We use first and third-party cookies for analytical and statistical purposes and to show you personalised advertisements based on a profile compiled from your browsing habits (e.g. pages visited). For more information, click on our Cookie Policy. You can accept all cookies by pressing 'Accept', you can reject all cookies by pressing 'Reject', or you can customize your choice by pressing 'Manage'.

Currency Broker

We were able to improve it, so we did.

Interactive charts

You'll be able to see the price correlation between the two currencies you select for a specific date range. And if you “hover the cursor” over each period in the date range you'll see the quotes at that moment in time.Reuters News

You'll see on your screen all the news that may have an impact on the foreign exchange market.Open 24 hours a day so you can trade in real time

25 real-time quotes

For international payments

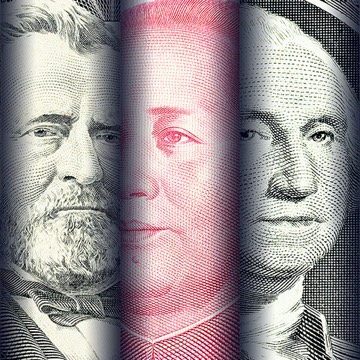

From a dollar, a yen, a florin...

As always, access is free of charge

Limit orders

You can enter your preferred price and a time frame in the system. As soon as the market reaches your price, the order will be closed. You'll also be able to place limit orders for both spot transactions and currency futures.Agile signing

A signing system already set up to establish a time range and number of transactions, so you don't have to sign every order.Notifications

You'll get an SMS or email when the selected currency reaches the level you have indicated within the allotted time period.Call order

Make it easier still. If you access the Broker from the email notification, your call order will be auto-completed, meaning that you can trade at the closest price at the time of your connection.Looking for peace of mind?

Take out currency futures. 1

You'll avoid the risk of fluctuations in the exchange rate by agreeing the price for your forward transactions.

- Fixed date currency futures: guarantee the exchange rate for up to one year.

- Flexible currency futures: use all or part of it at a fixed rate for the entire period requested.

Wherever and whenever your company needs us.

Find out how to make good even better: more features, more services, more opportunities.

See Currency Broker terms and conditions Currency Broker terms and conditions

Available transactions

- “Spot” trades against the euro and other currencies.

- Spot purchases for international transfers in foreign currencies.

- Currency futures at a fixed date and in a flexible format.

- Management of limit orders.

- Call orders.

- Notifications.

Transaction limits

- Up to 5,000,000 euros in the main currencies.2

- Up to 1,000,000 euros against other currencies.

Trading hours

You can trade through our Currency Broker 24 hours a day from Monday to Friday.

Currency futures

Currency futures is available from the third day up to one year.

To take out this currency futures, you must have already set up a risk facility with a high enough limit for forward transactions.

Price of the service

Use of the Currency Broker service is free and available exclusively to our customers.

See FAQs FAQs

How can I activate the service?

Through the "Foreign" section of our corporate website, under "Currency Broker". Enter your mobile phone, landline and email address, and in a few seconds the service will be activated.

What are the trading hours?

Currency Broker is operational 24 hours a day from Monday to Friday.

How many currencies are available?

There are currently 25 currencies available, but this number may vary according to their convertibility and access to the market.

What do I need to carry out spot trades with currencies?

You need an account in each of the currencies you want to trade in, 3 because one account will be debited and another credited, depending on the currencies in question.

Can I take out a risk facility for currency futures through the website?

No, you can't. Your local branch will have to analyse the risk facility you need but once that procedure is complete you can take out currency futures online through the currency broker.

What if I take out currency futures and when it matures I'm not interested in buying or selling and the transaction is cancelled?

It's important to remember that currency futures is a binding contract. If you don't buy or sell the agreed currency, the Bank will settle the currency futures against the day's fixed rate, which may generate gains or losses.

Información Interés

-

Show/Hide legal text1 The pre-contractual information for PRIIPs investment products and the key information documents are available on our website https://www.bankinter.com/banca/nav/documentos-datos-fundamentales.

-

Show/Hide legal text2 Depending on the liquidity in the foreign exchange market. Requires custom profiling.

-

Show/Hide legal text3 Remember, non-euro accounts are subject to exchange rate fluctuations.