The bank, in addition to being included on the Dow Jones World Sustainability Index for the first time in its history, has also been named on other noteworthy sustainability indexes (FTSE4Good, MSCI or Carbon Disclosure Project) and features in the Sustainability Yearbook drawn up by Robeco SAM.

In addition to exercising direct control over social action and environmental management, the Sustainability Division also acts as an observatory of trends and risks based on the dialogue it holds with stakeholders. This allows it to discover their expectations and identify the needs of an ever changing environment, and, where appropriate, to consider or integrate them into the sustainability strategy.

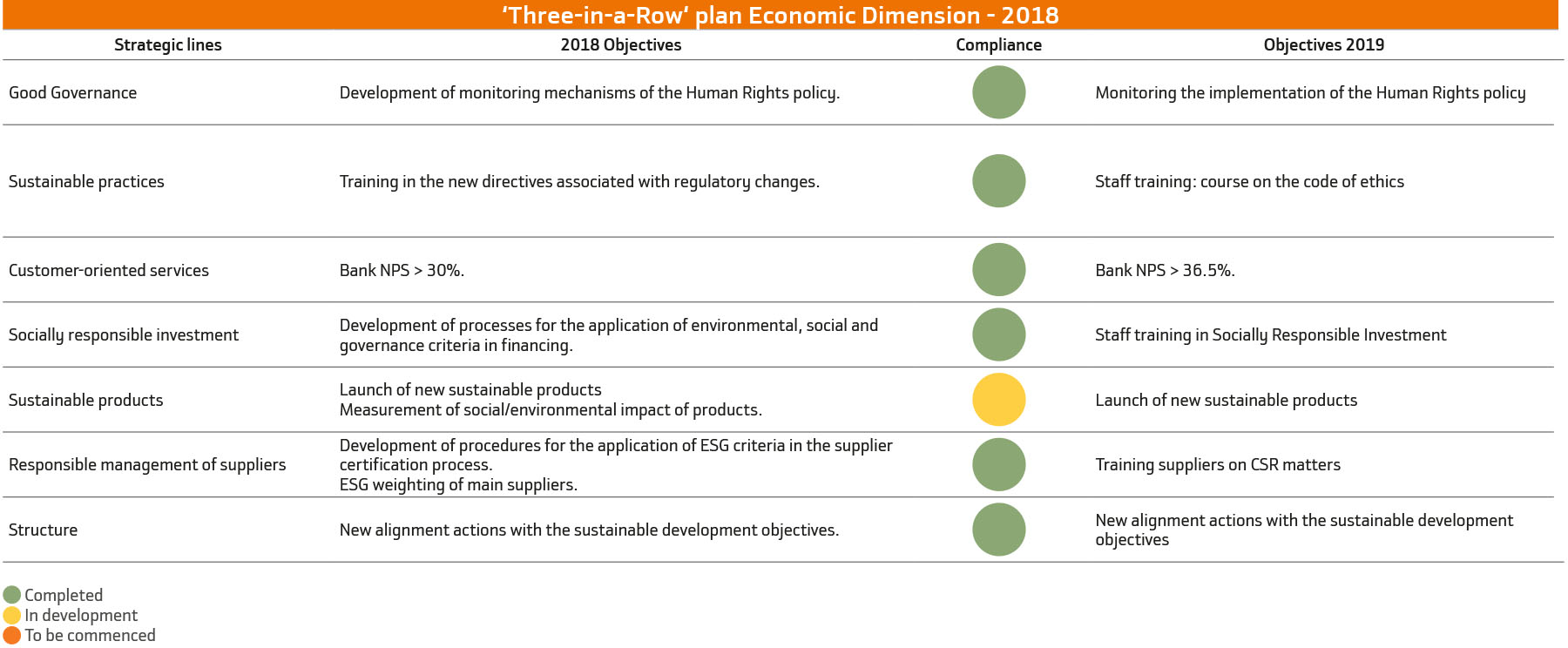

Similarly, it promotes the coordinated action of the business areas to develop initiatives focused on responding to these needs; proposing and monitoring the programmes contained in the strategic plan, verifying the degree of compliance with the objectives set for them and identifying areas for improvement, according to recognised ethics and sustainability standards and indexes.

