We use first and third-party cookies for analytical and statistical purposes and to show you personalised advertisements based on a profile compiled from your browsing habits (e.g. pages visited). For more information, click on our Cookie Policy. You can accept all cookies by pressing 'Accept', you can reject all cookies by pressing 'Reject', or you can customize your choice by pressing 'Manage'.

Investment funds

Progress will always, always depend on nature.

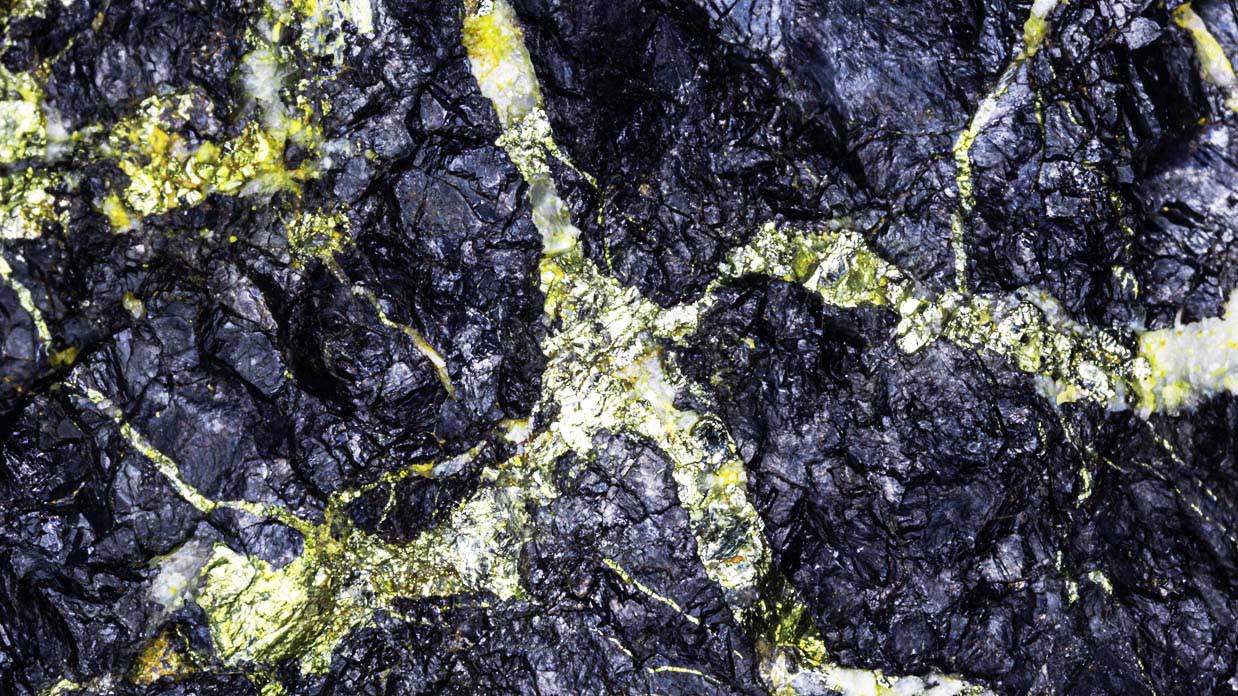

Commodities

It is so obvious that we sometimes forget. We often focus on transformation processes forgetting that these need something that is out there, in the natural world. Today, raw materials are often referred to as “commodities”, although they remain the same as ever: the source of all our consumer goods.

Why invest in this trend?

-

Emerging countries are growing, and demand for commodities is growing.The global population is growing and becoming more urban, increasing demand for raw materials. China is currently the world's largest consumer of raw materials.

-

Worrying inflation.This worries all of us. Investors too. In these uncertain times, raw materials can be safe-haven assets, in other words, assets with lower volatility whose prices tend to go up when economic growth shrinks.

-

Reductions in the supply of raw materials result in higher prices for them.Since the end of the last decade, the energy and mining sectors have increased their investment in exploring and developing new projects (mines and deposits, etc.) with a reduction in supply. Combined with the ongoing economic recovery, this factor has caused higher prices that are continuing to increase.

After a number of difficult years, the mining and energy sectors are recovering and outperforming stock markets as a whole.

This is combined with an attractive opportunity for their share prices, as both sectors continue to lag the stock market as a whole, providing a good option for diversification from traditional asset classes.

-

Low correlation with the stock market indexes of the market as a whole.

-

Very low - even negative - correlation with equities.

-

A closer relationship with the equities of emerging markets.

MSCI World in the year +11.6%

MSCI Energy in the year +29.2%

MSCI Metals and Mining in the year +23.7%

Source: Bloomberg

Copper, gold and oil: essential raw materials, now and in the future.

The transition to a more electrified world makes us focus on the increasing demand for copper. But other more traditional metals, such as gold, have also served as a source of diversification and protection of value in the face of central banks issuing money.

-

Copper.One example of the increasing demand for copper is electric vehicles, the manufacture of which is estimated to require around five times more copper than the manufacture of a vehicle with a combustion engine, due to wiring, components, batteries and so on.

-

GoldThe behaviour of gold continues to be very different to that of other metals due to its relationship with changes in interest rates. This is why gold continues to be considered a safe-haven asset.

-

Oil.Despite being in an energy transition, energy companies still represent an opportunity in the long and medium terms. Forecasts suggest demand for oil will peak during the current decade.

Raw material prices

Source: MacroTrends

Investment universe

A diversified investment approach to the mining and energy sectors.

- High-quality companies that, in general, outperform the market as a whole.

What do the experts think?

- The OECD estimates that the population will increase by 765 million people to 8.5 billion this decade, with the resulting increase in demand for minerals, food, rare earths and so on.

Our investment proposal

Invest in funds through shares in infrastructure corporates around the globe.

The value of investment funds1 can fall as well as rise, and you may get back less than you invested.

LU1864666240

BGF NATURAL RESOURCES GROWTH & INCOME "A2" (EURHDG) ACC

Advanced

EUR

1,50%

1000 €

LU0273158872

DWS INVEST GLOBAL AGRIBUSINESS "LC" ACC

Advanced

EUR

1,50%

1000 €

-

Show/Hide legal text1 Investment funds: The key investor information document, prospectus and all other legal documents related to Bankinter's collective investment institutions are available in Spanish at any of our branches, on the Bankinter website (www.bankinter.com) and on the website of the Spanish National Securities Market Commission (CNMV).

-

Show/Hide legal text2 The fees shown are the sum of the management and depositary fees. These fees are charged annually.

Access your private area to continue arranging the fund.

Go to y account

Call us on 900 816 833 and we'll explain how to arrange this fund.