Market risk

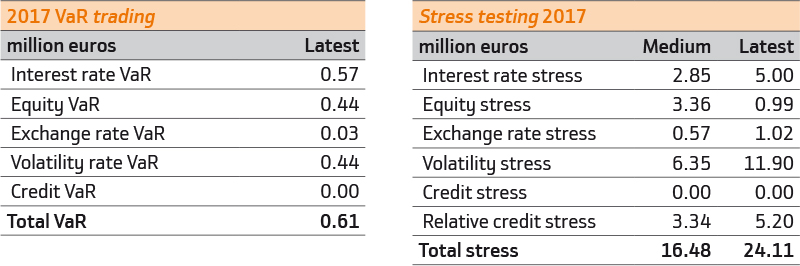

Market risk is the possibility of incurring losses as a result of changes in the market prices of on- and off-balance-sheet positions of the trading portfolio. Bankinter measures value at risk using the historical VaR methodology using one-year data and a 95% confidence interval.

An asset portfolio's value at risk (VaR) is the estimated maximum potential loss that could be incurred for a specific time horizon with a particular confidence level. Given the instability in recent years, Bankinter maintained the VaR limits from the previous year.

An asset portfolio's value at risk (VaR) is the estimated maximum potential loss that could be incurred for a specific time horizon with a particular confidence level. Given the instability in recent years, Bankinter maintained the VaR limits from the previous year.

The following chart details the VaR values of the trading positions at year-end 2017.

Moreover, the VaR of the portfolio positions of the subsidiary Línea Directa Aseguradora are monitored on a monthly basis using historical simulation methodologies. The VaR of the Línea Directa Aseguradora portfolio at 31 December was 1.8 million euros. The risk that may be incurred by the subsidiary Bankinter Luxembourg is also monitored. Using this same methodology, the VaR for 2017 was estimated at 0.1 million euros.

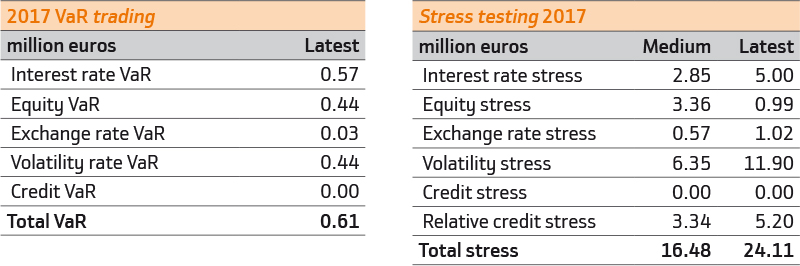

Stress testing is a complementary test to VaR. Stress test estimates quantify the potential loss that extreme changes in risk factors could cause to the portfolio's value. The scenarios are obtained based on analysing the behaviour of these risk factors (interest rates, stock markets, exchange rates, credit spreads and volatility) in historical situations and simulating their impact. The changes observed in major historical crises are also simulated.

The following table details the estimated data of the stress tests on the Bank's trading positions at the end of 2017, performed under a scenario of extreme changes in the different risk variables.

An asset portfolio's value at risk (VaR) is the estimated maximum potential loss that could be incurred for a specific time horizon with a particular confidence level. Given the instability in recent years, Bankinter maintained the VaR limits from the previous year.

An asset portfolio's value at risk (VaR) is the estimated maximum potential loss that could be incurred for a specific time horizon with a particular confidence level. Given the instability in recent years, Bankinter maintained the VaR limits from the previous year.