In accordance with the Corporate By-Laws, the Board of Directors is the competent body to approve the corporate policies of the Bank and its Group, excluding Linea Directa Aseguradora, which has its own regulations.

Bankinter's Corporate Governance Policy contains the general principles that underpin the specific corporate policies and internal procedure rules regarding corporate governance. Together, these policies and rules form Bankinter Group’s internal corporate governance framework and are mandatory for all group entities as well as their respective governing bodies. Furthermore, it contains the principles that define the Group's corporate structure, as well as the core rules of its internal operations for the implementation of current regulations and the best corporate governance practices.

The details of the Corporate Governance Policy, in addition to the associated policies (Director Selection and Succession, Suitability and Training Assessment) can be found on the Bank's website.

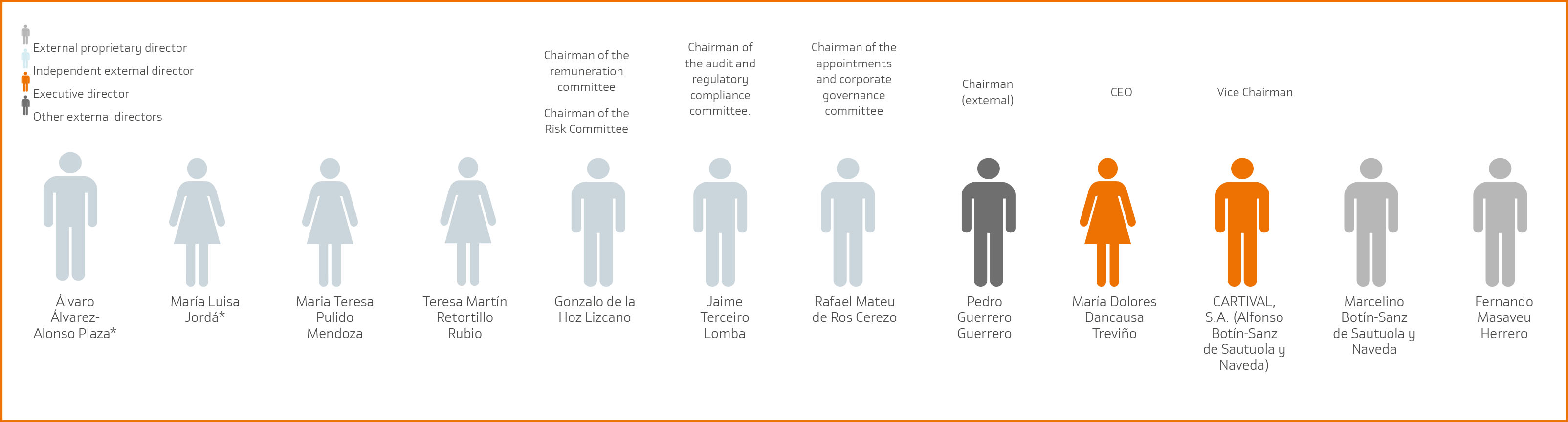

The members of the Board of Directors of Bankinter are characterised by their professional capability, integrity and independent judgement. These conditions are reported on annually in the corporate governance report, which is approved by the Board of Directors. At the time of writing this report, the Board is made up of ten members. However the General Meeting of Shareholders held on 22 March 2018 approved increasing this number to 12. Therefore, at the proposal of the Appointments and Corporate Governance Committee, Bankinter's Board of Directors, having received a positive assessment of suitability from the competent authority, will submit the appointment of two new independent external Directors to a vote at the General Meeting of Shareholders in March 2019; the profiles of these new members have been made available to shareholders on the corporate website.

The incorporation of the two candidates (Álvaro Álvarez-Alonso and María Luisa Jordá) represents huge added value for the Board, enriching its composition and diversity. In addition to their excellent academic background, they different profiles and experience. Álvarez-Alonso has extensive management experience in the highest level of the financial, banking and strategic sector, at a national and international level, in addition to the implementation of new businesses. Jordá, in turn, has audit experience, strengthening the Board's analysis and supervision of management decisions from all perspective, thanks to her experience as a member of other Boards of Directors.