In the corporate governance chapter of this report, considerable information is provided on the size and composition of the Board of Directors, member selection process, diversity, succession plans and so on.

In 2018, Bankinter received the Alembeeks Award in the category of Best Governance Disclosure, in recognition of its transparency in this area considering the content of its Annual Corporate Governance Report.

Bankinter, as part of its Risk Management and Control Framework, has defined Investment Sustainability Principles. Furthermore, it has established financial guidelines that allows it to develop measures and references that the bank must follow in its decision-making process, considering the best practices and international standards.

This line includes service quality and customer satisfaction management. The main indicator that measures this management, the NPS, comfortably beat the target set for 2018, reaching 30%.

The Bank adhered to the Equator Principles, a leading international initiative in the financial sector with the objective of evaluating and managing the environmental and social risks of projects. In 2018, nine new projects to which these principles apply were financed, all in Spain and the renewable energy sector. Seven were graded B and two C. Investment came to €140.5 million.

Bankinter undertakes to evaluate the practices in environmental, social and human rights issues, and to act in accordance with the principles established in its policies, in the due diligence processes carried out prior to entering into financing agreements or any other type of contract and within the framework of the Equator Principles and the environmental and social risk management policies.

The promotion of energy sources that are sustainable, competitive and safe is a key objective in the financing offered by Bankinter. Over the course of 2018, the Bank took part in renewable energy projects (photovoltaic and wind energy, among others).

The main Bankinter products that incorporate various attributes of sustainability in their design are as follows:

Bankinter Sustainability Fund. It invests in equities that are on the main social and environmental responsibility indices.

Energy Efficiency and Environment Fund. Invests in equities of companies involved in improving the efficiency of energy use and transport, the storage of electricity, automation and the improvement of industrial productivity, reduction of the environmental impact of using fossil fuels and renewable energies

Responsible investment funds. The Bank makes more than 250 funds of international prestige that invest with responsible criteria available to its customers. Their investment strategies centre on companies dedicated to renewable energies, innovation and technology, and reduction of the impact of climate change, or that are present in the main sustainability indices.

Venture capital funds or companiesthat invest in sustainable products. Stakes were held such as the 4.3% and 4.6% in Ysios Biofund I and II (biotechnology and life sciences), 10% in Going Green (electric automotion) and 2.5% in CPE Private Equity LP (clean technologies).

Since 2017, the bank has maintained an alliance with Plenium Partners to create Helia Renovables, a venture capital fund, and in 2018, a second fund was incorporated to invest in the renewable energy business.

InnovFin agreement.The bank has increased its support of the Innovfin2014 programme, within the scope of Horizon 2020, to €250 million. Its aim is to support the financing of Spanish companies with fewer than 500 workers that conduct research and innovation activities and projects.

Hal-Cash. This system, which enable customers to send money to any person's mobile phone so they can withdraw it from an automatic teller machine without using a credit card, was used in 2018 by 18,308 customers, who placed 208,685 orders for the amount of €68.6 million. Hal-Cash provides access to financial services to groups that do not have bank accounts.

Bankinter has a Suppliers Code of Conduct which constitutes a set of basic principles of practice and rules of professional conduct that ought to govern the actions of all its suppliers and establishes the ethical values that have traditionally existed in relations with them.

It should also be pointed out that Bankinter's average payment period to its suppliers is 20 days.

We use our own and third-party cookies to improve our services and show you advertising related to your preferences by analyzing your browsing habits. If you go on surfing, we will consider you accepting its use. You can get more information, or know how to change the configuration in our Cookies Policy. Accept