People

More quality jobs to underpin growth

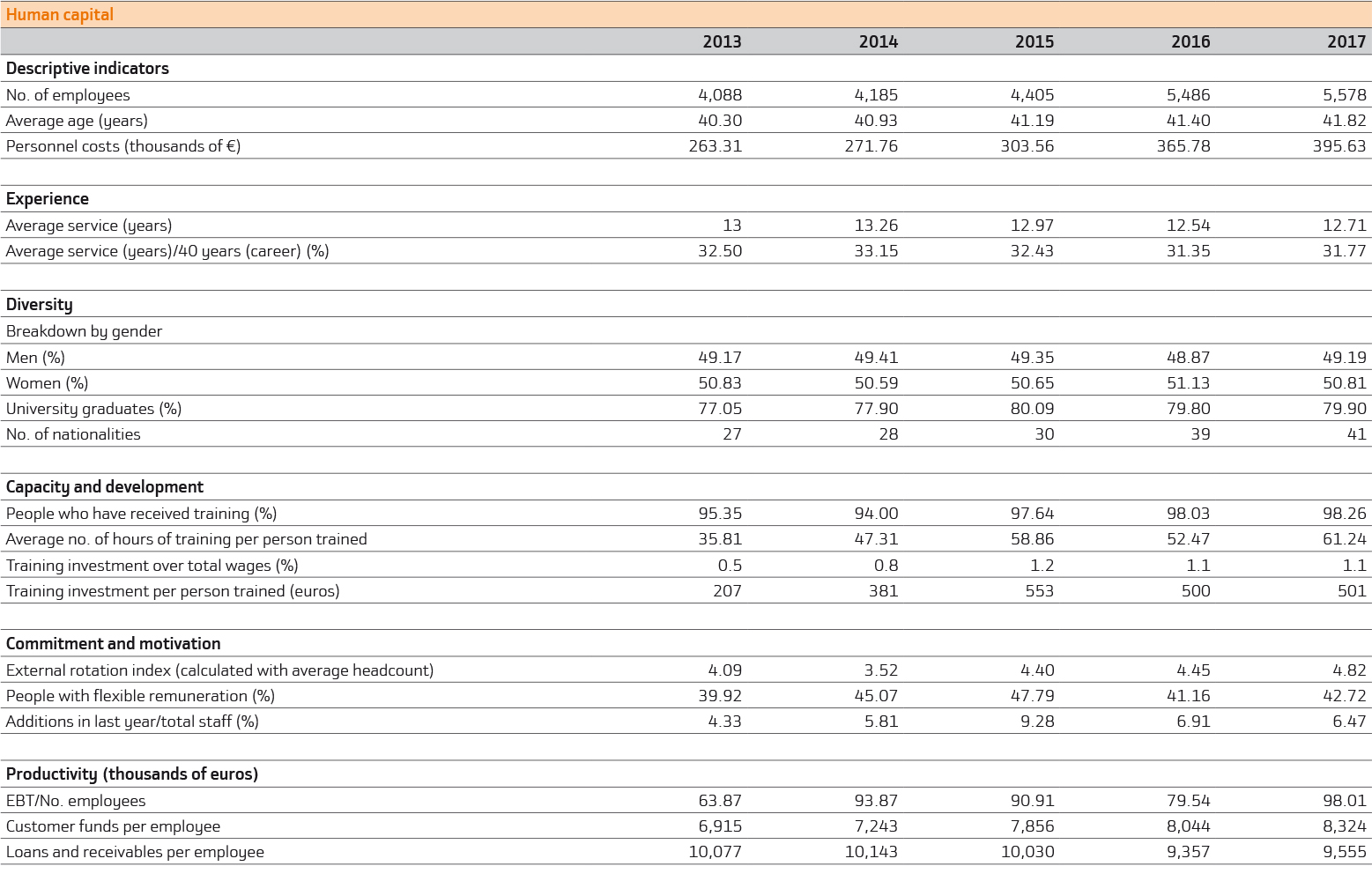

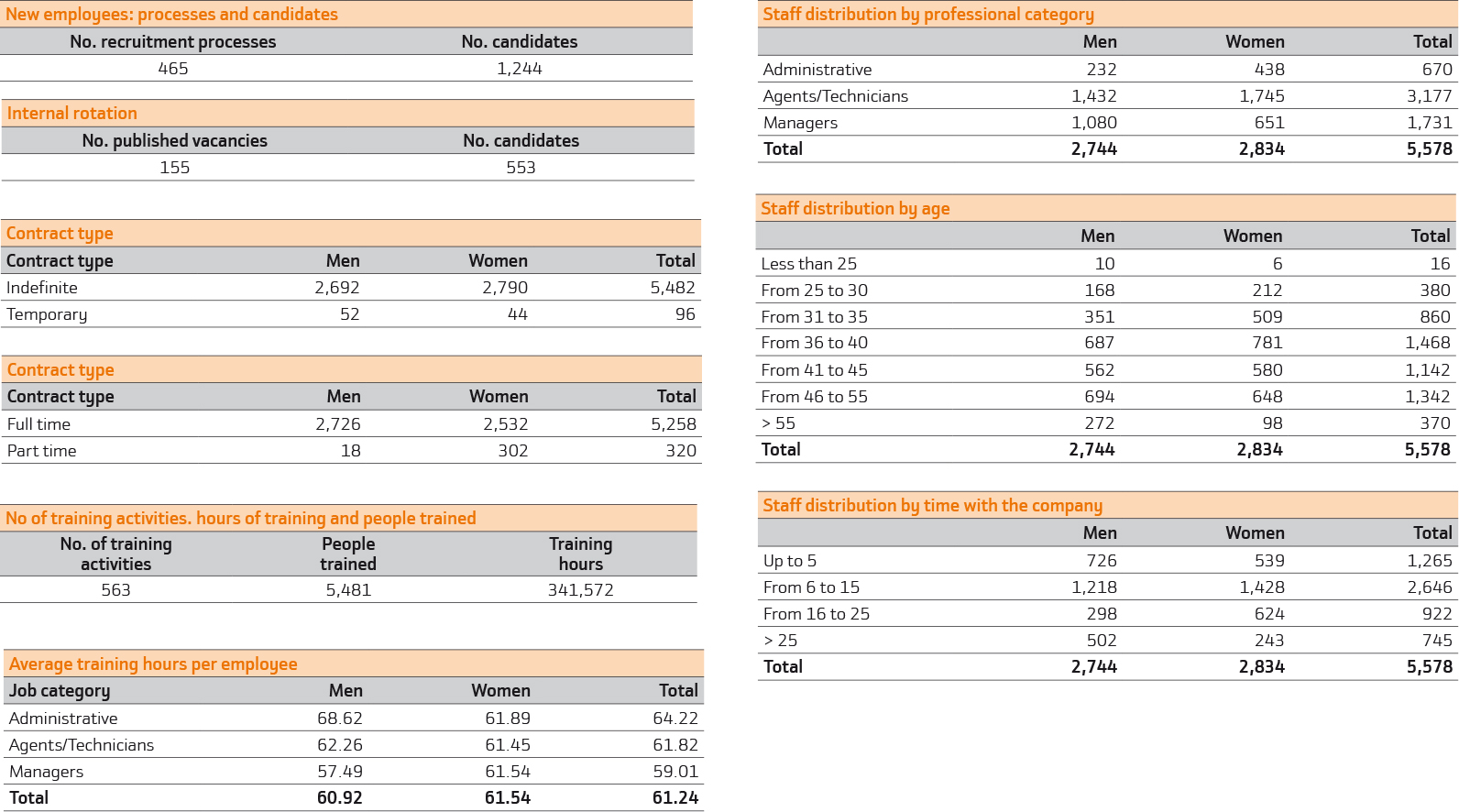

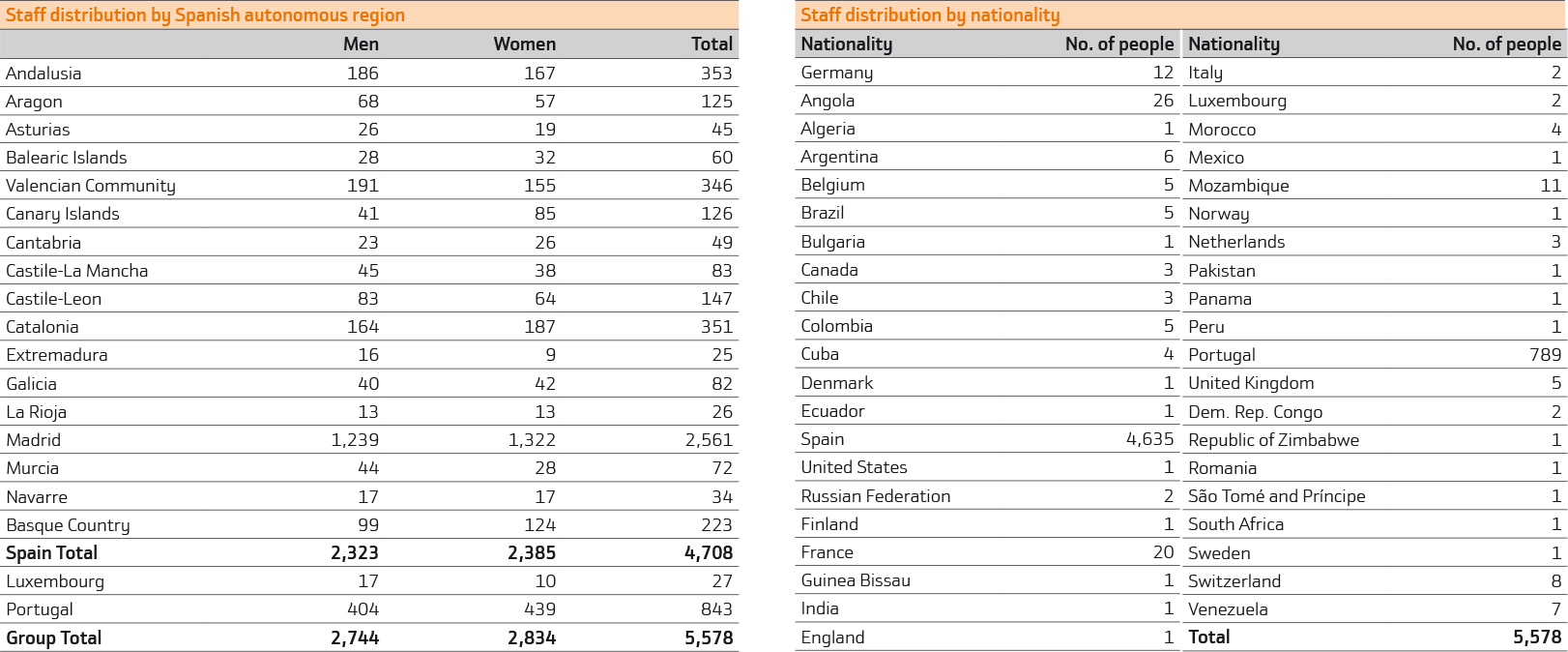

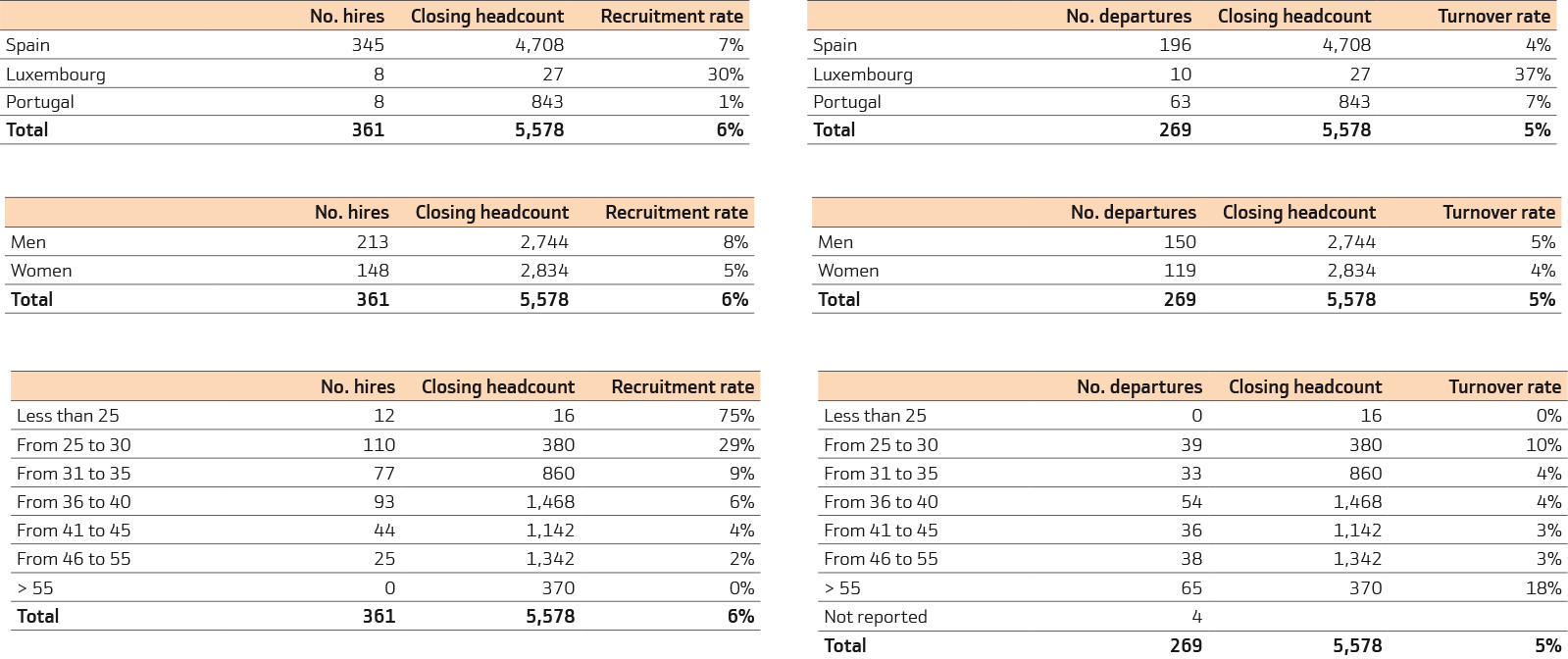

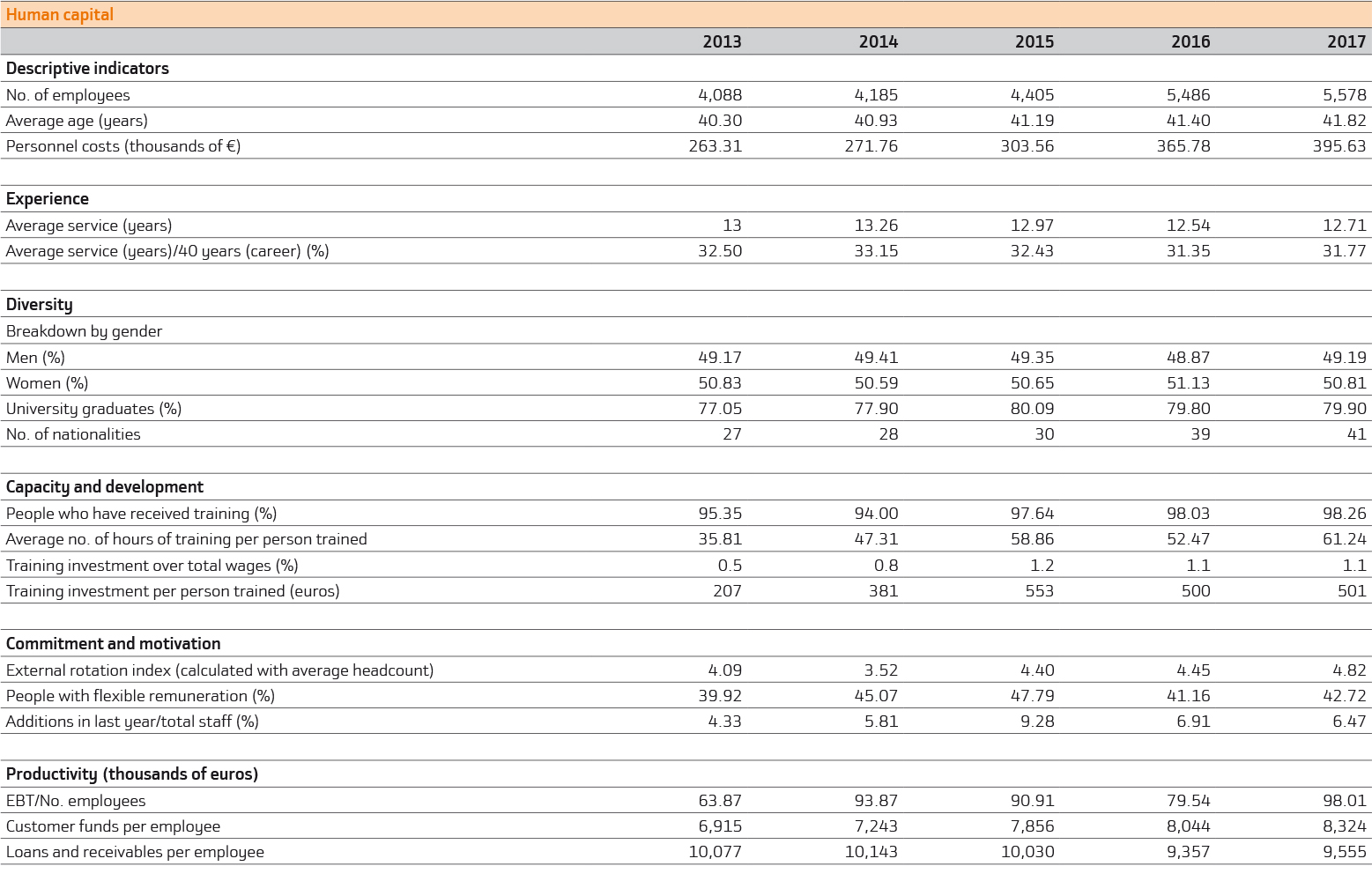

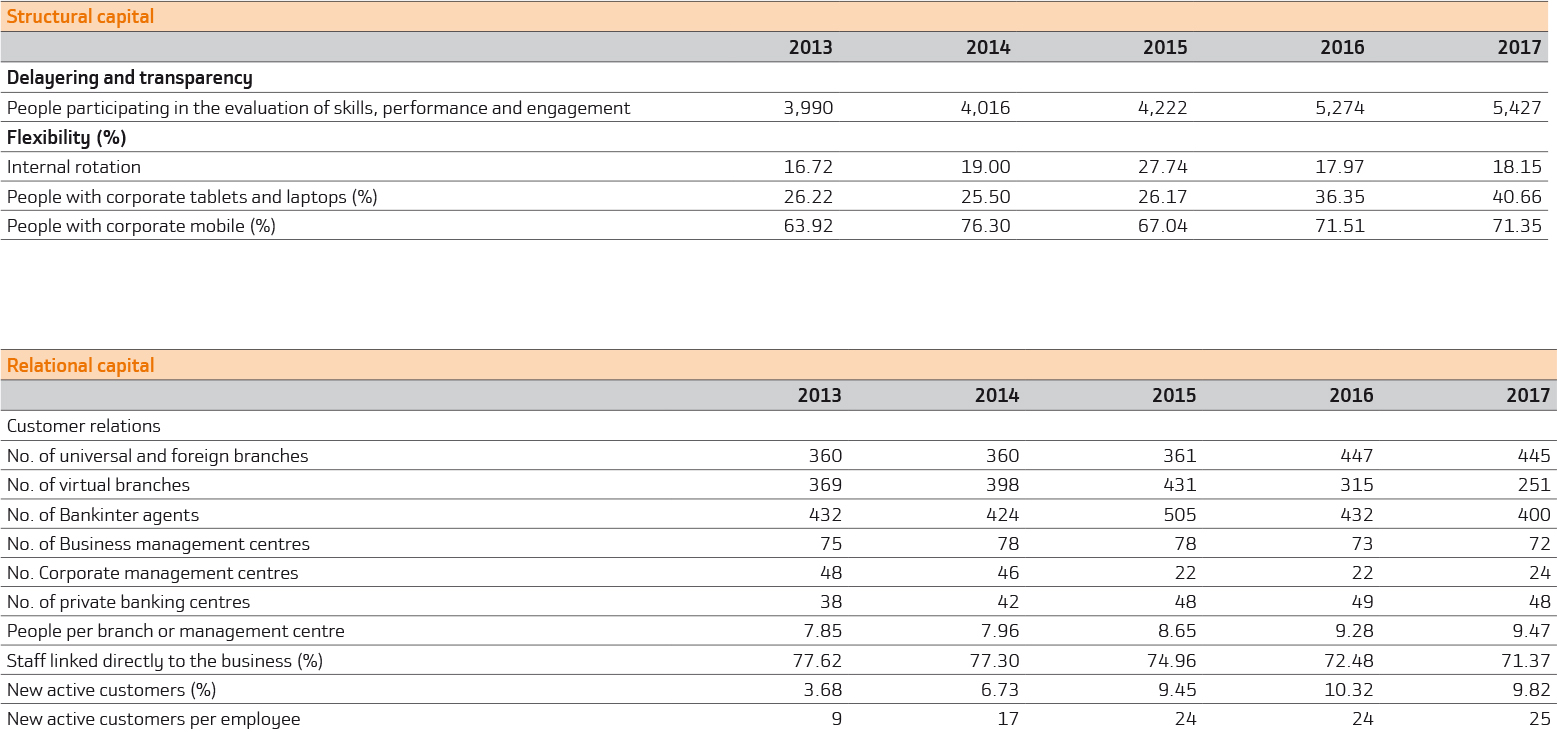

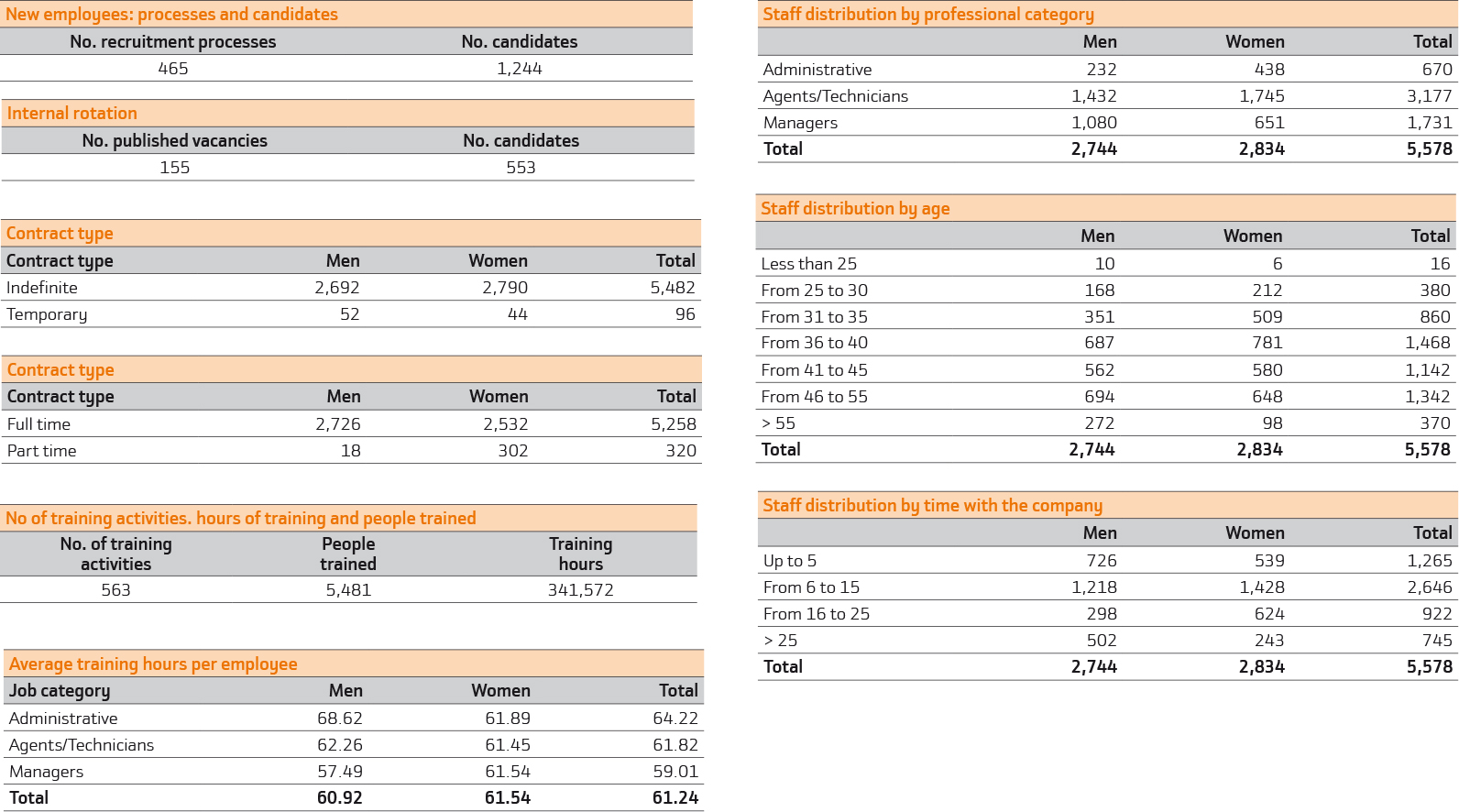

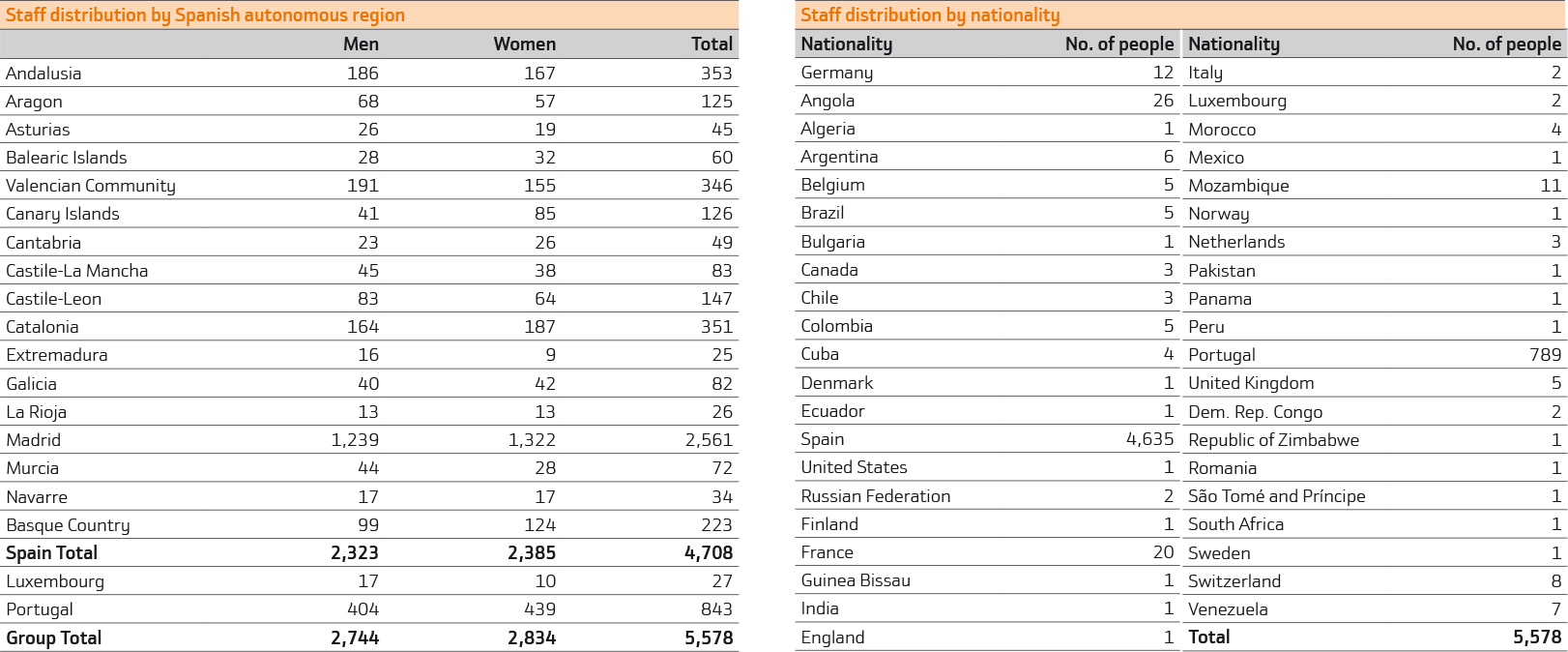

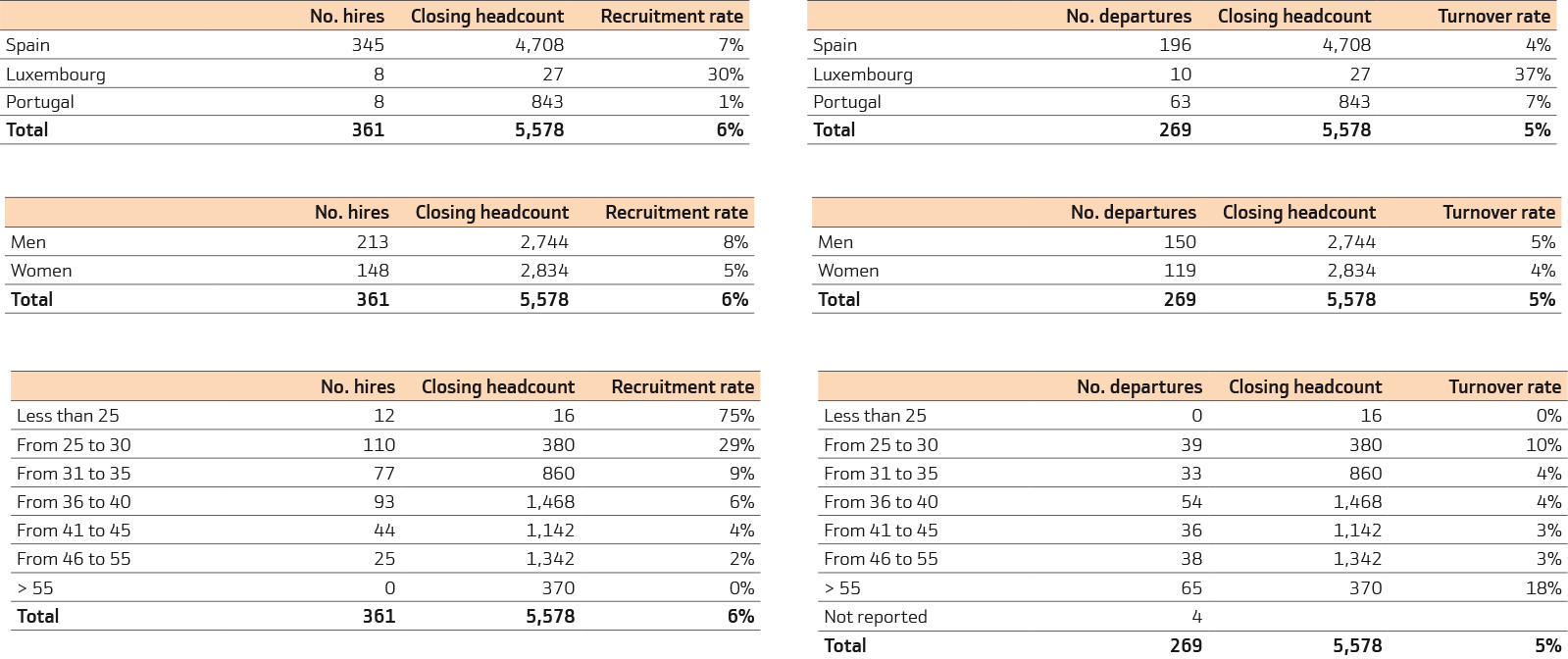

Bankinter closed 2017 with a headcount of 5,578, an increase of 1.7% on the 5,486 employees in 2016. This was the fifth successive year it had risen and was in line with the Bank's balanced growth strategy. The Bank believes that it is making a contribution, as far as it can, to job creation, one of the weak spots of the Spanish labour market. In this sense, the Bank is committed to stable and quality employment, as the vast majority of its employees have permanent contracts (98.3%) and work full time (94.3%).

The growth in the Bank's headcount contrasts with the trend in the Spanish financial sector in general, which lost over 84,000 jobs between 2008 and 2016 (30.2% of the total), according to Bank of Spain data.

