We use first and third-party cookies for analytical and statistical purposes and to show you personalised advertisements based on a profile compiled from your browsing habits (e.g. pages visited). For more information, click on our Cookie Policy. You can accept all cookies by pressing 'Accept', you can reject all cookies by pressing 'Reject', or you can customize your choice by pressing 'Manage'.

Differentiation

The 'D' of Differentiation. At Bankinter, we constantly strive to stand out through innovative solutions backed by cutting-edge technologies, offering recognized service quality and advanced people management. These pillars distinguish us as an entity with unique differential values in the market.

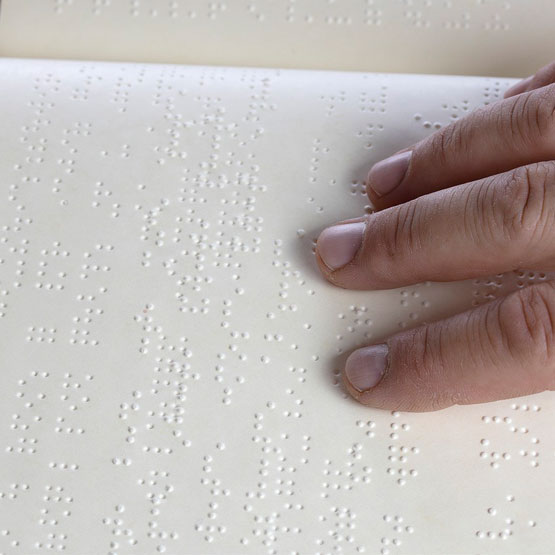

"A bank for everyone" project

Bankinter sees people with disabilities as a priority group for developing this project. Its objective is to make all its channels as accessible as possible, removing physical, technological and knowledge-related barriers and incorporating disability into the Bank's value chain.

The Bank is also aware of trends in society such as the gradual ageing of the population, related to increased life expectancy and low birth rates in Spain. This translates into a greater degree of dependency in the population, and therefore greater demand for accessibility.

Physical accessibility

In order to respond to this growing need, the Bank has implemented a Universal Accessibility Management System (UAMS) with the clear commitment to making available to everyone having dealings with the Bank, regardless of abilities, facilities and measures that provide an environment in which Bankinter's services are accessible to all.

His system has been certified under the Spanish AENOR UNE 70001 Universal Physical Accessibility standard

Bankinter also offers several accessible services, such as the card with contact details in Braille for operating by telephone and the monthly statement in large print and audio formats. Of the Bank's branches, 99.5% are accessible to people with impaired mobility, and technical devices are being installed to facilitate listening and reading, such as magnetic loops for users of hearing aids and magnifying glasses for long-sighted people.

The premises area's works manual includes accessibility criteria to which any new building or renovation carried out in the branch network must conform.

Bankinter accessibility

By developing the remote channels and implementing the best technology, the Bank aims to provide a service accessible to all customers everywhere.

ICT is a key factor in promoting integration, since it enables many activities to be carried out with minimal interaction with the physical environment, opening up great possibilities for normalisation of daily life and access to the world of finance. The Bank promotes e-accessibility, which it sees as a way of breaking down barriers, in both hardware and software, which prevent a large group of people with physical, intellectual or sensory disabilities, as well as elderly people, from accessing the technology.

Bankinter has an "Operational Plan for ICT Accessibility", the purpose of which is to create and consolidate a working methodology to ensure that accessibility is integrated into the bank?s various processes and thus, in accordance with corporate principles and values, to promote relations between people with disabilities and the Bank as regards access channels and the design of products and services.

The Bank has a system for visually impaired people to operate using a sum of coordinates via the keyboard with fully guaranteed security.

As for people with hearing difficulties, Bankinter?s website contains an explanatory video in sign language with information on content, portal functionalities and how to use the various channels. The Bank also has a video call service in sign language provided by bank professionals who are also sign language experts, enabling customers to carry out transactions and receive advice on products and services. This is the first service of its kind in the world.

We have also developed an accessible video player enabling all users to make use of the video players on the websites.

The Bank periodically renews the certifications for its financial portal Bankinter.com, which was the first to achieve a "Double A" (AA) rating for website accessibility and a "Triple A" (AAA) for certain information pages. We also renewed the "Eurocert" European accessibility certification.

Training programme for financial integration

As part of its "A bank with no small print" programme, Bankinter aims to facilitate access to common banking transactions for people who have previously had to rely on others in order to interact with banks because of their disability.

The aim is to facilitate access and make this routine part of their autonomous, independent day-to-day lives. This is the objective pursued both by the training course on basic banking concepts for persons with hearing difficulties and the four-module training programme on common banking concepts and operations for persons with intellectual disabilities.

The first course was delivered by the various regional federations of the CNSE (National Confederation for the Deaf) by Bankinter personnel expert in sign language, and the four training modules for people with intellectual disabilities were designed and delivered by volunteers from the Bank previously trained to ensure the proper adaptation and effectiveness of the programme contents.

The Bank has a two-pronged approach, since it considers that lack of knowledge on the part of Bank employees when satisfactorily dealing with persons with disabilities can also lead to barriers, which must be removed in order to improve accessibility.

For this reason, Bankinter carries out several training programmes, both classroom-based and online, involving employees and customers, designed to bring about integrative and accessible two-directional relations.

In the Customer Service Protocol, the Bank has included all the indications necessary for providing optimal, quality service to this group. Employees have at their disposal a Manual for attending to persons with disability in banking services, prepared in collaboration with the ONCE Foundation.

People

The values underpinning Bankinter's corporate culture are Integrity, Agility, Originality and Enthusiasm, and its most important assets are its People.

