Bankinter’s half-year earnings reach 241 million euros, with double-digit growth in all margins

Net profit for Bankinter Spain alone, without extraordinary results, amounted to 227.4 million euros, up 16.4% from a year ago.

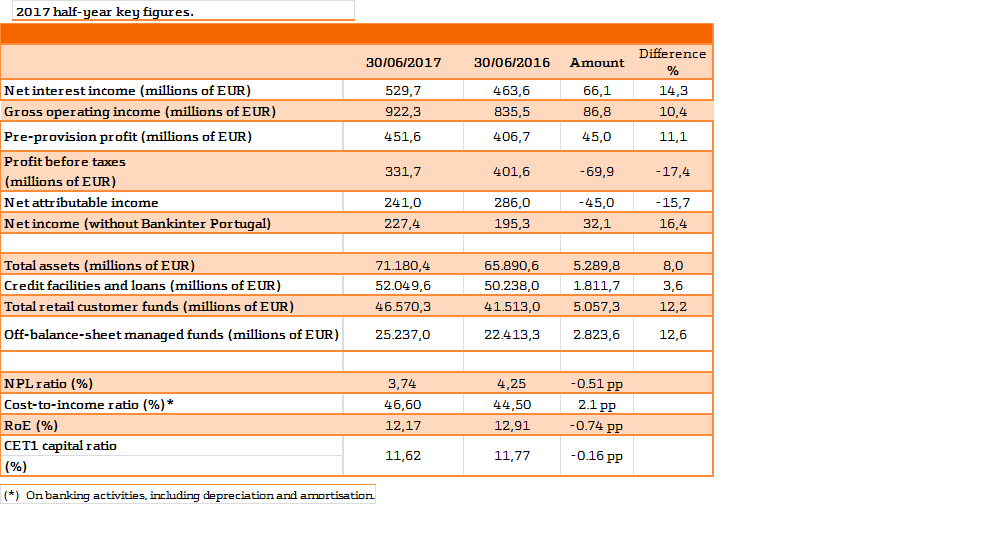

Bankinter maintains its leadership in terms of profitability, with a return on equity (RoE) of 12.2%.

Bankinter’s total loan book grew by 3.6% despite the overall loan book reduction in the financial system. Meanwhile, the bank’s customer deposits increased by 12.2% year-on-year.

Bankinter Group has ended the first half of 2017, bolstered by the robustness of its balance sheet and assets, along with other strong attributes that have traditionally underpinned the performance of its business.

Its net profit stood at 241 million euros at the end of June, with a pre-tax profit of 331.7 million euros. These earnings are, respectively, 15.7% and 17.4% lower than a year ago; however, it is important to bear in mind that, in the second quarter of 2016, the group recorded extraordinary earnings owing to its acquisition of Barclays’ retail business in Portugal, which began to be factored into its results that same quarter. Therefore, the half-year results for 2016 and 2017 are not strictly comparable on a like-for-like basis.

If we excluded data from Bankinter Portugal (for a like comparison), the group’s net profit in the first half of 2017 would be 227.4 million euros, 16.4% more than a year ago.

For another quarter, Bankinter maintains its leadership in profitability terms, with a return on equity (RoE) of 12.2%, the highest rate among listed banks in Spain.

Bankinter Group also continues to outrank other banks in terms of quality of assets, with a non-performing loan ratio of 3.74%, down from 4.25% a year ago. With Bankinter Spain alone, the NPL ratio would stand at 3.34%. This ratio is less than half the industry average in Spain, which was recorded in May 2017 at 8.74%. Bankinter’s provision coverage ratio now stands at 48%.

In a similar trend, Bankinter Group continues to have the lowest foreclosed asset book among Spanish banks. Including Bankinter Portugal, the group’s foreclosures amounted to a total gross value of 498.2 million euros (55.7 million less than a year ago), of which almost 50% account for residential properties. The provision coverage ratio for foreclosed assets grew to 44%.

As regards its solvency, Bankinter Group closed out the first half of 2017 with a fully-loaded CET1 ratio of 11.3% and phased-in CET1 ratio of 11.6%. Both figures are well above the 6.5% minimum required of the group by the ECB for 2017 (the lowest level required of any Spanish bank).

As regards the group’s financing structure, its liquidity gap has notably decreased by 1.8 billion euros in the last six months, amounting to 3.6 billion euros at the end of June. Furthermore, its loan-to-deposit ratio reached 106.9%, down from 114.8% a year ago.

Bankinter Group does not have any wholesale maturities until the end of this year. Its maturities profile until 2020 (with considerable lower spreads) total 2.2 billion euros. To manage these maturities, Bankinter Group has 12.2 billion euros in liquid assets, with the ability to issue up to 7.4 billion euros in covered bonds.

