Concerns about economic growth

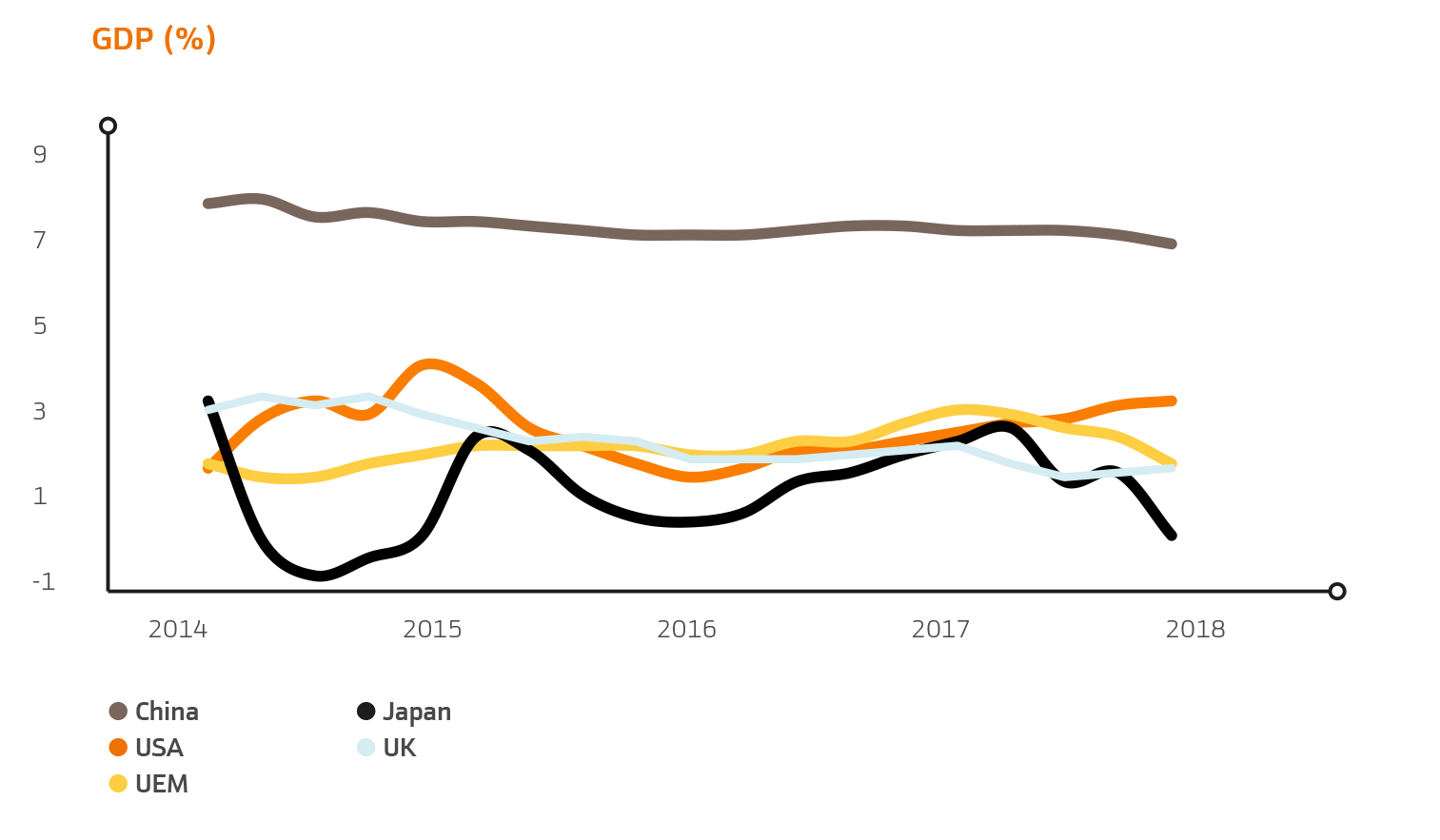

In 2018, the first seeds of doubt concerning the solidity of the world's economic growth were sewn. The year represents the transition from synchronised expansion to an asymmetric slowdown.

