Bankinter launches Capital Advisor, Spain's first 100% digital investment advisory service

The bank is innovating with the first fully 'online' advisor, and with it seeks to lead the technological transformation of the digital financial industry with a new type of service.

Capital Advisor allows customers to create and manage their own fund portfolios and receive constant advice, with the option of accessing a comparative analysis of the funds they hold in other entities.

The investor simply selects an investment objective, defines how much to invest and configures the portfolio after viewing the recommendations proposed by Bankinter, always having the last word on how and where to invest their money.

The new service digitises the entire advisory process from beginning to end, it is free and is only available to Bankinter customers.

Bankinter creates the first fully digital investment advisor in the Spanish market. The bank has launched Bankinter Capital Advisor, a service that is heralding a new category within the investment world. This digital advisor goes one step further and allows customers to build their own portfolio of funds as part of an easy and quick process in which they receive constant advice from Bankinter.

This innovative service is aimed at investors who want to invest in funds and build and modify their portfolios, while receiving recommendations and having total autonomy to decide whether to follow them or not. Capital Advisor represents two years of work. After exploring the most advanced solutions that exist in other markets the entity has established a very intuitive service that provides customers with a very simple procedure to trade with their portfolios.

This service is free for Bankinter customers beginning at € 10,000, which is an option with added value for those customers who wish to invest in a portfolio of funds through a 100% digital process.

With this service, "Bankinter seeks to lead the digital transformation of the financial industry by offering a 100% digital advisor that will allow customers to decide their own investments, while always having the bank's constant advice and recommendations," says Gloria Ortiz, General Director of Bankinter Commercial Retail Banking. "Capital Advisor is aimed at investment customers who want to make their own decisions, after receiving the necessary advice so as not to face a universe of more than 4,800 investment funds".

The new Capital Advisor service already has its own discernible space on the Bankinter website, at the same level as the services tab for "Individuals", "Companies" and "Broker".

The design of the portfolios is in line with Bankinter's Analysis and Markets Department, which has more than ten years of experience in selecting fund portfolios, with proven returns.

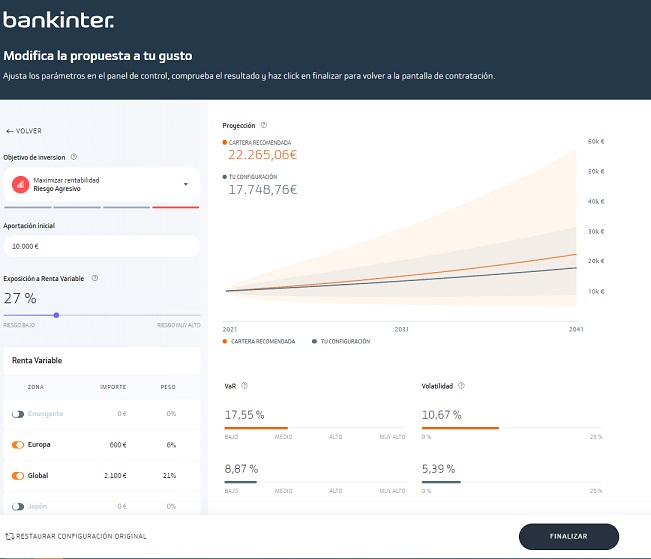

Before deciding to contract the service, customers can access a simulation that allows them to see how fast the service works and how they can build their portfolios. They just have to follow three simple steps: define the objective, indicate the amount that they are willing to invest, accept or modify the portfolio recommended by Capital Advisor that is most suitable for their risk profile. The service proposes four portfolio types depending on the risk profile: Conservative, moderate, dynamic and aggressive.

To build the Capital Advisor portfolios, Analysis and Markets perform a due diligence of more than 26,000 top-level funds and recognised management companies. Each portfolio is made up of approximately ten funds. Additionally, there are additional fund options if the customer decides to customise the geographic, equity, or fixed income asset types. These funds are also selected by Analysis and Markets.