Solid growth across margins

Bankinter Group’s half-year earnings continue to reflect its strength across all margins.

Its half-year net interest income reached 529.7 million euros, up 14.3% from a year ago.

As of 30 June, its gross operating income amounted to 922.3 million euros, a 10.4% increase from the same period in 2016, mostly on the back of its fee income, which increased by an outstanding 16.2% from a year ago. This is the result of the good performance of businesses such as equities trading, insurance and asset management, thanks in particular to growth in equity funds which yield higher returns to the bank.

Bankinter Group ended the last six months with a pre-provision profit of 451.6 million euros, an 11.1% increase from a year ago. Although costs were higher than in the first half of 2016, its ‘jaws’ (ie, the spread between income and costs) are wider than they were a year ago. Nonetheless, its cost-to-income ratio for banking activities with depreciation and amortisation stood at 46.6%.

Bankinter Group’s balance sheet closed out the first half of 2017 with over 71.18 billion euros in total assets, up 8% from 30 June 2016.

Its loans and advances to customers totalled roughly 52.05 billion euros, a 3.6% increase from a year ago, despite the 1.7% decrease in lending seen in the financial system.

Bankinter Group’s total managed customer funds also grew at a higher rate, reaching over 78.2 billion euros, 7.4% more than on 30 June 2016. In particular, its retail deposits increased by 12.2% to over 46.57 billion euros; and off-balance-sheet managed funds (investment and pension funds, as well as other managed assets) grew by 12.6% in the same period.

Five profitable business lines

Business from customers continues to be a major driver of the group’s earnings, based on five strategic lines of business that diversify its revenues.

The business line that contributed the most to the group’s gross operating income was enterprise and corporate banking (with 30%), thanks to Bankinter’s broad experience in this business, dating back to its origins as an industrial bank. Its corporate loan book has grown significantly each year. At the end of June, it amounted to 22.3 billion euros, a 6.1% increase from a year ago, despite the 2.3% decrease in enterprise lending across the Spanish financial system. Bankinter Group’s market share in new loans to companies now stands at 6.1%. The group also managed to attract new corporate customers, namely 10% more than in June 2016. Lastly, its international business with companies had commendable results, generating 69 million euros in gross operating income, 20% more than in the same period in 2016.

The second largest contributor to Bankinter Group’s gross operating income is commercial banking. In this business, the bank’s two strategic segments that had a particularly remarkable performance were private banking and personal banking. In private banking, total assets under management for high net-worth customers amounted to 33.9 billion euros, up 19% from the first half of 2016. Personal banking, on the other hand, saw a 17% increase in its total assets under management, which amounted to 20.3 billion euros.

In retail banking, the performance of the payroll account, which Bankinter has been commercialising for a long time as one of the strongest product offerings in the financial system, was particularly noteworthy. Total payroll accounts amounted to over 6.31 billion euros, a 30% year-on-year increase. On the other hand, new residential mortgage lending decreased by 2.2% from a year ago; still, overall mortgage lending across the industry fell by 9.4% as of May 2017.

The third largest contributor to Bankinter Group’s gross operating income was Línea Directa (LDA), the group’s insurance arm. In the first half of the year, the total number of policies taken out by LDA customers amounted to 2.7 million euros. Motor insurance and home insurance sales grew by 7.6% and 14.7%, respectively. Total insurance premiums totalled 394.5 million euros, up from 363 million euros this time last year. Accordingly, motor and home insurance premiums increased by 7.9% and 15.5%, respectively, well above the industry average. LDA continues to have a highly profitable insurance business, with a 33.9% RoE and a combined ratio of 89.2%.

With regard to Bankinter Portugal, deposits at 30 June 2017 totalled 4 billion euros, 35% more than a year ago. The Portuguese franchise increased its loan book by 4%, with a total 4.6 billion euros in loans to customers. Its gross operating income closed these last six months at a total 75.3 million euros, with a pre-tax profit of 18.8 million euros.

Lastly, Bankinter Consumer Finance, the group’s consumer lending subsidiary broke more records in the first half of 2017, reaching one million customers (a 25% increase) and recording 1.2 billion euros in its loan book (up 43%) since 30 June 2016.

A significant part of the success experienced by each of these five business lines was thanks to Bankinter’s digital offering, which enhances customers’ experiences with the bank and increases the group’s efficiency of the group while affording greater business scalability.

Bankinter Group’s digitalisation initiative includes the launch of several projects this quarter, such as its new equity broker, an omni-channel signature and a new app for corporates customers.

Lastly, the Bankinter share price closed the first half of the year at 8.07 euros per share, an almost 40% increase year-on-year.

Results presentaion and financial information