Technological profiles

In the employment created in 2017, technological profiles once again played an important role, with the purpose of meeting the growing need for specialists to work on the strategic projects of technological transformation and digital banking processes.

The Regulatory Risks and Compliance area was also strengthened, with an eye to the entry into force in 2018 of various different regulations, such as the new EU directives on investor protection (MiFID 2) and payment systems (PSD2), and the new accounting standard (IFRS 9). MiFID 2, also requires a major training effort to ensure that all the Bank's professionals that report or advise on investment services can obtain the certification required by the directive. In 2017, 93% of those on the various information and advisory services certification programmes had been certified.

By line of business, the processes of selection and attraction of employees are focused on the key areas of the Bank's expansion strategy, such as Bankinter Consumer Finance, which continues to grow at a good rate, and the commercial branch network for individuals in Spain.

As a result, the increase in headcount in 2017 matched the process of business growth. But Bankinter's people management policy goes beyond this purpose. The quest for excellence, due consideration of merit and the commitment to equality of opportunities are some of its hallmarks. The Bank has begun working with a people management model that allows it to be closer to the employee, with the intention of promoting a favourable environment for professional development and innovation.

The ultimate objective is to construct a comprehensive framework for action based on the fact that the Bank's employees are its main asset, for which reason their satisfaction and involvement in the project is vital to the Bank's success and has a direct impact on the income statement.

To achieve these objectives, the Bank implements professional recruitment programmes, provides training and achieves improvements in the working environment, stimulates motivation and promotes professional development. The following is a summary of these activities.

Attracting talent

