We use first and third-party cookies for analytical and statistical purposes and to show you personalised advertisements based on a profile compiled from your browsing habits (e.g. pages visited). For more information, click on our Cookie Policy. You can accept all cookies by pressing 'Accept', you can reject all cookies by pressing 'Reject', or you can customize your choice by pressing 'Manage'.

Bankinter signs agreement with Apple to offer ApplePay to its customers

This service will be available for Bankinter cards and the bankintercard, which is managed by Bankinter Consumer Finance.

Bankinter, where 91% of customers are digital, has revamped its service offering.

Bankinter Consumer Finance strengthens its commitment to offering financing for homeowner associations with pre-approved loans through IESA

The Bank is the only one offering pre-approved loans to homeowner associations through IESA, a leading provider of technology services to property administrators with a customer base of 600,000 homeowner associations and 21 million homes

The loans will be available for different types of renovation works, such as energy efficiency improvements, adaptations to deliver greater accessibility and the installation of lifts, and will mean that associations can avoid imposing immediate surcharges on homeowners.

Bankinter Consumer Finance predicts that, in three years, ‘Singles’ Day’ will be a strong trend

The fourth ‘bankintercard’ Report shows how large e-commerce platforms have capitalised on and expanded certain circumstantial events to turn them into worldwide business milestones in very few years.

‘Singles’ Day’ (also known as ‘11.11’) is taking off in Spain, a port of entry for consumer trends in Europe, as part of an initiative that pushing Christmas shopping even earlier and driving singles and non-singles alike to treat themselves.

On the rise in Spain and boosting consumption, singles spend the most, in relative terms, with credit card (in 2018, 2,650 euros a year per person on average), and have increased their spending the fastest (+11.6%) from 2016 to 2018.

Bankinter Consumer Finance launches bankintercard in Portugal

Bankinter Consumer Finance, the bank’s consumer lending outfit, has recently launched in Portugal bankintercard, its line of open market credit cards that do not require a bank account with Bankinter.

Bankinter Consumer Finance aims to attract 400,000 new customers and reach 500 million euros in new lending in the next 5 years.

The Bankinter subsidiary plans to account for around 15% of Bankinter Group’s income in Portugal in the next five years.

Bankinter Consumer Finance launches the four month interest free payment by card

The company, specialised in bank spending, permits payments of up to 500 euros at 0% with its credit cards.

Bankinter Consumer Finance launches its ‘Wallet’ app ‘bankintercard’

‘bankintercard’ is Bankinter Consumer Finance’s brand of cards, with over 720,000 users from both Bankinter and other financial institutions.

The app allows users to make payments, instantly manage the various types of ‘bankintercard’ cards and find current offers and discounts at nearby establishments.