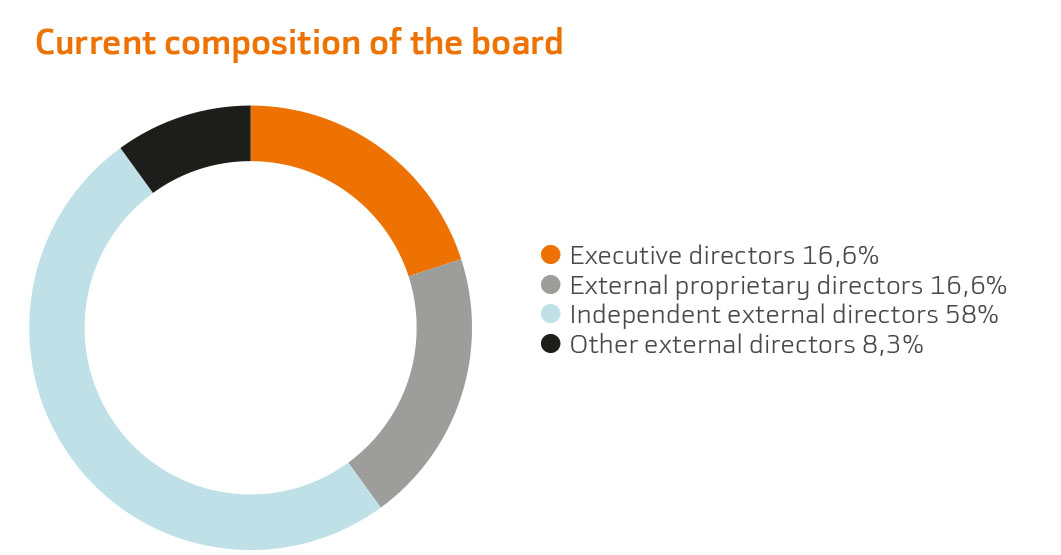

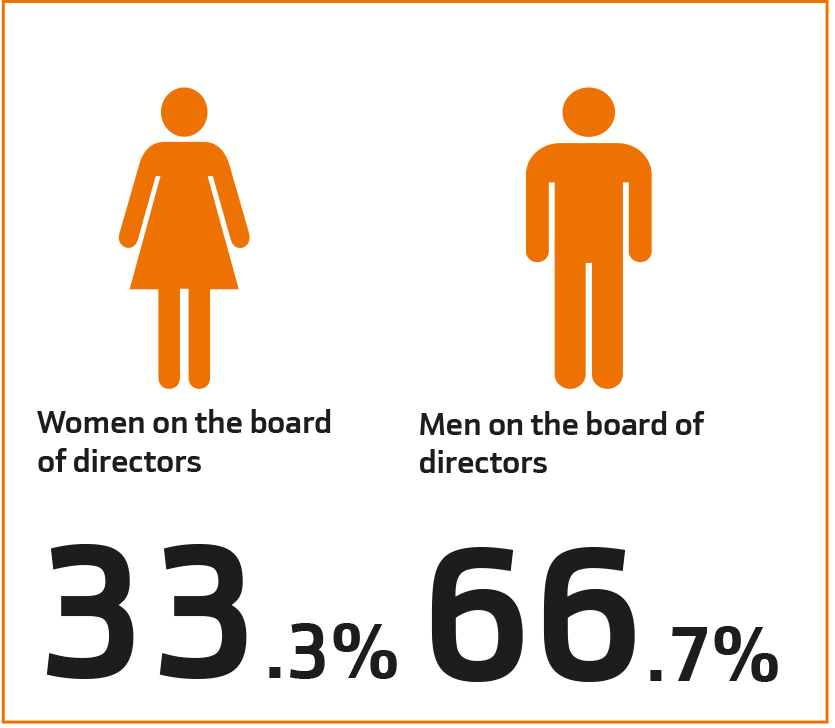

Following these additions, subject to approval by the Shareholders' Meeting, the degree of independence on the Board will increase, with the proportion of independent directors coming to 58%. This also contributes to the diversity of knowledge and experience, in addition to gender diversity, as 33% of directors are female.