This change of perspective introduced significant uncertainty that did not go unnoticed by the markets, increasing volatility and submitting stock markets to significant pressure. The global expansionary phase experienced a loss of momentum, the intensity of which varied depending on the region in question:

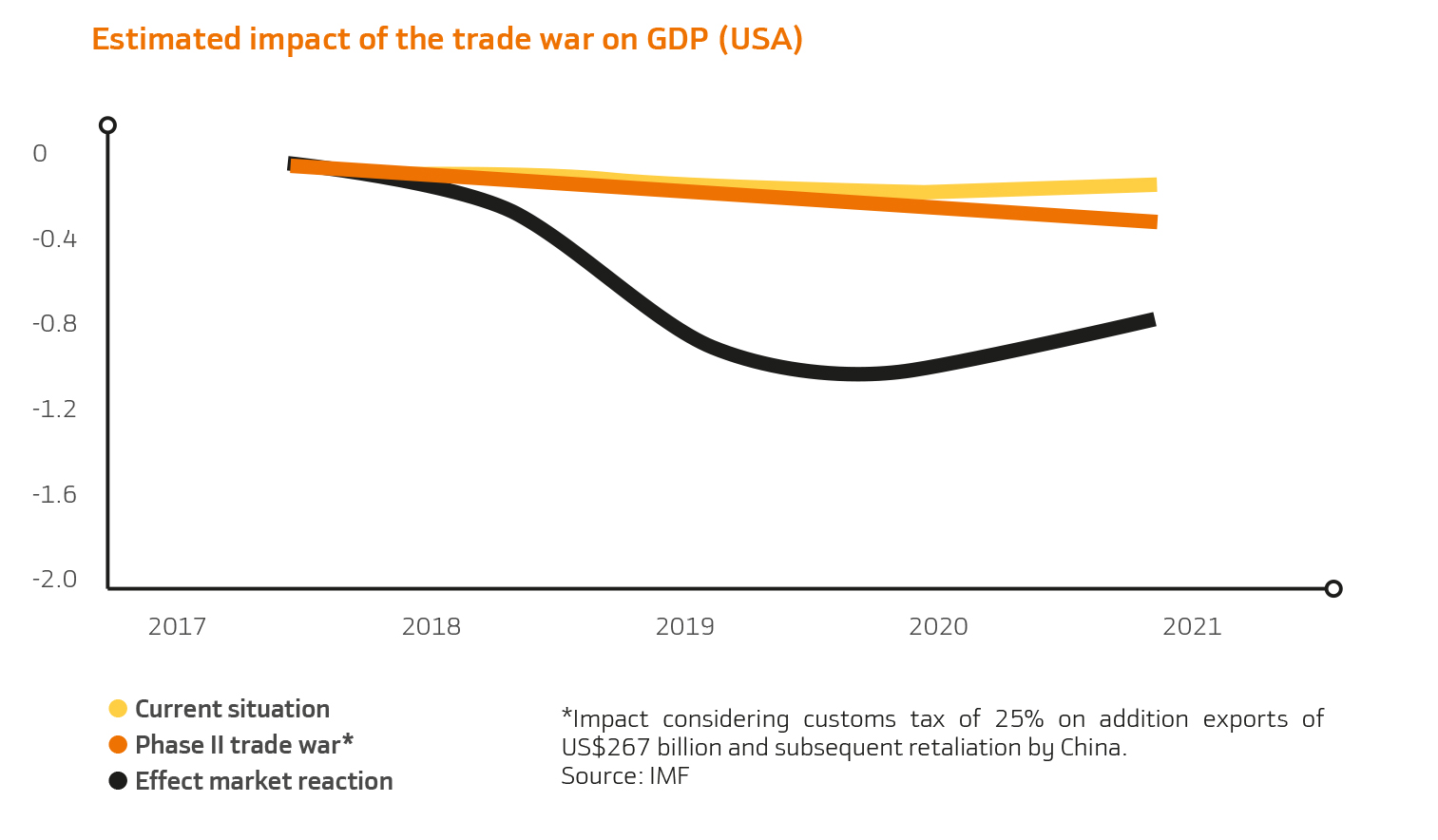

- United States. The US expansionary phase, which at one point experienced growth of almost 4%, extended through to mid-2018. Despite some loss of transitory traction in the second half of the year, the US maintained its leadership position amongst developed economies with solid average growth of around 3% year-on-year. The expansionary tax measures adopted in terms of income, not expenditure, contributed to invigorating private consumption, prioritising the achievement of improvements in household disposable income, which ended up strengthening corporate investment and employment. The complex trade relationships between the US and the rest of the world, but in particular China, significantly reduced the expansionary impact of tax measures, but failed to completely override them. In fact, the idle capacity of the job market progressively dropped over the course of 2018 and the unemployment rate remained comfortably below 4%, lower than the structural rate (i.e., the longterm unemployment rate).

