We use first and third-party cookies for analytical and statistical purposes and to show you personalised advertisements based on a profile compiled from your browsing habits (e.g. pages visited). For more information, click on our Cookie Policy. You can accept all cookies by pressing 'Accept', you can reject all cookies by pressing 'Reject', or you can customize your choice by pressing 'Manage'.

Bankinter Broker launches a new interactive trading platform

Bankinter’s new ‘graphic Broker’ provides customers with a new way to engage and trade in stock markets.

Bankinter agrees to acquire EVO Banco and its Irish consumer credit affiliate, Avantcard

Bankinter Group is committed to expanding in digital banking with its purchase of a leading brand in this market, with 456,000 digital customers and state-of-the-art technological tools.

Acquiring the Irish affiliate, Avantcard, and incorporating its sound, profitable portfolio with growth potential, will boost the Group’s consumer finance operations, diversifying operations geographically.

The acquired businesses will have a very limited impact on capital of 99 million euros, 29 basis points off the fully-load CET1 capital ratio at the end of June.

This deal is still subject to approval from regulators and official bodies.

Bankinter amplia la operativa de Bizum a sus clientes más jóvenes

Los clientes de la cuenta ‘bk mini’, con edades comprendidas entre 14 y 17 años, podrán enviar y recibir dinero desde el móvil a través de Bizum con los límites establecidos por sus padres o tutores.

La opción se incluye dentro de “bk”, la línea creada por el banco para ofrecer servicios financieros globales a clientes jóvenes, con propuestas diferenciadas por edad.

Bankinter converting the phone into a onetime-use credit card

Users download a virtual replica of any of their credit or debit cards into the Smartphone for contactless payments.

The project is being carried out in partnership with Visa Europe, Net1 UEPS and Seglan.

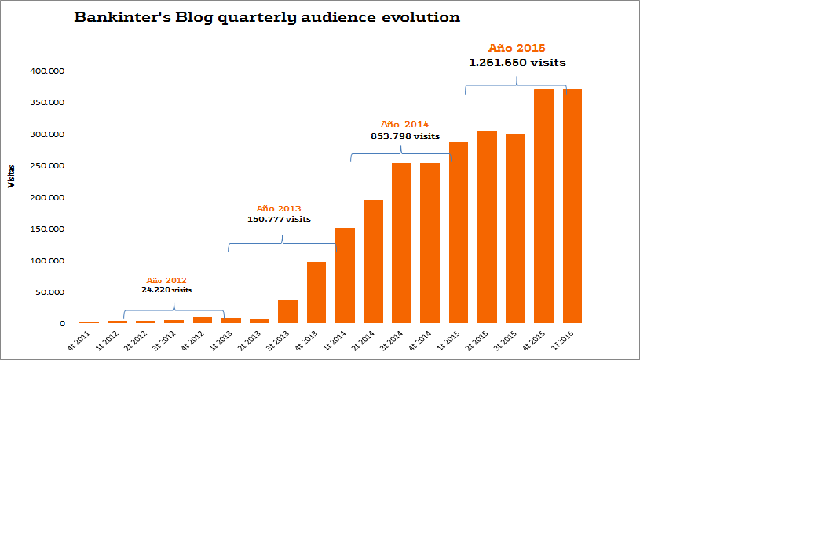

Bankinter turns its blog into an up-to-the-minute financial portal

The bank provides its customers and non-customers open access to information and the possibility of a customised subscription by topics with the aim of helping them take investment decisions.

The new blog will continue at https://blog.bankinter.com, which already offers stock prices and direct links for trading in the stock exchange.

Bankinter crea Gneis Global Services, un proyecto empresarial que dará soporte tecnológico y de operaciones a las empresas del Grupo

Participada al 100% por Bankinter, Gneis pretende convertirse en una plataforma flexible y multiempresa, que genere sinergias dentro y fuera del grupo bancario

