We use first and third-party cookies for analytical and statistical purposes and to show you personalised advertisements based on a profile compiled from your browsing habits (e.g. pages visited). For more information, click on our Cookie Policy. You can accept all cookies by pressing 'Accept', you can reject all cookies by pressing 'Reject', or you can customize your choice by pressing 'Manage'.

CARDS

Need a card? We have the right one for you.

Combo Débito+ card1

Decide how you want to pay: now or later

- Use the 'now' side as a debit card.

- Use the 'later' side to split your purchase into four instalments.

Combo Card1

Two cards in one

- Use the Combo 1 side if you want to pay at the end of the month.

- Use the Combo 2 side if you prefer to pay little by little.

- There are no issuance or maintenance fees with the Salary, Non-Salary and Pension accounts.

Combo Profesional card1

A card with a personal side and a business side

- Two separate statements.

- Month-end or deferred payment.

- No issuance or maintenance fees with the business account.

Única card1

A card with everything for everything

- Split your purchases in a few easy steps.

- Withdraw cash from your account at more than 17,000 free ATMs.

- Transfer funds to your account.

Bankinter Solidarios card1

Help us with our solidarity projects.

- they get up to 5% of what you spend.

- Choose when and how much you want to pay2.

- We donate 100% of the fee.

Quiero card1

Instant access to extra expenses.

- No issuance or maintenance fee.

- Choose when and how much you want to pay2.

- Withdraw cash from your account at more than 17,000 free ATMs.

PSD2: the new directive on secure card payments.

BANKINTER CARD SERVICES

No intermediaries, no explanations.

Because your cards are much more than a payment method. Solutions to meet your needs, whatever they happen to be at any given time. You have them there, to use whenever you need them.

Compra Smart

Buying something big? Cut it down to size.

- Split the cost of large purchases from €90.

- You can split one or several purchases or your credit card bill.

Smart Cash

Do you need to top up your account?

- Transfer money from your credit card to your current account.

- Instantly, no questions asked.

Plazox

When paying with your card, decide if you want to split the payment.

- From your computer or at the time of entering your PIN at the POS.

- You can divide your purchase into 3, 6, 9 or 12 months.

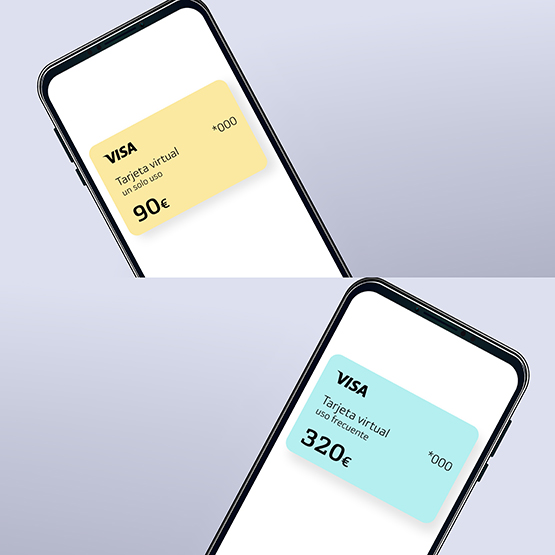

Virtual cards

Supplementary cards to your credit or debit card to improve your spending online.

- A single-use card for greater security.

- A frequent-use card to improve the way in which you control what you spend.

Manage your card limits whenever you need to.

Recharge your cards

Have you used up your card limit? Transfer money from your account to your card and continue shopping.Change limits

Because every month is different, you can increase or decrease the limits of your cards according to your needs.Transfer credit between cards

Your cards are so flexible that you can instantly transfer credit limits between them.More services for your cards, more convenience for you.

Mobile payments

Instant card

An ATM always nearby

EURO 6000 Plus Programme

Paying with our cards makes you eligible for discounts at hundreds of fashion, homeware, technology and sports retailers as well as food delivery services.

Other payment methods

Different solutions for different situations.

Vía T card

Pay for motorway tolls automatically. No need to queue, no need to stop.Debit Card

All your expenses will be charged to your account straightaway.You can choose from more than 17,000 ATMs for free debit card cash withdrawals.

- Bankinter

- Deutsche Bank

- Euro Automatic Cash

- Grupo Cajamar

- Banca March

- Grupo Cajas Rurales

- Laboral Kutxa Bank

- Targo Bank

- Euronet

Now from EURO 6000 banks as well:

CajaSur Banco, EVO Bank, CECABANK, Cashzone, Caixa Ontiyent, Liberbank, Colonya Caixa Pollença, ABANCA, Ibercaja, Kutxabank, Unicaja.

Find branches and ATMs

Important Information

-

Show/Hide legal text1 For Combo, Única, Quiero and Solidarios cards: Card issued and financing offered by Bankinter Consumer Finance, E.F.C., S.A., a hybrid payment entity with a safeguard system consisting of the deposit of the funds in a separate current account opened at Bankinter, S.A., registered with Banco de España under number 8832, with registered office at 12 Avda. de Bruselas, 28108, Alcobendas, Madrid, recorded in Volume 22,729, Folio 181, Sheet No. M-259543 of the Madrid Companies Register, and with Tax ID Number A82650672. For all other cards the issuer is Bankinter, S.A., which also offers the financing.

-

Show/Hide legal text2 The Solidarios and the Quiero cards are issued with the deferred payment (revolving) method. The monthly instalment can either be a fixed amount or a percentage of the credit drawn.