This segment, which included customers with annual net income greater than €70,000 or with assets of between €75,000 and €1 million, also suffered as a result of market volatility and the regulatory changes introduced during the year.

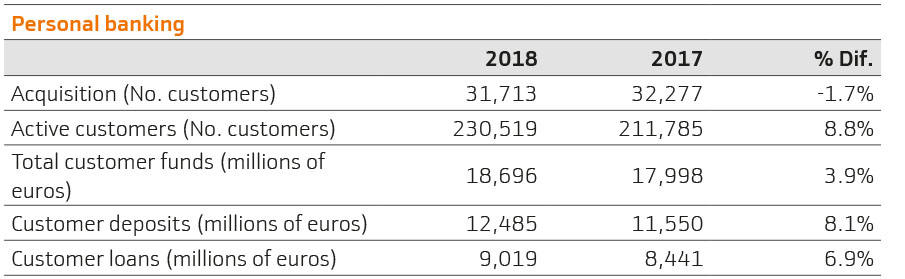

In spite of all of this, Personal Banking achieved strong results, as can be seen in the acquisition of 31,713 new customers, which has made it possible for us to reach 230,519 active customers. Active customers have grown by 8.8% during the year.

Once again, one of the main points of access to the bank was the Payroll Account, which has become one of the most successful products launched by Bankinter in recent years.

Mortgage activity also experienced significant growth, offsetting the fluctuations seen in the second half of the year on account of the legislation applicable to taxation. New production in this type of loan increased by 8.9% to €1,255 million.

The strategy to diversify the range of investment funds as an alternative for the lower spreads on deposits, generated very strong results for the second successive year. Property assets in investment funds came to €4,648 million, thanks in large part to the range of profiled funds launched in 2018, which adapts to all customer types, from the most conservative to the most dynamic customers.

However, Personal Banking not only experienced an improvement in its business figures in 2018; there was also a notable increase in quality, in line with Bankinter's aim of offering a progressively better service.

In this respect, the training acquired by Personal Banking managers and branch directors in consultancy proved to be a significant help, which was essential in obtaining the certifications required by MiFID II.

The challenge for 2019 will be to continue improving the figures in terms of customer acquisition, mortgage production and new property assets under management.

We use our own and third-party cookies to improve our services and show you advertising related to your preferences by analyzing your browsing habits. If you go on surfing, we will consider you accepting its use. You can get more information, or know how to change the configuration in our Cookies Policy. Accept