The comfortable position of the job market allowed the Federal Reserve to raise its benchmark rate progressively over the course of the year, ending at 2.25%-2.50%, without compromising economic growth.

- Europe. The European political and economic context became gradually more complex in 2018, both on account of Brexit negotiations, with the process in principle due to end at the end of the first quarter of 2019, and the gradual slowdown of the European cycle, with the measures adopted in response being both uncoordinated and insufficient. The weakening of tax discipline in different member states forced the European Commission to intervene to address the situation. Despite this, the risk premium of the most lax economies in terms of compliance with tax obligations increased and a sense of vulnerability was seen, leading to a slowdown in European economic growth. The political climate became more tense and uncertain in the main member states, projecting the same sensation about the direction and effectiveness of the main economic policies applied in the main European economies. The uncertain outcome of Brexit not only led to a dangerous escalation in political tension, but also in the risk of the British economic cycle drying up. This situation is unlikely to be resolved until well into 2019, provided that Brexit deal is reached. Otherwise, the outcome for the British economy, in particular, but for mainland Europe as well, would be much harsher. Consequently, from an overall perspective, economic growth and the creation of employment lost momentum in 2018, leaving challenging circumstances to be overcome in 2019.

- Japan. Amongst the developed countries furthest away geographically, the loss of vitality in the Japanese economy placed its structural weaknesses in the spotlight once again (demography, high level of debt, low inflation, etc.). The worsening of forward-looking indicators, particularly in the second half of 2018 (consumer confidence and Tankan production capacity), the downturn in exports and the strength of the yen were signs of what is likely to be the end of the longest expansionary cycle Japan has seen over almost the past two decades.