In short, of its twelve members, two are executive directors and ten are nonexecutive directors. Seven of the latter are independent, two are proprietary and the last, in the opinion of the Board, is neither proprietary nor independent.

Furthermore, Bankinter staunchly defends the importance of a balance of power in decision-making processes and, to this end, has established a clear separation of functions between the Non-Executive Chairman and the Chief Executive Officer. In addition to this separation, Bankinter's Corporate By-Laws envisage the possibility of appointing a lead director from among its independent directors.

The Board of Directors has created an Executive Committee with delegated authority. Furthermore, It has a range of committees with supervisory, reporting, advisory and proposal powers. They are the following:

The Rules and Regulations of the Board of Directors defines the functions and powers designated to each committee. The composition of each committee can be consulted on the bank's website.

Furthermore, the Board of Directors recently approved a specific regulation for the Audit and Regulatory Compliance Committee, following the recommendations defined by the regulator and to equip it with greater functional independence.

In November 2015, the Board of Directors of Bankinter approved the Director Selection and Succession Policy, which defines the general principles of such processes:

In addition, the Board of Directors, applying the joint ESMA and EBA Guidelines, which came into force on 30 June 2018, approved a Policy on Assessing the Suitability of Members of the Board and those appointed to key positions at Bankinter. As a result of this, the Board also approved a number of amendments to the Selection and Succession Policy, which are complemented with the expected succession of the Chairpersons of the Board's committees.

The director selection processes are based on an analysis of the needs of Bankinter and of the institutions that make up its Group. The Board of Directors carries out such analysis with the advice of the Appointments and Corporate Governance Committee.

Additionally, and as a general rule, the candidates to become directors must be persons of integrity and suitability and have recognised solvency, skill, experience, qualification, training, availability and commitment to their duties.

The appointments and corporate governance committee assesses the balance of powers, expertise, diversity and experience necessary for the board of directors. For this purpose, it defines the functions and aptitudes required of candidates for each vacancy; and assesses the time and dedication necessary for them to properly discharge their duties. In 2018, the Committee embarked upon the selection process to cover the two new posts approved by the General Meeting of Shareholders. Considering the needs to be covered at the time and the profile of existing directors, the decision was made that the candidates would have to satisfy most of the following characteristics:

External advisers were involved in the selection process, as generally established for the selection of candidates capable of forming part of the Board of Directors in the capacity of independent directors.

In terms of gender diversity, Bankinter has been committed to the quality of opportunities for men and women for years. The selection processes it organises are objective and refrain from using conditions or bias that would limit the ability of women to be appointed as directors, assessing the independence of candidates on a case-bycase basis, in addition to their professional worth, their capacity and their experience in the sector. The candidate selection process procures that the analysed candidates always include women.

As a result of this commitment, in 2010, the first woman became a member of the Board of Directors as executive director and chief executive of the company. At the time of writing and provided that the General Meeting of Shareholders approves the new appointments, the ratio of female directors will be 33.3%, meaning the Bank will have achieved the target of 30% representation set out in the Good Governance Code of Listed Companies for 2020 earlier than required.

Pursuant to the policy approved by the Board, the processes for Board Member succession ensure that it will be carried out in a planned and coordinated manner, protecting the continuity of the business with no delay.

The appointments and corporate governance committee looks to ensure the existence of succession plans and update them for the chairman and the executive directors of the Company and, where applicable, to submit proposals to the board of directors so that this succession is carried out in a planned and orderly manner. This analysis is submitted to the board of directors on an annual basis.

Likewise, the Selection and Succession Policy for members of the Board of Directors contains the expected succession of the Chairpersons of the Board's committees.

On 25 October 2017, the Board of Directors approved the Training Policy for members of the Board, which defines the planning and principles required to guaranteed the up-todate qualification of members of the Board of Directors through training. The aim is to ensure that the Board has the skills required for its supervision functions to be performed objectively and independently at all times. It sets out two training scenarios:

The Rules and Regulations of the Board of Directors contain an article describing the functions of the secretary of the board, attributing them all the functions that correspond to them under the Spanish Corporate Enterprises Act and in line with best corporate governance practices. These functions include safeguarding the formal and material legality of the board's actions, overseeing compliance with good governance recommendations assumed by the Bank and ensuring that the procedures and rules of governance are respected and reviewed on a regular basis.

