Bankinter promotes the issue of virtual cards as a formula to improve security in online transactions

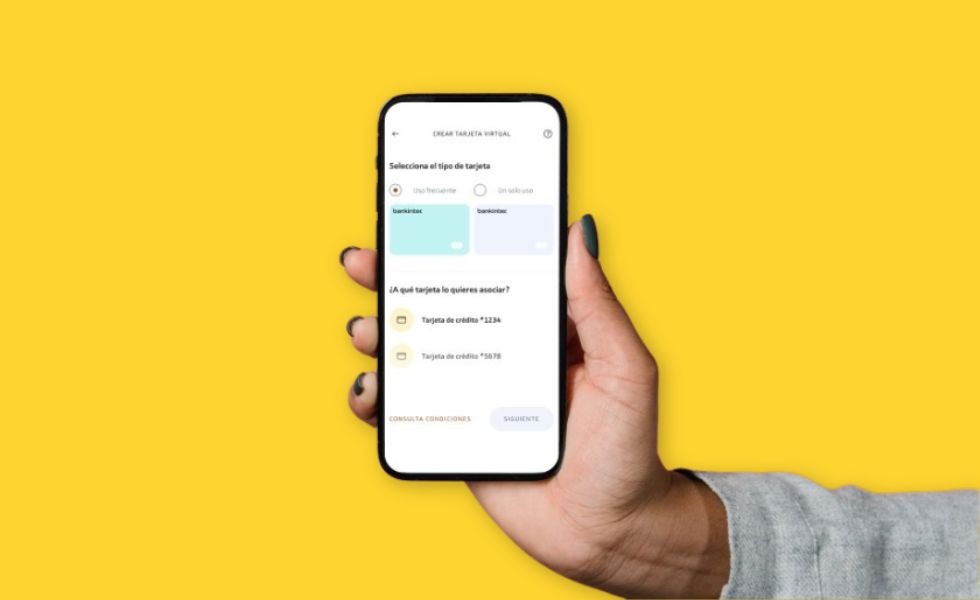

- The Bank has pioneered this innovative payment method with two versions: a single-use card to carry out a single transaction or online purchase; and a multi-use card to use with online merchants that collect recurring payments.

- The main advantage is that it provides customers with greater control of their expenses and, above all, greater security in all types of online purchases thanks to limited transactions and expenditure amounts.

Bankinter takes another step in fraud prevention by encouraging customers to use its “virtual cards” as their habitual payment method for all types of online purchases and transactions.

The Bank has recently pioneered one of these cards with two different versions: a single-use card, designed to carry out a single online transaction or purchase for a specific amount, after which the card is ceases to be active; and a multi-use version to use with online merchants that collect recurring payments, such as subscriptions to streaming platforms.

In the case of the single-use version, the customer generates a virtual card linked to their physical card, assigning a specific amount for a specific online purchase. Once the card balance has been used up, or a period of time has passed without making the transaction, the card is blocked. In this second case, the unused balance returns to the customer's current account.

The multi-use virtual card is designed for use with merchants that collect recurring payments, such as online subscriptions to specific services. In this case, the customer sets a monthly amount to use for as many transactions as they want. They can also change the assigned limit whenever they want.

Since its launch, Bankinter has issued nearly 200,000 virtual cards, and more than 50,000 customers have requested one of these virtual payment methods.

Issued through the website and app without any fee, the virtual cards are linked to a credit or debit card that the customer already has, so they have the same characteristics, limits and payment method as the card from which they have been generated. And as with all the other transactions made with the parent card (provided it is a credit card with end-of-month payment), the payments made with these cards can also be split using the Compra Smart service.

All of these characteristics make it a unique product on the market, while its main advantage is that it provides customers with greater control of their expenses and, above all, much more security in all types of online purchases and payments because of the limited expenditure amount. Bankinter virtual cards have a unique number and security code, different from those of the physical cards to which they are linked. In the case of single-use cards, their life begins and ends with the transaction for which they were generated.

Bankinter is already working on making this solution compatible with payment applications such as Samsung Pay, Google Pay and Apple Pay.

In short, the features of these cards add great value to customers in terms of cybersecurity.

The Bank has recently pioneered one of these cards with two different versions: a single-use card, designed to carry out a single online transaction or purchase for a specific amount, after which the card is ceases to be active; and a multi-use version to use with online merchants that collect recurring payments, such as subscriptions to streaming platforms.

In the case of the single-use version, the customer generates a virtual card linked to their physical card, assigning a specific amount for a specific online purchase. Once the card balance has been used up, or a period of time has passed without making the transaction, the card is blocked. In this second case, the unused balance returns to the customer's current account.

The multi-use virtual card is designed for use with merchants that collect recurring payments, such as online subscriptions to specific services. In this case, the customer sets a monthly amount to use for as many transactions as they want. They can also change the assigned limit whenever they want.

More than 200,000 cards issued

Since its launch, Bankinter has issued nearly 200,000 virtual cards, and more than 50,000 customers have requested one of these virtual payment methods.

Issued through the website and app without any fee, the virtual cards are linked to a credit or debit card that the customer already has, so they have the same characteristics, limits and payment method as the card from which they have been generated. And as with all the other transactions made with the parent card (provided it is a credit card with end-of-month payment), the payments made with these cards can also be split using the Compra Smart service.

All of these characteristics make it a unique product on the market, while its main advantage is that it provides customers with greater control of their expenses and, above all, much more security in all types of online purchases and payments because of the limited expenditure amount. Bankinter virtual cards have a unique number and security code, different from those of the physical cards to which they are linked. In the case of single-use cards, their life begins and ends with the transaction for which they were generated.

Bankinter is already working on making this solution compatible with payment applications such as Samsung Pay, Google Pay and Apple Pay.

In short, the features of these cards add great value to customers in terms of cybersecurity.