Quality

After a very difficult 2020 financial year due to the health and economic crisis, last year, with all the countries still feeling the effects of the pandemic, Bankinter focused its management around ensuring proximity to its customers, and with a firm commitment to making progress with digitalisation and continuously improving quality.

In 2021, 28.3% of the bank's customers were surveyed to find out about their experiences in their relationship with the bank, through 63 measurements of processes and services. In addition, 104 internal processes were assessed in order to find out the degree of employee satisfaction with the bank’s Central Services. These measurements enabled the bank to gauge the perceptions of both groups, which it communicated to areas of the bank to foster improvement initiatives for their processes and so they could adapt their range of products and services to meet the expectations of customers in the commercial networks and Digital Banking, and in the Business, Technical Support and Operational Support areas.

Customer and employee participation in surveys is essential for improving quality management and achieving excellence in our services. The 2021 results show positive developments in the quality perceived by customers and employees, as described below.

Higher levels of customer satisfaction

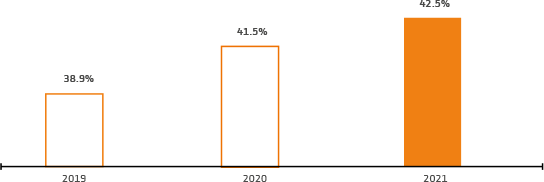

In 2021, the aggregate index of quality perceived by customers in Spain and Portugal, measured through the Net Promoter Score (NPS) index, stood at 42.5%, an increase of 2.4% compared to the previous year. In Spain it rose to 42.9% (+1.9%), improving the perceived quality of customers in the different commercial networks of the bank and in 56% of the branches of the branch network. At Bankinter Portugal, the customer NPS was 36.2% (+5.2%), with improvement in 57% of the branches.

The trend in the level of customer satisfaction remains very positive: in Spain, 52.6% (+1.7%) of customers said that they would recommend Bankinter, while 9.7% of customers expressed dissatisfaction; in Portugal, the percentages are 49.4% (+4.4%) and 13.1%, respectively.

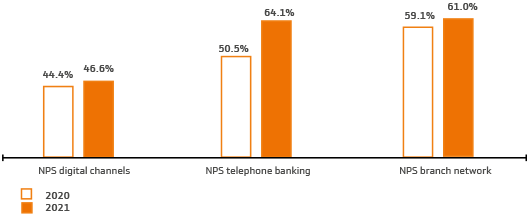

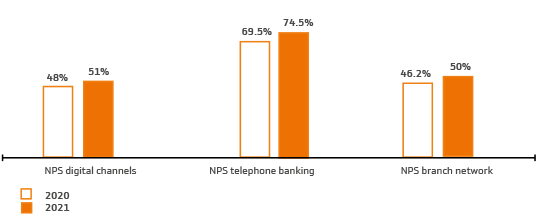

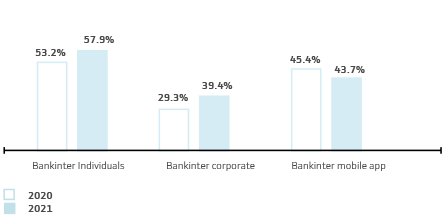

In terms of relationship channels, the increase in the level of satisfaction with digital channels (websites and apps) stood out in 2021, reaching 5% in Spain and just over 6% in Portugal. Telephone Banking and the Branch Network are also highly recommended by customers.

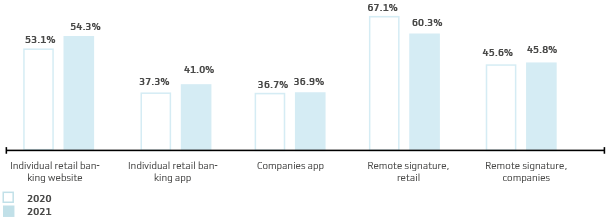

To improve the digital assets service, in 2021 we measured 28 processes that provide customers with very important information on the bank's websites and apps (+27.3% more than a year ago) in order to streamline processes, improve design, expand functionalities and improve performance. By doing so, the technical teams gain real-time information on customer perception, complaints and suggestions. As part of the transformation of internal processes, 64 processes that provide operational support to commercial networks are measured in real time.