Bankinter's policy for attracting talent is based on its reputation as an innovative bank and as one of the best companies to work for in Spain. This positive image, that helps to attract professionals, has been built over time, and was further strengthened in 2017 with new recognition. The Bank was placed in 25th position in the ranking of the best companies to work for in Spain by the magazine, Actualidad Económica (up 12 places on 2016) and was also awarded, for the eleventh successive year, the Top Employers seal.

The talent recruitment strategy is carried out on two levels:

The Bank was placed in 25th position in the ranking of the best companies to work for in Spain by the magazine, Actualidad Económica (up 12 places on 2016).

Senior incorporations. These are professionals with prior experience in other banks or companies. Their arrival at the Bank contributes alternative viewpoints that enrich the workforce's knowledge and serve as a positive contrast to internal values.

Identification of junior talent. In 2017, 23.5% of hiring processes in the branch network were for junior profiles, and 13.1% of those chosen in the central services selection process were for remote network (which functions as a pool of young talent within the Bank) profiles. Bankinter also has an internship programme, which acts as its recruiting pool for professionals and is aimed at recent graduates and students in the final year of their degree. Agreements with universities and business schools to complete graduates' training are also actively encouraged.

Training and development

The Bankinter Corporate University, which celebrated its fifth anniversary in 2018, has consolidated its position as a strategic tool to create value and exchange knowledge within the Bank. It offers employees the chance to develops their professional skills and qualifications within a collaborative environment that facilitates learning.

The Corporate University carries out its function in two areas: the physical campus, which is in Tres Cantos, Madrid, and which has facilities and rooms of different formats and capacities, and the virtual campus, which is ever more important due to the development of new technologies, which is available to all employees through the intranet.

Its training offer continued to diversify during last year and ended it as follows:

Commercial Excellence School. Exclusive space for the training and development of commercial teams, with a clear customer-centred focus. It had 3,244 participants in 2017. Involves technical training programmes (including certification for MiFID 2 or promotion to branch or centre manager) and commercial skills development programmes (such as the Advanced Sales Programme aimed at commercial executives and the Commercial Coaching Programme for branch and centre managers, among others).

Technical Schools. Their purpose is to train central services professionals in specialist content, through mainly practical programmes and courses, which are very useful when carrying out their job. Included in these is a large new technologies element. 1,286 employees studied at these schools last year.

Language School. Is a basic pillar for Bankinter, as its growing internationalisation makes it increasingly more important to be able to speak different languages fluently. English, Spanish and Portuguese are taught there.

