COINC expands its service offer with pre-authorised loans

The Bankinter digital web portal expands its product portfolio with an offer of customised loans in accordance with the customer.

In addition to managing and achieving a return on their savings in a simple and fun way, COINC customers will now be able to reach new goals with this immediate loan-granting service.

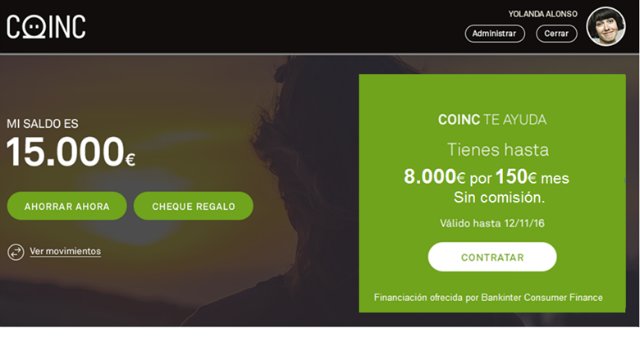

COINC, the Bankinter digital platform of financial services, has expanded its commercial offer to pre-authorised personal loans. From now on, COINC customers will have the opportunity to get an immediately granted customised loan with very beneficial conditions.

If up until today COINC customers were able to design, manage and share their saving goals on social networks, or obtain discounts for their online purchases, from now on their capability to achieve their goals will be expanded with a service that will enable them to get money simply and immediately.

These pre-authorised loans are not available by request, instead they will be offered in COINC with unique conditions that are customised according to each customer: capital, interest rate, start-up fee, term, etc.

In line with the rest of the functions of the web portal, the loans are contracted in a simple manner from the website, with a single click, and without the need to undertake administrative procedures, send documentation, gain approval or undergo prior analysis. Thus, and once the proposal is accepted by the customer, it is paid into their account immediately.

With this function COINC provides a very significant step in its objective of becoming a global tool for online financial management, launching a new generation of digital services based not on the marketing of banking products but instead on resolving the needs of each customer and enabling them to achieve their dreams. The objective of COINC is to continue surprising customers with new functions.

With this new service, COINC once again makes good use of the knowledge that, thanks to technology, it has of its customers to provide them online customized financing, avoiding the usual procedures of a traditional financial service.

COINC (www.coinc.es) it is a free digital tool that Bankinter implemented in 2012, and whose objective is to help the users to achieve specific aims making saving and the management of loans something that is easy and even fun to do.

COINC brings together the advantages of the traditional banking saving format - which includes security, return of the account and immediate financing - with the simplicity, the dynamic character and the total virtuality of the Internet and social networks.

COINC is open to all audiences, although it is specifically intended for native Internet users, who are comfortable with the use of online tools, habitually use social networks in their daily life and who want to make their dreams come true, but prefer to do it in a fun way and without the obligation of using traditional banking systems.

According to data up to 30 September of this year, COINC has 77,000 registered users, constituting 28% more than at the end of 2014, with accumulated assets of 900 million euros, 32% above the existing assets at the close of the previous fiscal year.