To this end, having a highly qualified team that receives constant training, as is the case at Bankinter is essential; this team comprises 223 professionals, who are amongst the best in the industry.

The vast majority of these professionals have taken the Expert in Private Banking course, approved by the CNMV and who must taken 30-hours of refresher training each year.

This has made it possible, for example, to launch an independent assessment service for customers with the most property assets, which will globally managed by Bankinter.

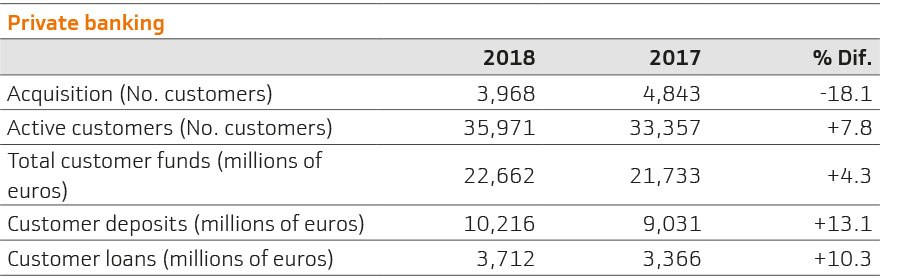

These initiatives contributed to Private Banking meeting the targets set in 2018, despite the adverse circumstances that affected its activities, such as market volatility, political instability, growing regulations and low margins in the finance sector.

At 31 December, property assets under management came to €35,650 million, increasing by €3,110 million during the year.

The Helia Renovables II capital fund is also worth particular mention, launched by Bankinter 2018 in collaboration with Plenium Partners, with investment over the past year coming to €251 million, in addition to the Vstudent Venture Capital Fund in collaboration with Valeo, which came to €153 million.

In addition to strong results, in 2018 Private Banking achieved a high level of acceptance: set the target of 39%. this business segment obtained a score of 41.6% from its customers and its staff received a score of 65.5%, according to data for December.

Amongst the means provided most recently to private bankers, worth special mention is the new reporting system, which was launched in 2017 and consolidated in 2018, and an advice tool that ensures homogeneity and high quality in investment proposals.

One of the challenges in 2019 will be to continue making progress, making the most of the opportunities offered by digital technology.

We use our own and third-party cookies to improve our services and show you advertising related to your preferences by analyzing your browsing habits. If you go on surfing, we will consider you accepting its use. You can get more information, or know how to change the configuration in our Cookies Policy. Accept