Leadership School. The school's mission is the development of Bankinter's people managers, who receive the necessary tools to help them reach their maximum potential, within the framework of the transformational leadership and development of the Bank's personnel. In 2017, Bankinter launched ‘B-Líder’ (‘B-Leader’), an innovative leadership development programme for people managers, with a solid methodology based on 360º feedback, developing strengths and supported through coaching and mentoring. 165 people undertook this programme in 2017.

Talent School. Bankinter makes development programmes available to its employees for their professional growth, some of which are focused on skills, and others which are targeted at the identification and development of high-potential employees, such as the ‘Horizon’ (‘Horizonte’) programme, which is aimed at young talent (see more detailed information in the section on talent promotion).

Summer School. A variety of experiential learning courses are available on-site and online in such areas as wellbeing, health, family, latest trends and languages. Both originality and the possibility of applying the skills and knowledge acquired to day-to-day professional and personal life are of prime importance. Last year 673 people participated.

Digital School. This is Bankinter's commitment to improving the digital skills of its employees, making specific benchmark programmes available to them to support digital transformation and improve customer service. 1,256 professionals took part in these programmes in 2017.

Corporate training. This is aimed at all Bankinter Group people. It is concerned with values, corporate culture and regulatory compliance in the various areas where this is mandatory. Also included in this chapter is a Welcome Programme for new staff at the Bank and which comprises various training and integration activities, such as an induction course, ‘The office day’ (aimed at new central services employees), a 4-month mentoring process and a warm welcome.

Talent promotion

The ‘Horizon’ programme, one of the pillars on which talent identification and promotion policy is based, consolidated its position as it celebrated its fourth year in operation in 2017, with 25 professionals taking part. The programme has twin objectives:

To identify the people in the organisation with the most ability and potential to carry out leadership functions in the future and to transmit the Bank's values.

To provide them with the knowledge, experience and training tools necessary to develop their potential as quickly as possible, through a robust executive development programme in a prestigious school and with a mentoring process in which the mentors are the Bank's senior executives.

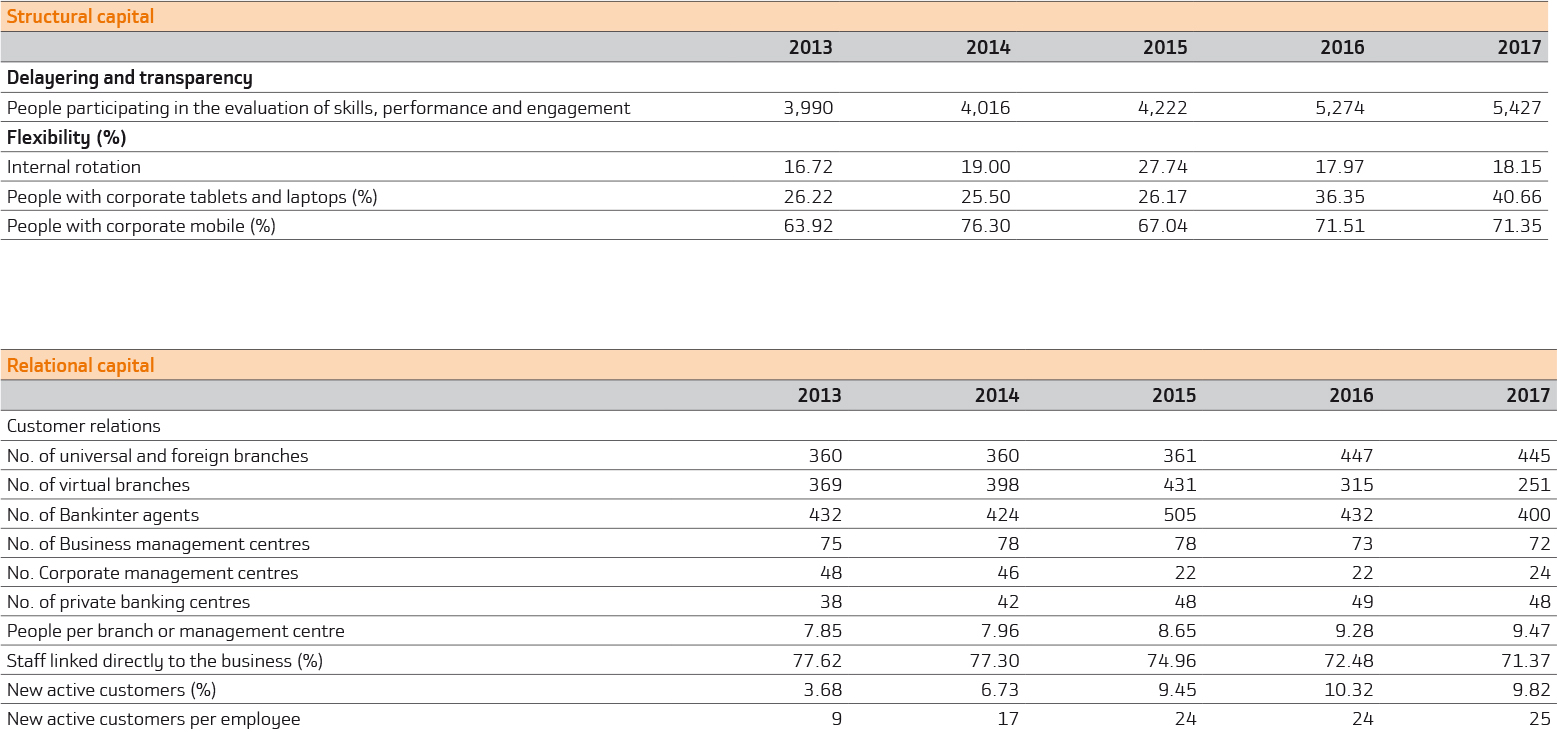

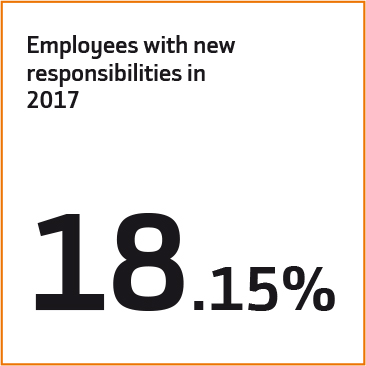

Bankinter has another important lever in promoting talent: its rotation or internal mobility policy. In 2017, 18.15% of employees were given a new responsibility, which enabled them to take on new challenges and develop professionally. The inclusion of the Portuguese business in the organisational structure has broadened the range of options for international mobility, on which Bankinter has placed a great deal of focus with the aim of learning from each other, ensuring cultural integration and promoting international professional development. In 2017, 14 of the Bank's professionals were involved in this process of international mobility.