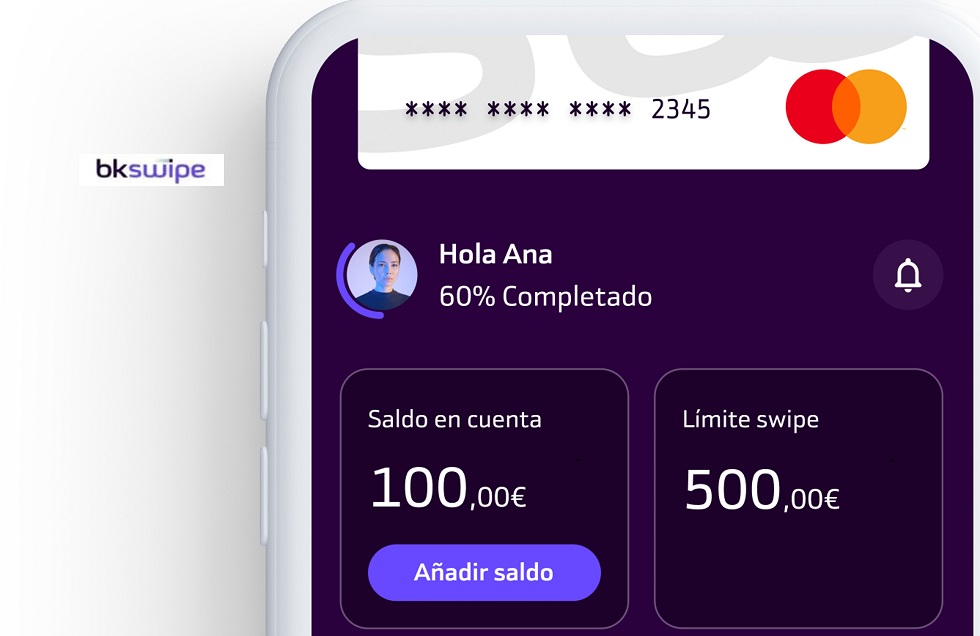

Bankinter Consumer Finance launches 'bkswipe', a disruptive app for non-customers of the bank that allows them to manage payments globally and pay in instalments

With this service, Bankinter Consumer Finance is looking to burst into the payments business with an innovative concept that goes beyond 'buy now pay later', seeking to capture new customers with a young profile who want a unique digital solution to manage their payments and split payments without changing banks.

Users can recover money from any expense made up to three months earlier with any bank account, getting back money from bills paid, purchases made, transfers sent or even Bizum payments, in order to split these expenses.

The app provides a virtual current account and debit card and, in addition, credits users 1% of the total amount of purchases made with the card every month.

Bankinter Consumer Finance breaks a record with over 1 billion euros in consumer loans

The Bankinter affiliate increased new lending by 40% in less than a year.

It is the financial institution that has grown the most this year.

Bankinter Consumer Finance's lending exceeds 4,000 million euros at the end of May

These figures represent growth of 16% so far this year, and 39% growth year-on-year.

Among the geographies in which this Bankinter subsidiary operates, growth in Ireland stands out. Turnover in Ireland has now reached 1,325 million, from cards, personal loans and mortgages.

Bankinter Consumer Finance and Pullmantur Cruises launch new Pullmantur Visa card

• The Pullmantur Visa card is intended for all consumers and can be used for all types of daily purchases and payments.

• This strategic partnership between the two entities will help Pullmantur Cruises guests pay for their cruises with financing for up to 18 months.

• There are also other exclusive advantages, like discounts of up to 6% on financed purchases and a €20 cashback reward for purchases made in Pullmantur Cruises.

Bankinter Consumer Finance and Sonae set up a joint venture with the aim of creating Portugal's leading consumer-credit institution

Bankinter Consumer Finance will purchase a stake in Universo, the entity responsible for managing Sonae's financial services in Portugal, which will create a shared company, owned 50% each by both groups.

Bankinter Consumer Finance and Sonae materialize their joint venture to grow in the consumer credit business in Portugal

- The alliance has become a reality today and Universo is now equally owned by Sonae and Bankinter Consumer Finance.

- Universo's growth strategy focuses on creating a leading company in consumer credit in Portugal, providing a diversified offer of innovative and simple solutions and opening the way to internationalisation.

Bankinter Consumer Finance and Universidad Pontificia Comillas give the First Award for Business Ethics Research

The professors and researchers, José Luis Retolaza and Leire San José, received this award for their academic contribution to the field of corporate ethics, a priority in corporate social responsibility.

According to the judges, 43 studies ‘of the highest quality’ were submitted, of which 10 were finalists.

Bankinter Consumer Finance and Pontificia Comillas University hold the Fifth Business Ethics Research Awards

Clara Gallego Sosa, Milagros Gutiérrez Fernández and Yakira Fernández Torres, of the University of Extremadura, win the Fifth Business Ethics Research Awards for: “Commitment to sustainability in the large European banking sector and its relationship with gender diversity in management - a perspective from the 2030 Agenda.”

The winning work takes an international approach in analysing the role of female managers and progress with the pillars of the SDGs in 50 European banks.

This well established award is now in its fifth year and attracted over 250 research papers from international authors.