In 2015, the Board of Directors approved a procedure for preparation of meetings of the board and its committees, attributing to the Secretary of the Board, among others, those functions related to assisting the Chairman to ensure that all directors receive the relevant information in order to discharge their duties in good time and in the appropriate format.

In line with its Rules and Regulations, before each financial year begins, the Board of Directors shall approve the programme of meetings for the following year in addition to the likely agenda. Directors are entitled to propose additional agenda items. The calendar and the agenda may be amended by virtue of a resolution of the Board itself or if the Chairman so decides, who shall communicate any such amendments to directors with as much notice as possible, emergencies aside. The minimum number of meetings will be 10 per year (well above the legal requirement to hold meetings once a quarter). The Board of Directors of Bankinter met 11 times in 2018.

Directors are guaranteed to receive the necessary information in order to adequately assess the corresponding transactions or decisions prior to when the board or committee meetings are held, so that they may reasonably prepare for the meetings and actively participate in the discussions.

One of the board's powers is to produce an annual assessment of its own workings and those of its committees and, based on its conclusions, to propose an action plan to correct any shortcomings detected.

In accordance with corporate governance recommendations, the Board of Directors decided that this assessment will be carried out by external advisors at least every three years. In 2016, the assessment was conducted by an independent external expert (Russell Reynolds), whilst in 2017 and 2018, it was conducted internally. As part of all these assessments, aspects covered included the operations of the Board of Directors and its committees and the performance of its Chairman and executive directors.

In conclusion, during the assessments performed, no shortcomings were detected that required the implementation of an action plan to correct any of the areas analysed (quality and efficiency in the Board’s functions;the functions and the composition of its committees; diversity in the composition and the authority of the Board; performance of the Chairman of the Board CEO; and performance and contribution of each director, with a special focus on committee chairs).

Nonetheless, the analysis of the findings of both assessments led to suggestions for improvement, which will be examined by the Appointments and Corporate Governance Committee.

The principles and components of director remuneration are detailed in the Remuneration Policy and in the Annual Report on Directors' Remuneration, which is subject to an advisory vote at the General Meeting of Shareholders.

As part of its Good Governance policy, Bankinter has implemented, since 2008, the recommendation of the then Unified Good Governance Code of Listed Companies, later included as a requirement in the Spanish Corporate Enterprises Act, in relation to submitting its report on the directors' remuneration policy to the General Meeting of Shareholders as a separate item on the agenda, subject to an advisory vote.

The annual general meeting of shareholders is the competent body to approve the maximum annual amount of remuneration corresponding to all directors acting as such. This amount remains in force until the General Meeting of Shareholders agrees to change it, although the Board may reduce its amount.

The specific amount that corresponds to each of the directors for the concepts established in the corporate by-laws and the form of payment will be determined by the board of directors. To this end, the positions held by each director on the body itself and their membership to and attendance at the various committees will be taken into account.

This remuneration currently has two components: an annual fixed amount, and attendance fees

The directors are entitled to remuneration (salaries, incentives, variable remuneration, pensions, insurance and severance payments) that, as proposed by the remuneration committee and approved by the board of directors, is deemed appropriate for the performance of other functions in the Bank, regardless of whether they are executive directors or not, other than those that entail collective supervisory and decision-making functions discharged as mere board members. Currently, only executive directors receive variable remuneration.

The variable components will be defined in a way that generates an appropriate ratio between fixed and variable components of total remuneration and shall not exceed one hundred per cent of the fixed components, unless the general shareholders’ meeting approves a higher ratio, although it may not, under any circumstances, exceed two hundred per cent of the fixed components of their total remuneration, in the terms established by law.

The Annual Report individually presents the remuneration received by each director, expressing the amounts relating to each remuneration item. Additionally these items appear individually in the report as well as the remuneration that corresponds to the executive functions entrusted to the Bank's executive directors.

We use our own and third-party cookies to improve our services and show you advertising related to your preferences by analyzing your browsing habits. If you go on surfing, we will consider you accepting its use. You can get more information, or know how to change the configuration in our Cookies Policy. Accept