Third party funds.

The recommended funds not only include Bankinter's own but also a wide universe of third-party investment funds. It is a well-known fact that the bank was a pioneer years ago in introducing open architecture in its range of funds.

Thanks to the simulation, the customer can see how the different investment scenarios change. This is an example of a 20-year investment projection, calculating volatility and assigning an expected return in the expected scenario (without unforeseen events), also including adverse and optimistic scenarios:

The customer will also be able to consult the performance of recent years for the funds that make up the recommended portfolio. However, the customer must remember that past returns do not guarantee future returns.

Bankinter Capital Advisor allows you to customise the proposed portfolio at any time by modifying the investment objective, exposure to equities or the geographical areas or the type of fixed income assets in which you wish to invest.

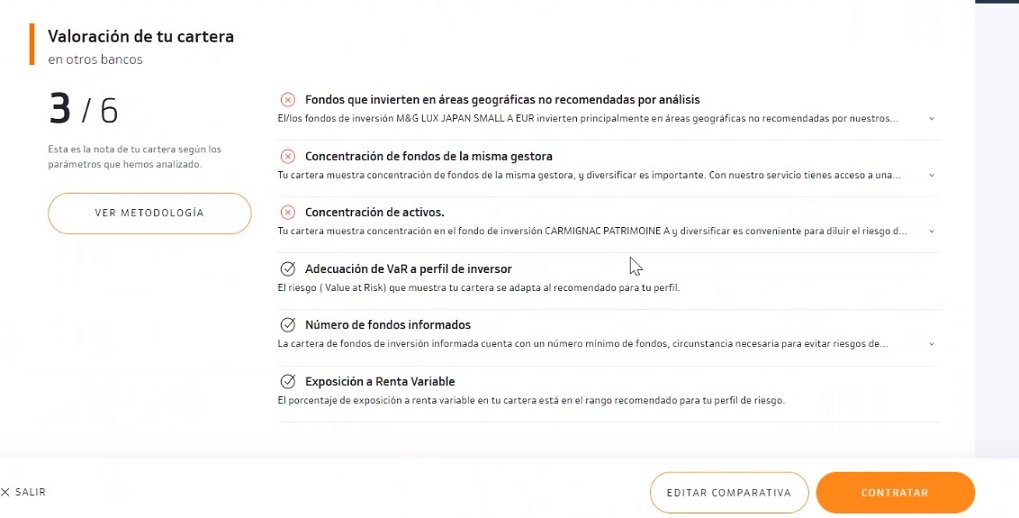

The digital advisor also provides the customer with a comparative analysis between the portfolio he wants to arrange and the funds he owns in other entities. You just have to automatically or manually add the data of your other funds from Capital Advisor and access an objective comparison.

Free and exclusive advisory service for customers.

The Capital Advisor service and its advice are free. The customer only has the cost of managing the funds, the same as if they were arranged through another channel of the bank or in another entity.

The investor will be occasionally informed of the monitoring of the portfolio and will receive quarterly recommendations with the assessments by the Analysis and Markets Department, which will allow the customer to decide if they want to follow that recommendation or prefer to carry out their own investment strategy.

If special market events occur that may affect the profitability of the portfolios, Analysis and Markets will issue ad hoc exceptional recommendations. Furthermore, if requested by the customer, they can have access to the bank's experts who can help them in their decision-making.

A commitment to digital innovation.

With its new digital advisory service, Bankinter has taken a step forward in its commitment to digital innovation in Commercial Retail Banking, a business segment in which it has hit several milestones, and is now focusing on the area of 100% online investment, an area in which it is a pioneer with the launch of the first digital banking broker twenty years ago. It is a leader in retail stock exchange brokerage. The savings and mortgages platform COINC, the first digital mortgage and the first roboadvisor Popcoin, joined forces, as well as other milestones.