Bankinter Consumer Finance y la Universidad Pontificia Comillas comunican los ganadores de la III Edición de los Premios de Investigación en Ética Empresarial

D. José Félix Gonzalo Camarero, de la Universidad del País Vasco, recibe el galardón por un trabajo de investigación titulado: “Análisis y control del riesgo moral: Modelo de Cumplimiento Moral (MCM)”.

El premio se consolida con un mayor número de trabajos presentados y con creciente internacionalización.

Bankinter Consumer Finance and Universidad Pontificia Comillas give the second Award for Business Ethics Research

Francisco Javier Forcadell, Elisa Aracil and Fernando Úbeda awarded for their contributions to studies about financial services, digitalisation and corporate sustainability.

50 academically rigorous projects were submitted, according to judges: 46 projects in Spain and four in Portugal.

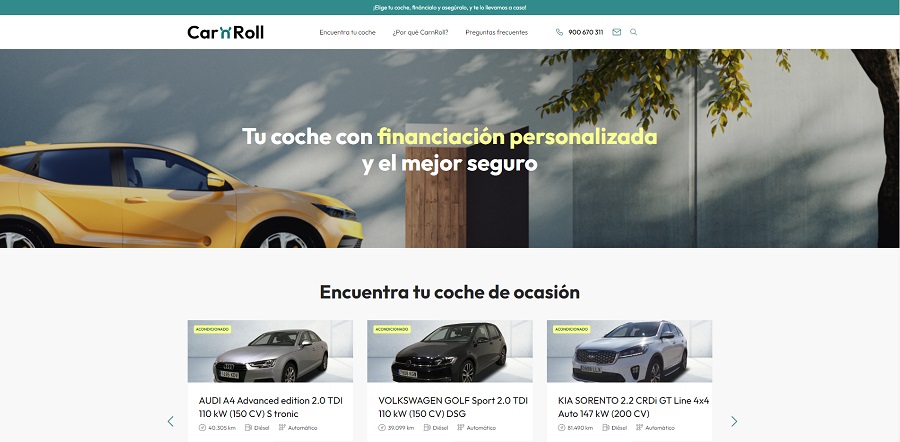

Bankinter Consumer Finance, Línea Directa and VASS partner up to create a used-vehicle sales platform

This partnership has created "CarnRoll", a new innovative digital platform for buying second-hand cars and accessing financing and insurance at competitive rates at the same time.CarnRoll has a 'stock' of used cars, featuring leading brands and models, which have all been checked through more than 100 screening points. Customers can reserve their vehicle free of charge on this platform and then have it delivered to their home. All vehicles will come under a one-year warranty.

Users can access quick and easy financing on their vehicle, with a nominal interest rate (NIR) starting from 4.45% and an annual equivalent rate (AER) of 4.54%, without changing banks and with no set-up fee, as part of a fully online

Through the platform, customers can request and receive a fully tailored car-insurance quote starting from 299 euros per year, pay monthly instalments and access specific types of cover, such as free choice of garage, 24-hour travel assistance, replacement car, vehicle MOT transfer service and cover for pets travelling in the car.

Bankinter Seguros Generales inicia su actividad comercial

La entidad comercializa seguros de Empresas, Comercios y Oficinas y Decesos.

Bankinter adquiere una ficha bancaria en Luxemburgo como complemento a su nueva estrategia de banca privada

La nueva estrategia se basa en servicios de asesoramiento, gestión de activos, nuevos productos y servicios especializados, y está orientada a impulsar los activos del banco y la base de clientes en este segmento estratégico.

Los clientes de banca privada requieren, cada vez en mayor medida, propuestas financieras globales y productos más sofisticados y eficientes.

Bankinter continues to innovate in payment methods with two cards in a new single plastic card

The new Combo Mastercard lets customers carry two cards in one.

Customers can select how to manage daily payments and extraordinary expenses with two complementary payment methods.

It plans to offer various combinations with this card: credit and deferred payment; debit and payment in three months, interest free; and a version for sole traders to be able to pay off personal and business expenses with the same plastic card.