We use first and third-party cookies for analytical and statistical purposes and to show you personalised advertisements based on a profile compiled from your browsing habits (e.g. pages visited). For more information, click on our Cookie Policy. You can accept all cookies by pressing 'Accept', you can reject all cookies by pressing 'Reject', or you can customize your choice by pressing 'Manage'.

Alternative Investment

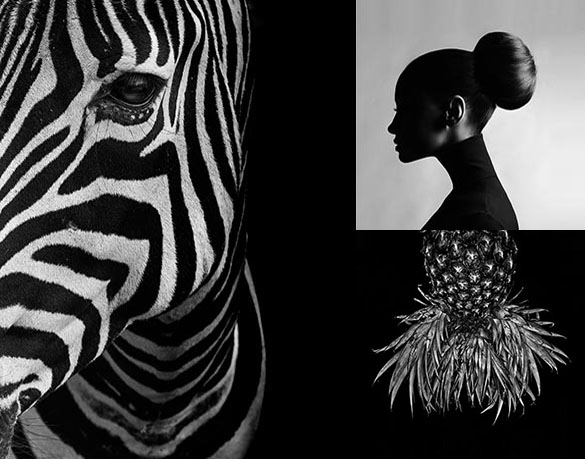

Thinking differently in order not to conform.

Not settling for the current situation means helping our customers to increase the diversification of their investments, helping to increase the long-term financial savings base.

- Real assets generating predictable and recurrent annual income.

- More attractive risk-return trade-offs.

- Optimal diversification of portfolios.

- Investment projects in critical or more relevant sectors of the economy. Strong and exclusive partnerships.

- Exclusive, long-term alliances with a select group of national and international industrials partners, renowned experts in each of their fields of activity.

Bankinter Investment is the largest alternative investment savings manager in Spain.

An open mind so as not to close any door.

Sectors

Looking far to see what is near

Real estate

Real assets generating predictable and recurring cash flows that allow diversification of exposure in the real estate sector.

Renewable energies

Real assets supported by public institutions and favoured by a regulatory regime that encourages their development.

Infrastructure

Assets essential for socio-economic development, under long-term public-private partnership contracts.

Private equity

Transactions financed with private capital aimed at generating long-term value.

Environment

Critical assets to achieve European environmental objectives, with a real impact on the circular economy and focused on environmental aspects, energy efficiency and resource sustainability.

We benefit from the shrewd instincts of our expert industrials partners

Our commitment: be the anchor investor and to remain in each fund throughout its lifetime.

Investments so real you can touch them.

Since 2016:

- - investment vehicles (- regulated by the CNMV).

- Over -M € in capital raised.

- Over -M € in assets under management.

- Over -M € in cumulative distributions.

Investment vehicles

Our alternative investment vehicles not only improve the return on customers' portfolios but reduce volatility and the risks associated with market correlation. This enables us to generate recurring stable dividends for investors, helping them to weather inflation cycles.

Since the launch of our first alternative investment vehicle in 2016, we have distributed more than - million euros among our investors, generating high returns even in volatile and changing environments such as those of recent years.