To foster active employee participation in running the business, Bankinter encourages a free, open, non-hierarchical, creative and motivating work environment, promoting the direct involvement of its professionals in decision-making processes and the introduction of significant improvements and innovations.

Flexibility

Bankinter's work-life balance policy applies measures that seek to offer greater employee well-being, always applying criteria of flexibility, in the belief that work-life balance is a lever for equality, for positioning men and women on the same level in balancing their personal, family and professional lives.Sustainability Training Plan

As part of the Sustainability Training Plan, courses are planned, both classroom-based and online, with the objective of involving and training the workforce on a model of responsible management, such as the online course "A bank for everyone", on attending to persons with disabilities, or the online Environmental Management course.Climate

Regular studies are carried out on the climate in the workplace, enabling us to gain a thorough understanding of employees? opinions. A realistic knowledge and comparison of the working environment is the best basis from which to improve people management.Social benefits

Bankinter offers social benefits which apply to all employees, irrespective of their working day or the region they live in, such as a sports allowance, study allowance, medical insurance, life insurance, etc.Collective labour agreement

The Bank acknowledges and guarantees its employees full exercise of their rights to trades union membership, association and collective bargaining in the terms established by law. The entire workforce is covered by a collective labour agreement.Diversity and equality

Support for diversity and equal opportunities form part of the Bank's corporate culture.Customers

Bankinter's value proposition to its customers is based on providing excellent quality of service, constant innovation in products and services and a wide range of multi-channel banking options facilitating their dealings with the Bank.

To ascertain customers perceptions and hear their suggestions for improvement and their expectations of the Bank, Bankinter continually carries out satisfaction surveys to measure the impact of the service customers receive in its distribution networks and service channels as well as in the selling of specific products and services.

Trends in the degree of customer satisfaction and intention to recommend, together with complaints and claims to the Customer Service department are key factors for drawing up action plans in each of the various areas of the Bank.

In our customers' opinion, Bankinter's strengths are rooted in the combination of people (professionalism and advice) and its multi-channel approach (accessing the Bank from any device). The factors rated highest by customers in their dealing with the Branch Network were employees? competence and professionalism, the treatment and service that customers receive at the branch, speed in resolving banking queries and procedures and the dedication and advice of their personal account manager.

The Bank also has a Protocol for customer service and a Manual for attending to persons with disabilities with a view to adapting to and covering all its customers' needs and motivations.

Bankinter periodically evaluates its branch network?s sales and customer service processes, using outside observers in order to identify aspects with room for improvement in relations with existing and potential customers and consequently to take the necessary action to improve their overall satisfaction.

External Ombudsman

Customers of the Bank can address their complaints to the External Ombudsman, either because they disagree with the way Customer Service has resolved an issue, or directly if they so prefer.

Claims Service of the Bank of Spain

Customers disagreeing with the response from Customer Service or the External Ombudsman may address their claims to the Claims Service of the Bank of Spain.

Customer Service

The Customer Service department centralises the handling of complaints and claims relating to financial services provided by the Bank, the prevention and reduction of errors in the provision of services and the corresponding notifications to customers. Its mission is to ensure a high level of quality in their resolution by means of applying uniform criteria and standardising response times, as well as promoting their reduction and providing management information to all areas of the Bank.

Data Protection

Bankinter has always been one of the pioneering companies in its commitment to the protection of personal data and the confidentiality of information, and in offering its customers measures that ensure compliance at all times with the law.

Volunteer work

The Bank considers that its greatest contribution to the development of society and its environment must come from its own activity and knowledge of the financial and business world. In this respect, a qualified volunteer programme has been promoted for collaborating with foundations and NGOs on projects that require financial training or management, so as to facilitate inclusion in the labour market and entrepreneurship.

Bankinter has a specific volunteer-work website called "Mueve.te", through which employees can propose participation in working sessions of social or environmental interest, giving them the opportunity to transform some of their personal concerns into solidarity initiatives, or they can consult and register with those sessions undertaken by the Bank.

Cooperation with the third sector

"Involvement and Solidarity" Programme

The profits obtained from the Solidarios Bankinter Card are donated in their entirety to social action projects sponsored by Bank employees.Solidarity Accounts

A system for alerting the public to humanitarian emergencies has been developed for the website bankinter.com with a view to collecting donations from customers wishing to help mitigate these emergencies. Bankinter also has a system for sending instant message (SMS) alerts in emergencies.Associations membership

Innovation and entrepreneurship

Bankinter Innovation Foundation, Greenweekends, Circularweekends, Mashumano Foundation, etc.Financial sector working groups

Spanish Association of Banking, Chambers of Commerce,IMEX business meetings.Communication and responsible advertising

Autocontrol, Communication and CSR directors associations, Spanish Association of advertisers.Sustainability

Equator principles, London Benchmarking Group, Global Compact, Foretica, Climate Change, Social Impact and Transparency Clusters.

Brand and reputation

Corporate Excellence,Reputation working groups.Sustainable Innovation

Bankinter, a solid bank with a forward-thinking vision, stands out for its innovative approach and its ability to adapt to the changing needs of its customers. Its business model is based on diversification, being a pioneer in the development of mobile banking services and in the use of technologies such as artificial intelligence and data analytics to offer a more personalized and efficient experience. Furthermore, Bankinter is distinguished by its commitment to energy efficiency and the environment, developing financial solutions that promote sustainable and environmentally friendly development. The Bankinter Innovation Foundation, aligned with the bank's purposes, works to transform society through innovation, fostering a community of innovators in key areas such as knowledge, entrepreneurship, education, and support for businesses. In summary, Bankinter is not only a solid bank but also a leader in innovation that seeks to improve the banking experience and contribute to sustainable development.