Bankinter hits record profits of 490 million euros in 2016, up 30.4%

Results show strong growth in recurrent business with customers, with increases of 27.5% in retail deposits and 16.2% in credit & loans.

Bankinter remains as the most profitable financial institution in the Spanish market and one of the most solvent.

Despite interest rates at all-time lows, net interest income has increased by 12.6% (5.1%, not including business in Portugal).

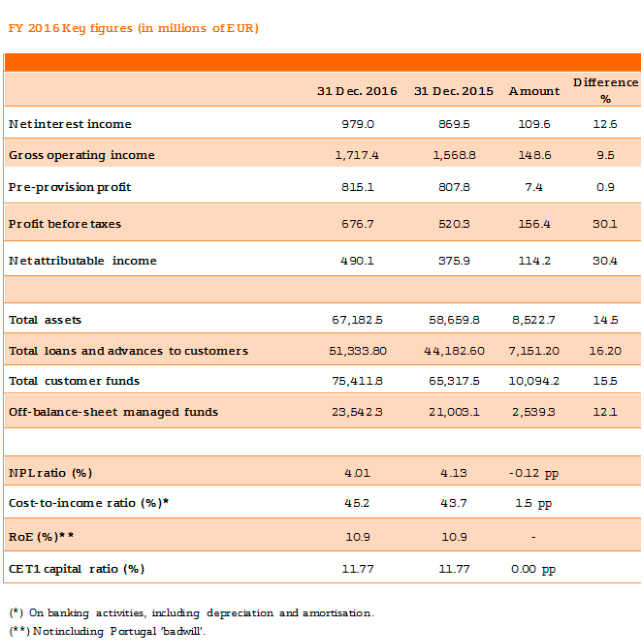

Bankinter Group closed out 2016, once again, with record-breaking profits, reaffirming its position as the most profitable financial institution among listed Spanish banks. At the end of the fiscal year, the group’s net profit stood at 490.1 million euros, with a pre-tax profit of 676.7 million, a 30.4% and 30.1% year-on-year increase, respectively.

These results are based on Bankinter’s recurrent customer business and include figures from Bankinter’s business in Portugal, which was acquired from Barclays on 1 April 2016. This transaction aside, Bankinter’s net profit amounts to 426.5 million euros, 13.4% more than in 2015, with a pre-tax profit of 588.8 million euros, a 13.2 % increase.

Return on equity (RoE), without the extraordinary positive effect of ‘badwill’ in Portugal, stood at 10.9%.

Meanwhile, Bankinter continues to reap the benefits of its successful risk management, with once again the best asset quality among listed Spanish banks.

Bankinter’s non-performing loan ratio fell to 4.01% (from 4.13% a year ago) despite the NPL figures of its newly acquired business in Portugal, which were relatively higher than those of Bankinter Group. On a like-for-like basis, Bankinter’s NPL ratio stands at 3.56%, less than half the average of the banking sector in Spain.

As regards its capital adequacy, Bankinter closed the year with a fully-loaded CET1 ratio of 11.2% and phased-in CET1 ratio of 11.77%. These figures are well above the 6.5% required of Bankinter by the ECB for 2017 (the lowest level required of any Spanish bank) following its SREP 2016 assessment.

Bankinter also improved its funding structure, reducing its loan-to-deposit ratio to 90.4%, down from 83.5% last year. The bank’s liquidity gap decreased to 5.4 billion euros, 3.1 billion euros less than in 2015.

Moreover, total wholesale issues reaching maturity by 2019 amount to 2.6 billion euros. To manage these maturities, Bankinter has 10 billion euros in liquid assets and could issue 6.7 billion euros in new covered bonds.

Growing margins despite low interest rates.

Bankinter Group’s results continue to show strong margin performance versus the previous fiscal year, both with Bankinter Portugal and on a like-for-like basis.

Bankinter’s net interest income reached 979 million euros in 2016, up 12.6% from last year. Without the group’s business in Portugal, growth would have been +5.1%.

The group’s gross operating income came to 1.71 billion euros, up 9.5% from 2015. Not including Bankinter’s business in Portugal, its gross operating income would have grown by 3.7%.