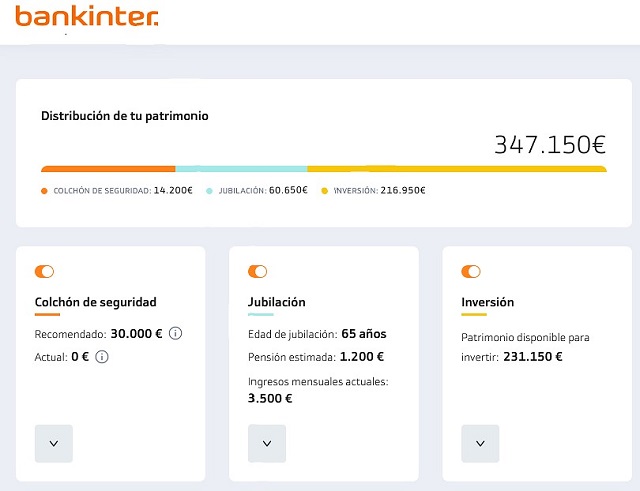

Bankinter has created a Planning Tool with Afi's support, which takes the customer's needs into account, in order to help them make investment decisions

It is a digital, advanced technology tool for wealth analysis that the bank has created with the collaboration of Analistas Financieros Internacionales (Afi) which serves as essential support for managers as they accompany customers during the planning process.

The system uses algorithms and simulators which provide various planning options under different scenarios, while taking each customer's specific situation into account.

It generates an overview of the customer's financial, real estate and other assets, both within Bankinter and with other entities, which allows the manager to offer the customer various asset distribution alternatives, each of which is consistent with their specific needs.

Bankinter turns its marketing strategy around and launches a new campaign which appeals to emotional concepts

The campaign will focus on the digital and TV formats. On TV (both open signal and paid platforms), the campaign will be run in more premium positions and during much longer periods.

Bankinter remains true to a line of communication based on differentiation and grounded in the concept that "not all banks are the same".

Bankinter develops an instantaneous system of notifications and alerts through Apple Watch

On the Apple watch, customers will have real-time information on the transactions of their accounts and cards, and will even be able to block them.

It is a solution developed by Gneis, the technological and operational subsidiary of the Bankinter Group, together with the firm Intelygenz.

Bankinter has developed an instant smartwatch notification and alert system.

Customers will receive real-time information about their account activity and cards on their smartwatches, and will even be able to block their cards from their watch.

This solution has been developed by Gneis, the Bankinter Group's technological and operational subsidiary.

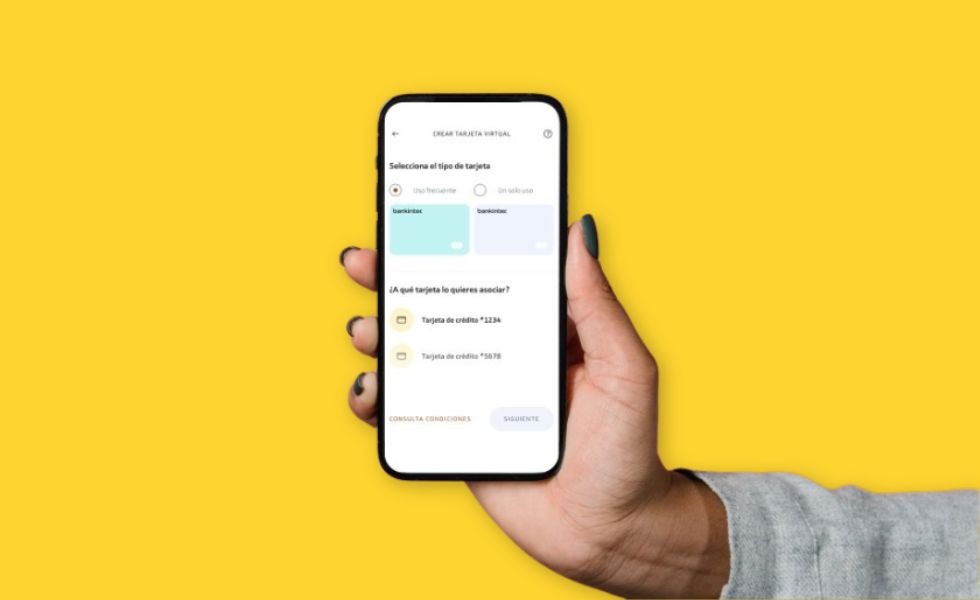

Bankinter impulsa la emisión de tarjetas virtuales como fórmula para mejorar la seguridad en las operaciones online

- El banco ha lanzado de forma pionera este innovador medio de pago en dos modalidades: tarjetas de un solo uso, para realizar una única operación o compra online; y de uso frecuente, para utilizar en comercios online con pagos periódicos.

- Su principal ventaja es que proporciona al cliente un mayor control de sus gastos y, sobre todo, más seguridad en todo tipo de compras online, al tener acotadas las operaciones y los límites de gasto.