Key element for business

The CRM area is responsible for having the best possible knowledge and a unique vision of the customer, so as to optimise its relationship with the latter. Its task consists of identifying what must be offered in each interaction, based on the channel and moment, using behavioural patterns and the analysis of results. It is a strategic item for the bank's different business, to whom CRM provides the necessary tools for the launch and prioritisation of commercial actions and for the adoption of any decisions that contribute to more comprehensive management.

CRM's work in Commercial Banking continued to be focused on customer connection in 2016, facilitating the advisory service tasks that may lead to a decision to have Bankinter manage part of the customer's assets. CRM also helps with 'connection' accounts (the salary account, the non-salary account, the youth account, the You and I account), designed to offer the conditions and services that best suit each customer, and its contribution is fundamental in consumer finance, with pre-authorised loans linked to different profiles.

In Enterprise Banking, CRM continued to identify opportunities to increase quality loan investments and to achieve growth within customers' day-to-day business. Personalised amounts were developed for short-term payment of tax, and operations and financing were improved of companies that have international operations, and specific needs in relation to that fact.

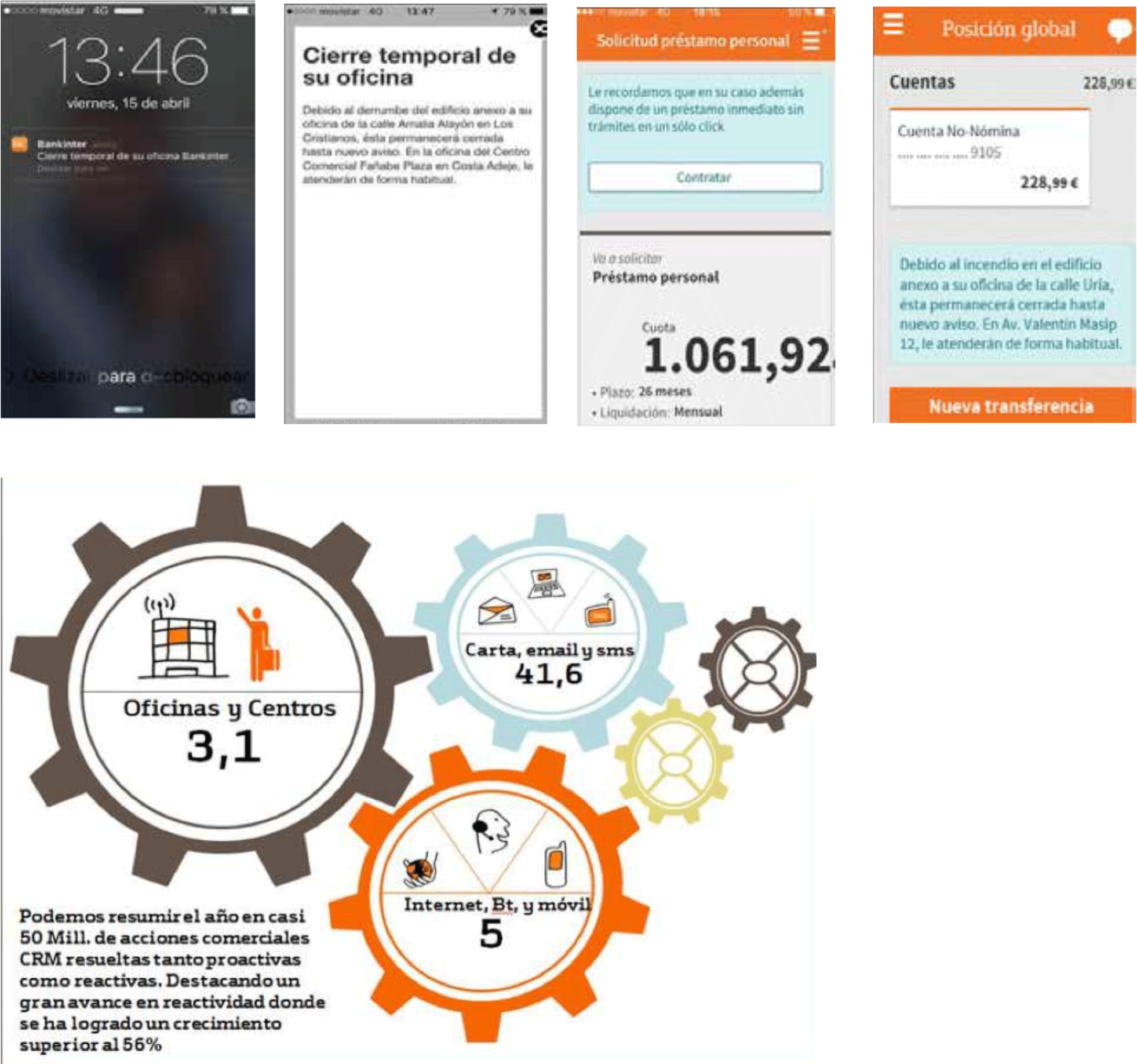

In 2016, CRM led a new and important advance in digital transformation. Although the bank has been interacting with customers through remote channels for years, the growing use of the mobile and of tablets meant that Bankinter needed to make its products and services available to the public through these devices. Accordingly, CRM's contact system (the push notifications channel) was integrated in the multi-channel structure, which allows for communicating in real time offers and events that may affect the operations the customer had intended to carry out at the branch office.

In 2016, CRM led a new and important advance in digital transformation. Although the bank has been interacting with customers through remote channels for years, the growing use of the mobile and of tablets meant that Bankinter needed to make its products and services available to the public through these devices. Accordingly, CRM's contact system (the push notifications channel) was integrated in the multi-channel structure, which allows for communicating in real time offers and events that may affect the operations the customer had intended to carry out at the branch office.

Further, the new bank app grew in commercial intelligence by personalising its messages according to timing, the customer's personal situation or even location. Jointly with Consumers, new models for contracting propensity were developed in order to be more efficient in commercial contact. Recourse to Big Data technology also increased Over the course of the year 49.8 million CRM actions were carried out with customers, which represents 24% growth compared to 2015.

The bank's CRM, with its knowledge of the market and of customers' background, coordinates the commercial planning of the different business segments and of the distribution networks. It participates both in devising the annual plans of Commercial Banking and Enterprise Banking, and in the distribution of targets to each of the channels, territories, regions and centres. Then, over the course of the year, it contributes to their monitoring.

In 2016, there was a significant improvement in reporting, which allows for quickly and easily tracking achievement of targets at all levels. This saves valuable time for management of businesses, which receives lots of data without even having to ask for them, owing to CRM's advances in proactivity.

As a centrepiece of the organisation and an unquestionable competitive edge, work is proceeding on the transfer of CRM capabilities to Bankinter Portugal, with the aim of significantly increasing its commercial activity.

We use cookiesCookies Policy. Accept