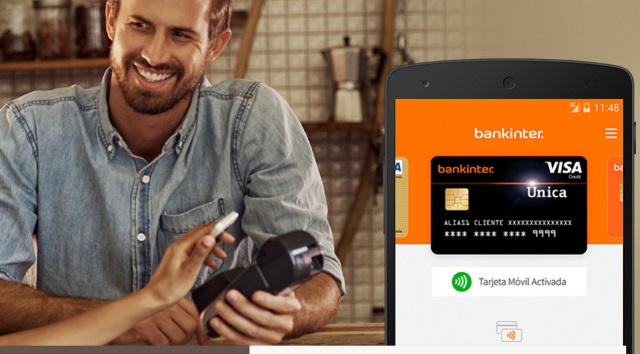

Bankinter enhances its mobile payment system with a more user-friendly ‘Wallet’

Bankinter customers may pay in an easy and safe manner with their mobile devices, without necessarily being connected to the Internet, by only taking it to points of sale.

Customers may instantly choose if they want to charge payments to their personal credit or debit card or to a corporate card.

Bankinter has taken one step further in making it easier for customers to pay with their mobile devices. The bank has recently released the ‘Bankinter Wallet’ application. It is a free service that allows customers to make purchases at business outlets, petrol stations, cafés and various other establishments in a safer, more user-friendly manner.

The Bankinter ‘wallet’ allows users to pay with their mobile devices without needing to take out their credit or debit cards. Users only have to put their device close to the establishment’s point of sale (‘POS’) and enter their PIN (the same code for their card) in order to make payment. This digital transaction is made possible by near field communication (‘NFC’) technology, which connects both terminals without the need for cables or a physical connection. Users also do not have to add anything to their mobile phone in order to use it to make purchases. With Bankinter Wallet, users only need to download the application, available in Play Store for Android mobile devices.

After customers download the application, they only need to link it to the credit or debit cards they wish to use to charge payments made with their mobile devices. One of the main advantages of this payment system by Bankinter is that it does not require network connectivity. It lets customers pay at establishments without necessarily having their mobiles connected to the Internet. Charges are made on-line through the Internet connection of a business’s POS.

Another unique advantage of Bankinter’s ‘Wallet’ is that it lets customers choose, when carrying out a transaction, to charge it to their personal card or to a corporate card. They only need complete the easy step of linking the corporate card to their mobile device.

With the ‘Wallet’, customers will avail of other functions, in addition to making payments in shops and other establishments. Customers may see all the payments made with their cards, not just the ones made on their mobiles. Furthermore, they will have access to on-line banking to make queries and carry out transactions.

With this new application, Bankinter enhances its digital selection of services available to its customers as part of its strategy to consolidate itself as a key player in the digital transformation. 91% of the bank’s active customers have gone digital, transaction-wise, carrying out transactions usually on-line or with their mobile devices. Out of this 91%, one third never carries out transactions in branch offices or via telephone banking.