61% of potential investors are concerned about the impact of the pandemic on their retirement, according to a Bankinter survey

However, only 9% of medium-high net worth respondents have decided to change their retirement plans.

Nearly six out of ten respondents say their financial habits have been affected by the Covid-19 pandemic and more than half value the advantages of investing digitally, but with expert support.

The pandemic has undoubtedly affected Spaniards' outlook on their spending and finances, as well as that of investors and potential investors. A Bankinter survey of 1,400 medium-high net worth individuals reveals a curious fact about retirement: 61% of survey respondents say they are concerned about how the current economic climate will affect their retirement savings plans. This makes retirement savings the second overall concern, although 21% of those interviewed rank it in first place.

However, what most worries Spaniards interested in investing is the risk of losing their job, as stated by 70% of those who have participated in this survey, which Bankinter carried out in order to detect how priorities and habits have changed in this segment as a result of the coronavirus.

Six out of ten respondents admit that another of their concerns is not being able to afford payments such as the mortgage or rent. This is the same percentage as in the case of impact on retirement, which shows that, for Spaniards of medium-high financial capacity, the coronavirus has awakened the need to pay more attention to both short-term spending and long-term savings.

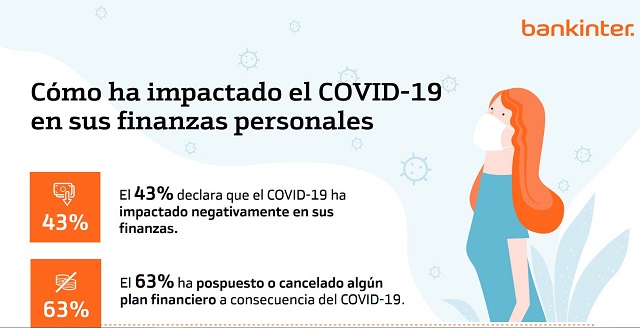

COVID-19 has negatively affected the personal finances of 43% of survey respondents. In fact, the real impact is greater than perceived – when asked about changes in spending, saving and investment habits, 63% of all survey participants stated that they had to modify their financial habits due to the pandemic. For example, almost eight out of ten – specifically, 79% – have postponed their holidays because of the special circumstances.

Survey respondents have also postponed both car purchases (19% of respondents) and house purchases (15%).

With regard specifically to the financial situation, nearly six out of ten respondents say that they have become more concerned about monitoring their savings and investments. It is quite remarkable that 23% of medium-high net worth individuals in one of the youngest age groups, 24 to 35 years old, say they are more aware of their personal finances.

In terms of investment attitudes, if caution had been the norm before the pandemic, it has now intensified: Now 50% of the people surveyed say they are cautious, seven percentage points more than before the coronavirus outbreak. At the same time, scepticism regarding investments has increased, as stated by 26% of survey respondents, and optimism has also decreased notably: From 13% to 5%.

Investments: consulting and digital channels.

If we go deeper into the topic of investment, there are two opposing poles when it comes to using the support of an investment expert. 45% of people surveyed, almost half, say that they have received some type of advice or recommendations and 21% have paid for consulting services. In addition, almost a third of total respondents, 32%, affirm that they would like to receive financial advice in the future.

When asked about the amount of money medium-high net worth respondents can allocate to savings or investment, eight out of ten, 81%, said between 50 and 500 euros per month. Another 13% would set aside between 500 and 1,000 euros.

As far as investment, there is no doubt that the pandemic has reinforced digital channels as a way to perform banking operations. When asked about an online platform to carry out their investments, more than half (56%) showed interest in using this tool.

Another noteworthy fact, which contrasts with the accelerated digitisation among financial users in general, and more so in those with medium/medium-high net worth, is that only one out of ten knows what a robo-advisor, a digital investment manager, is. This shows that digitisation is proving more difficult in more specific areas such as savings and investment in contrast to individual budgets and spending.