Bankinter has created a Planning Tool with Afi's support, which takes the customer's needs into account, in order to help them make investment decisions

It is a digital, advanced technology tool for wealth analysis that the bank has created with the collaboration of Analistas Financieros Internacionales (Afi) which serves as essential support for managers as they accompany customers during the planning process.

The system uses algorithms and simulators which provide various planning options under different scenarios, while taking each customer's specific situation into account.

It generates an overview of the customer's financial, real estate and other assets, both within Bankinter and with other entities, which allows the manager to offer the customer various asset distribution alternatives, each of which is consistent with their specific needs.

Bankinter makes advances in digital asset analysis for its customers. The bank has developed its first Savings and Investment Planning Tool in collaboration with the consulting firm Analistas Financieros Internacionales (Afi). It is a tool for internal use by the managers themselves which generates a detailed overview of the customer's financial situation.

In this manner, the bank seeks to understand its customers' expectations in order to help them establish their savings and investment strategy, once their spending for financial needs and emergency savings have been addressed.

To do this, the Planner builds an overview of the clients’ assets, by aggregating financial and real estate ownership both within the bank and with other entities, using information provided by the customer.

Using all this, the Planning generates an overview of the financial, real estate and other assets. Based on this overview, the manager will propose a plan savings and investment for the medium and long term, and will analyse it with the customer.

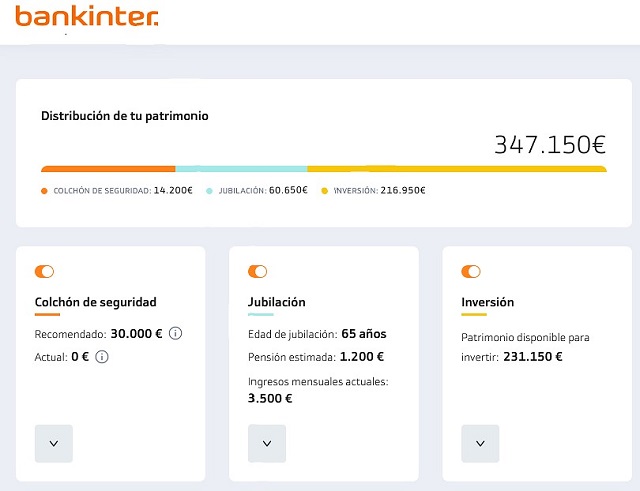

Within this digital analysis, which will be provided to the customer, is an overview of their assets: from financial to real estate, and including investments in other assets. Based on the information that the customer provides to his relationship manager about income, expenses and assets, the planning tool generates an estimate for three components. The first and most important is to calculate an amount for emergency savings which is the amount that the bank recommends having in order to handle unforeseen events.

The system calculates how much the customer will have to save per month, in order to reach a specific income goal during retirement, after addressing the need for emergency savings.

Finally, the tool estimates how much, after all the above, would be available for investment, including setting a personalised goal that the customer is pursuing in order to suggest corresponding investments.

This tool uses algorithms to forecast the behaviour of investment and savings scenarios based on market data. The bank has been supported by Afi in both the investment projection and algorithm creation efforts in order to make the customer assets overview and investment scenarios possible.

Bankinter has recognised that having the financial support of an independent consulting firm provides added value and also contributes to addressing the technological challenges. Additionally, the bank has carried out, for its part, the pertinent internal advancement of technology in order to launch this planning tool.

The Investment Planning Tool is part of the process of improving digitalisation that Bankinter has carried out for years, in this case, for the marketing systems, which now include a planning tool offering a complete visual overview, with graphs and estimates of wealth and savings and investment projections.