Bankinter’s operating margin ended 2016 with 815.1 million euros, up 0.9% from 2015, despite the cost of integrating Bankinter Portugal and other expenses relating to IT and digitalisation projects. Its cost-to-income ratio from banking activities, with depreciation and amortisation, stands at 45.1% (42.9%, like-for-like).

Bankinter Group’s year-end balance sheet revealed 67.18 billion euros in total assets, a 14.5% year-on-year increase.

Its total loans and advances to customers amount to 51.33 billion euros, up 16.2% from last year.

Its total customer funds also grew considerably, reaching 75.41 billion euros, up 15.5% from 2015. In particular, retail deposits increased by 27.5% to 44.12 billion euros, and off-balance-sheet managed funds (investment funds, pension funds and managed assets) grew by 12.1% year-on-year.

Nonetheless, without Bankinter Portugal, both customer funds and lending volumes continue on an upward trend.

Total customer loans and receivables (like-for-like) at the end of 2016 reached 46.76 billion euros, a 5.9% increase from last year. This represents 2.6 billion euros in annual organic growth, at a time when the lending has decreased by 3.1% across the board in Spain total loan book.

Bankinter’s retail deposits (not including Bankinter Portugal) totalled 40.45 billion euros on 31 December, up 16.9% during the year, while retail customer funds balances increased by only 2.8% among Spanish banks.

Balanced and profitable lines of business.

These results indicate that Bankinter’s customer business maintains its full potential, now with an increased perimeter following its strategic entry into the Portuguese market. Furthermore, it continues to be the main contributor to Bankinter Group’s operating income.

The largest contribution to the bank’s gross operating income came particularly from its corporate banking business, with 21.7 billion euros in its loan book, including Bankinter Portugal. However, even without Bankinter Portugal, this line of business reached 21 billion euros in loans, which indicates a purely organic year-on-year growth rate of 6.7%, despite a 5% decrease in lending to companies across the Spanish banking sector. Furthermore, Bankinter’s international corporate banking business has now become one of its most thriving activities, with a 27% increase in its gross operating income in the year.

Bankinter’s commercial banking business also experienced strong growth, particularly in regard to two of its products that the bank has promoted significantly in recent times due to their strong appeal to customers: the payroll account and mortgage loans. Total payroll accounts reached 5.6 billion euros at the end of 2016, a 33.1% year-on-year increase. On the other hand, new residential mortgages continue on an upward trend from previous years. New mortgages granted in 2016 totalled 2.33 billion euros, up 25.7% from last year, while the entire banking sector only grew by 8% in this regard.

Within other commercial banking segments, Bankinter’s private banking business had excellent results and continues to be a recognised bastion of the Bankinter brand. Total managed assets from private banking customers amounted to 31.2 billion euros, an 11.4% increase. Its net new money for the year grew by 3.5 billion euros.

The performance of Bankinter’s consumer lending business, ran by Bankinter Consumer Finance, is also significant. Bankinter Consumer Finance’s reached 898,000 customers, up by 23% since 2015. Its loan book grew by 46% in the last twelve months, reaching 1.045 billion euros in consumer finance loans.

As for Línea Directa, the number of policies taken out by December 2016 reached 2.57 million, compared to 2.37 million the year before. Motor insurance and home insurance sales grew by 7.1% and 13.5%, respectively. By year end, total insurance premiums had reached 738.7 million euros, up from 679.7 million euros in 2015. Línea Directa continues to have a highly profitable insurance business, with a 33.2% RoE.

With regard to Bankinter Portugal, in light of its results from the last nine months, we feel encouraged about its potential. Between 1 April and 31 December 2016, its customer deposits and loan book increased by 24% and 3%, respectively. Its gross operating income closed the year at a total 90.2 million euros, with a pre-tax profit of 7.7 million euros.

Also worth mentioning is Bankinter’s digital banking business, with an increasing number of customers that use this particular value proposition. 31% of Bankinter customers use on-line channels exclusively to do business with the bank. 60% are ‘mixed’ customers, who operate on both traditional and digital channels. Lastly, 9% of Bankinter customers are considered ‘traditional’, engaging the bank mostly through branch offices or telephone.