The talent management policy is also supported by the new Bankinter people website, a user-friendly tool that improves efficiency in control, enables the use of metrics and facilitates analysis of the organisation's human resources model.

Performance evaluation

Bankinter's performance evaluation programme was consolidated in 2017 through the BKcreceprogramme, the purpose of which is to foster a culture of development and growth, talent management and continuous improvement, in which the employee has an important role to play. The programme is based on a sound methodology and is rolled out in various successive phases:

- At the start of the year, each people manager sets the annual performance targets for each member of their team and notifies them of this.

- Although the Bank has a culture of continuous feedback, after six-months a monitoring meeting is held, with the aim of reviewing the progress made in the targets set, and providing feedback on and support for the individual development plan.

- At the end of the year, the annual evaluation performance process begins, which involves the following phases:

- Each employee self assesses to what extent they have met their targets and their level of skills development.

- The head of team evaluates whether their team members have achieved the targets set for them, their level of skills development and engagement.

- People managers with teams with at least three members are evaluated by them under the Bank's leadership model and through an anonymous and confidential process.

- The process culminates in a conversation of constructive feedback, after which each employee can design their own individual development plan, with the help of the Bank's various tools and guidelines and with the support of their head of team.

Remuneration and compensation

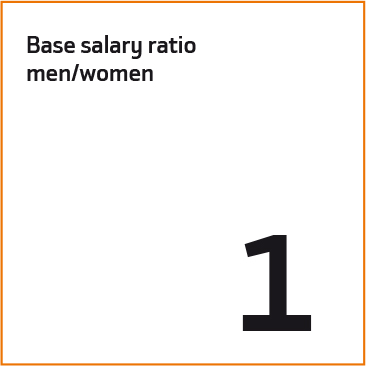

Bankinter bases its remuneration policy on the principle of non-discrimination on grounds of gender, race or any other factor, and places a higher value on criteria of competitiveness and performance. If the base salary is taken as a benchmark and additional remuneration for length of service, welfare or other benefits is excluded, the male/female pay ratio is 1.

The remuneration structure is based on two levels:

- Fixed remuneration. This is determined by factors such as the function performed, the responsibilities taken on, experience in the position and the ongoing individual performance in the job.

- Variable remuneration. This is designed to be compatible with appropriate and effective risk management and aligned with the business strategy. It is applied to the whole workforce, differentiating by functional areas. Groups of employees with a direct commercial relationship with the customer or with distinct activities have specific bonuses. Al other employees receive a variable incentive, which is individually assigned and the purpose of which is to ensure an appropriate correlation between the remuneration levels and the results attained. The amount each employee finally receives, which is capped at a certain maximum amount, depends on the performance of pre-tax profit of the banking business (which has an impact on all groups) and for the achievement of the targets established for each area.

Corporate employee benefits

Bankinter offers social benefits that go beyond legal requirements and which apply to all employees. These include:

- Assistance in the education of employees' children.

- Medical insurance.

- Life insurance.

- Advances against monthly salary.

- Banking services and products with special conditions for employees.

Bankinter also offers its employees meal subsidies, depending on their working hours, which can be taken as an addition to salary or on the form of restaurant vouchers.

Employees also have right to the following benefits:

- Mortgage loan (including renewal).

- Home construction loans.

- Mortgage interest rate review.

- Home loan.

- Loans for other purposes (no proof is required).

- Advances. Those included in the banking collective bargaining agreement and those for the purchase of a computer, to pay for language courses abroad, or postgraduate studies relating to the employee’s professional activity.

- Pension simulator.

Employees can also opt into a flexible remuneration system, whereby they can agree to partially substitute monetary remuneration for non-monetary remuneration (such as nursery vouchers, shares, medical insurance, training, pension plan contributions, travel card or restaurant vouchers).

In this way, the employee increases their remuneration in two ways: through the Bank’s bargaining power to get the best price possible and through the tax advantages accruing to certain products or services contracted through this system. Currently 48% of employees use this flexible remuneration system.

In long-term remuneration designed to cover certain contingencies, the bank offers the following benefits:

- Supplementary cover additional to the benefits paid by the Social Security system in the case of widowhood, orphanhood, permanent occupational disability, absolute permanent disability or severe disability. It is provided for the entire workforce.

- Coverage off pension commitments for employees in service since before 1 March 1980, as established in the sector collective bargaining agreement.

- Annual contribution of 400 euros, pursuant to the provisions of the banking sector collective agreement, to the pension plan of employees who have more than two years' service in banking and whose pension commitments are not covered by any other scheme.

Bankinter is also a member of the Employee Family Plan. This programme, promoted by the Adecco Foundation, provides a variety of assistance to employees with a disability, and/or family members in a similar situation, to help them achieve real employment and social integration, or to help them perform various activities, including those related to leisure.

Employee relations

Thanks to the combined efforts of companies and workers, Bankinter benefits from a good working environment, as is clear from the regular surveys that are carried out to monitor it. Contributing to this work environment is one of the main goals of the people management team, and therefore all policies, programmes and incentives that are put into practice focus on achieving this goal.

Far from limiting itself to complying with the legal requirements in risk prevention and occupational health, Bankinter has also launched a series of initiatives to ensure the wellbeing of its employees, not only as professionals but as people.

Of particular note among these initiatives is Health Week, which includes everything from ergonomics and nutrition courses to advice for getting the most out of physical exercise; and the Summer School, where both training and purely recreational courses are delivered, aimed at promoting wellbeing.

Bankinter is particularly proud of having being recognised as a family-responsible company and that its rating as such increased in 2017.

The Bank rolled out a total of 155 activities in this area, including some where the beneficiaries are workers who have a degree of disability equal or greater than 33% themselves or have direct family members who do (financial assistance, permits, loans).

Encouraging participation in these activities is one of the objectives for 2018.