NPS Bankinter aggregate (Spain and Portugal)

NPS by channels, Spain

NPS by channels, Portugal

NPS digital channels, Spain

NPS digital channels, Portugal

Internal quality

As in the case of customers, the quality of the bank's internal processes is systematically evaluated, through continuous studies and measurements that allow us to find out what employees think about the Central Services. The objective of this is to identify priority action and foster improvement to meet their needs and promote service excellence.

To this end, 104 measurements were taken in 2021, which provided thousands of opinions and suggestions and led to the introduction of 346 initiatives aimed at streamlining processes, improving information for customers, enhancing products, supporting commercial networks and promoting internal training. The information provided by internal surveys (completed by a large number of employees and performed regularly) is an essential for continuous improvement of Central Services.

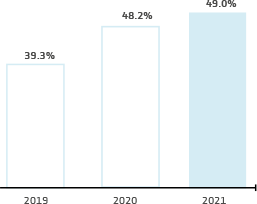

In Spain, the degree of satisfaction with the Central Services increased in 2021. The net satisfaction index was 49.01%, up 1.7% from 2020.

Internal quality, Spain (cumulative data)

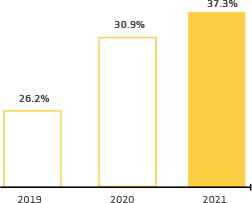

Internal quality, Portugal (cumulative data)

At Bankinter Portugal, the overall satisfaction level was 37.3% (+20.7%), showing excellent improvement. Initiatives to achieve this improvement mainly fell into the three below categories:

- Improve the communication process between areas (response time and ease of contact).

- Increase the closeness between the internal customer and the areas providing services.

- Simplify internal processes and provide digital solutions that increase efficiency.

- The objective of accelerating digitalisation processes, simplifying processes in all areas and increasing efficiency is maintained.

Leaders in service

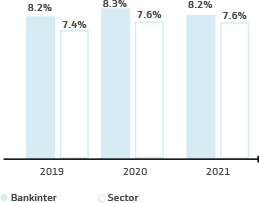

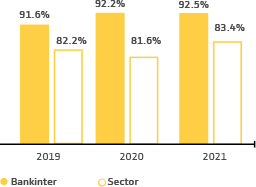

In 2021, Bankinter was one of the leading companies in Spain in terms of its sales network service. This was confirmed by the EQUOS RCB-2021 study, carried out by an independent company, which assesses the objective quality of sales support provided to potential customers in the branch network of the main Spanish financial institutions through the technique of mystery shopping. The bank excelled in its treatment, friendliness and engagement in terms of customer service, the time spent on it, the speed with which customers were handled and the explanation of products.

Likewise, Bankinter Portugal stayed consistently ahead of the 14 banking entities analysed. Its rating for 2021 remained well above the market average.

Objective quality, commercial network Spain (cumulative data)

NPS Bankinter Portugal (cumulative data)

Objectives

In 2022, the Quality area will continue working on the following objectives:

- Expanding the measurement of Digital Banking and Central Services processes to improve the customer and employee experience.

- Supporting branches and centres with low ratings to achieve quality levels that meet the expectations of their customers, by helping them with the design of their offerings and improvement initiatives.

- Sharing the best practices of the offices and centres with the best NPS results with all teams.

- Improving and streamlining the quality information provided to all the bank's teams to improve management of their results.

- Automating all quality feedback (from customers and employees), to speed up identification of improvement opportunities.

- Developing digitisation processes, simplifying processes in all areas and increasing efficiency (Portugal).

- Managing the processes with the lowest ratings to implement improvement plans.