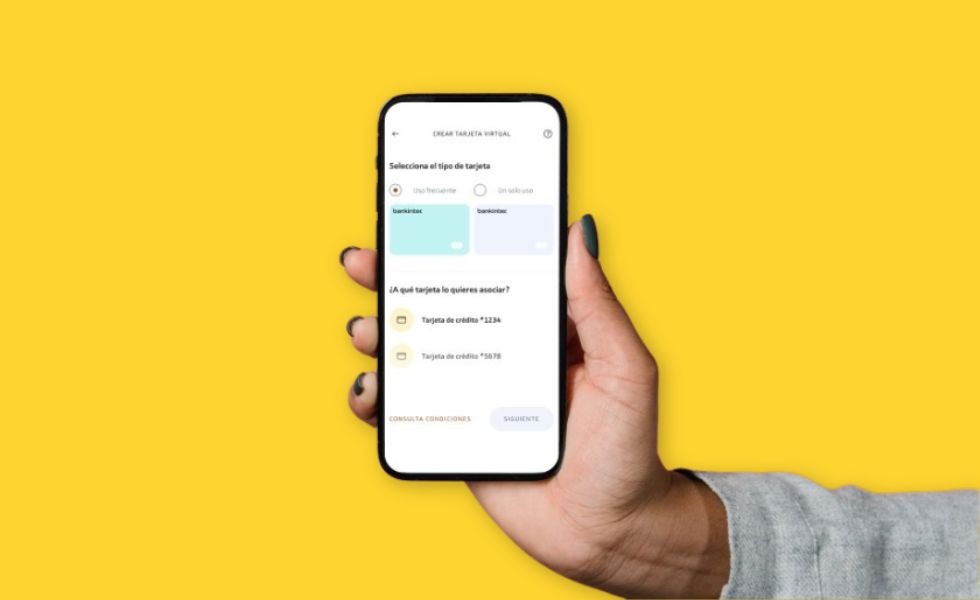

Bankinter promotes the issue of virtual cards as a formula to improve security in online transactions

- The Bank has pioneered this innovative payment method with two versions: a single-use card to carry out a single transaction or online purchase; and a multi-use card to use with online merchants that collect recurring payments.

- The main advantage is that it provides customers with greater control of their expenses and, above all, greater security in all types of online purchases thanks to limited transactions and expenditure amounts.

2024-04-11 10:20:00.0

Bankinter's chairman takes his leave at the Annual General Meeting, emphasising his pride at having had the opportunity to contribute to the “extraordinary progress” made by the bank

- Pedro Guerrero emphasised in his speech that the bank has established “a far more diversified, profitable and resilient business model.”

- María Dolores Dancausa, chief executive officer of Bankinter, emphasised that the bank “has doubled its total assets, and achieved a 5.6-fold” increase in its profits since 2010, in addition to expanding internationally in the Eurozone and strengthening its diversification.

- The CEO dedicated offered her gratitude and recognition to the bank's 6,500 professionals, who are “the true architects” of what the banks represents today, and also to the chairman for his outstanding contribution to the Group over 33 years and his “brilliant career and leadership”.

- Gloria Ortiz is appointed executive director by the Annual General Meeting and appointed by the board as the new chief executive officer.

2024-03-21 15:25:00.0

Bankinter successfully launches an issue of subordinated debentures for 200 million euros

- The placement was carried out in just three hours and was aimed at institutional investors.

- It registered a demand of 1.9 times the amount offered, reaching over 390 million euros.

2024-03-19 16:10:00.0

Bankinter reaches 1.5 billion euros in less than five months with the Bankinter Premium Renta Fija investment fund

- It's become the Bank's third biggest fund in terms of the volume of assets.

- At the end of last October, the Bank launched a fund designed by Bankinter Asset Management to offer customers with an option with potential.

2024-03-13 11:20:00.0