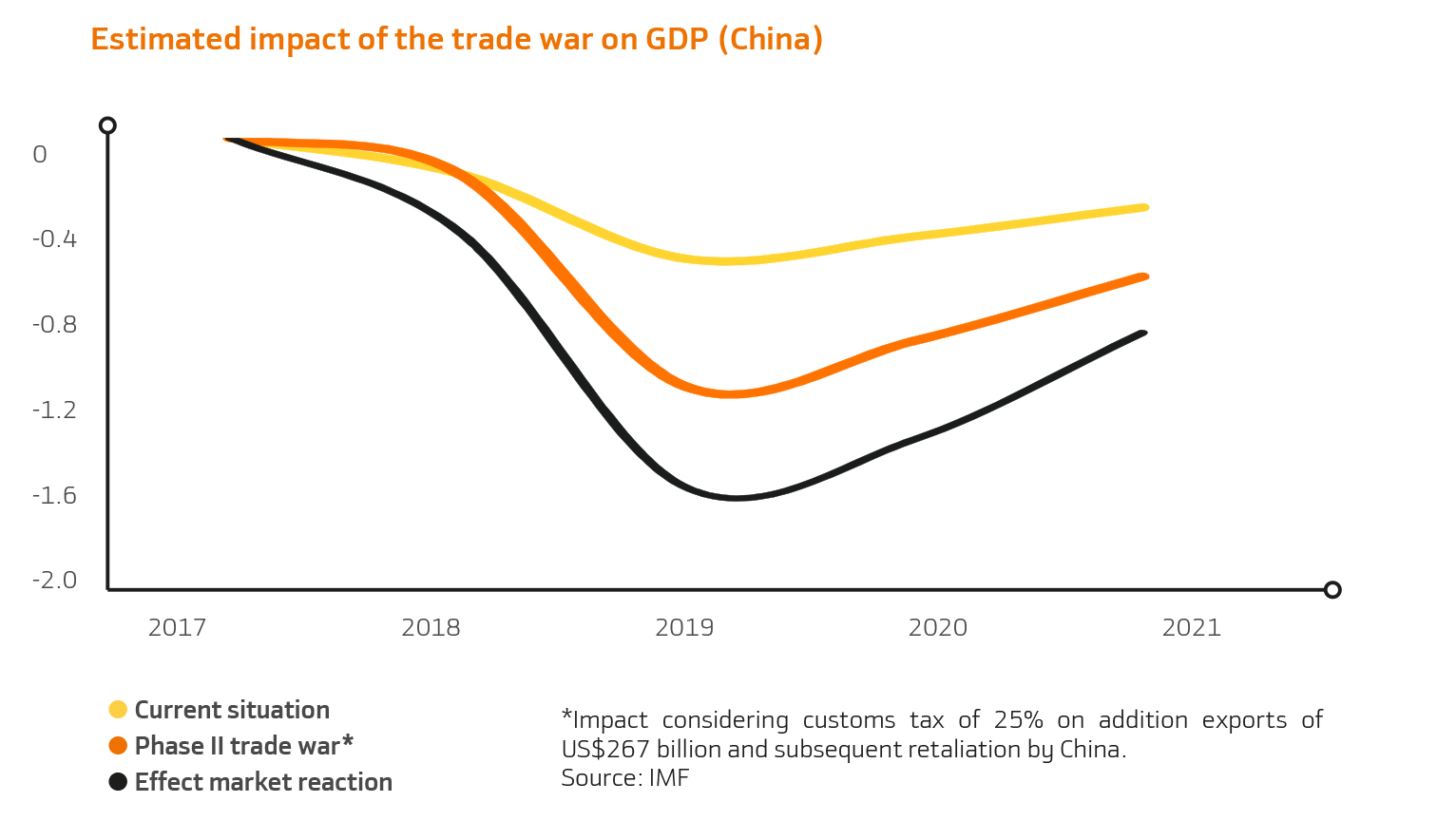

- Emerging economies. The environment was also hostile for developing countries in 2018, as they were also more vulnerable than developed countries (on account of their own economic models and internal imbalances) to the trade war and increase in interest rates in the US. As a result, for the large part, there was a general slowdown in activity indicators and a depreciation in currencies, in addition to local one-off crises (in particular, Turkey and Argentina). The progressive loss of momentum in China remained a serious cause for concern, which despite being expected was no less significant. The direct involvement of the Chinese economy in the realignment of US commercial interests significantly increased uncertainty, particularly in the technology sector.

On a positive note, other emerging economies showed more promising signs. This was the case of India and Brazil, where the drop in fuel prices offered significant breathing space in terms of the reactivation of private consumption and corporate investment. In parallel, progress or expected progress with the implementation of structural reformed was encouraging for both economies.

Interest rates and foreign currencies

2018 was defined by an increase in interest rates in the US (four hikes, from 1.25% to 1.50%, from 2.25% to 2.50%), and one single increase in the UK despite Brexit (from 0.50% to 0.75%) and stability in the Eurozone and Japan.

The tightening of US monetary policy, combined with the excellent performance of its economy, resulted in a general appreciation of the dollar compared to the other main currencies, but in particular in comparison to the euro. The euro ended 2017 at 1.201/$ and ended 2018 at 1.147/$. This trend towards appreciation also saw the dollar act as a safe haven at times of greater uncertainty. The same applied to the Swiss Franc, which appreciated 3.9% compared to the euro (to 1.126/€). As an indirect result of the foregoing, the euro lost significant ground to the other main currencies.

Stock exchanges and bonds market

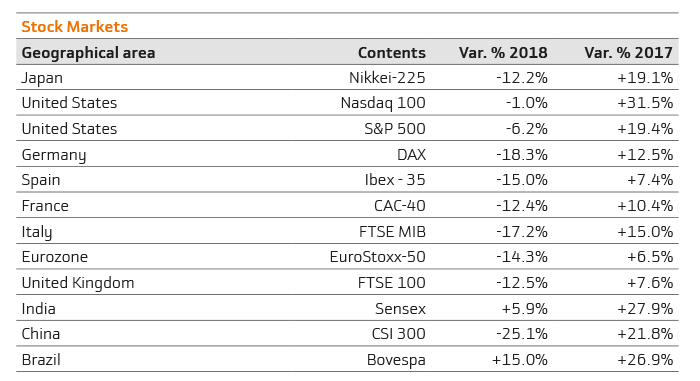

The main trend in the securities markets in 2018 was the withdrawal of stock market exposures and the search for refuge in bonds. In the second half of the year, the debate was dominated by the scope of the economic slowdown, to the point at which there was significant contention as to proximity of the next recession.

Risks and uncertainties penalised risk assets (practically all the main stock indexes closed 2018 in the red), favouring the revaluation of other assets, such as bonds and currencies. For example, the IRR of the bund, or 10-year German bond, dropped from 0.43% to 0.24% over 2018, which means its market return was chopped almost in half and, therefore, it appreciated significantly, despite the expected withdrawal of monetary stimulus (asset purchase programme) by the European Central Bank (ECB).

However, gold, another safe-haven asset par excellence, saw 1.7% wiped from its worth over the past year, from $1.303/ounce to $1.281/ounce, against the odds considering the pursuit of safe havens that characterised 2018.

This contrast demonstrates that 2018 was an extremely uncertain and unpredictable year on many fronts, in particular in relation to the market's interpretation of the scope and consequences of the global economic slowdown.